Bolstered by a rise in on-chain activity and increased accumulation by whales, analysts are eyeing $2.70 as the next major target for the Ripple-backed token.

While the Ripple network shows renewed momentum, investors and traders are paying close attention to the technicals and broader market signals that could fuel the next leg of XRP’s rally.

Bullish Chart Formations Suggest Upside Potential

Crypto analyst Ali Martinez recently took to social media to share a bullish forecast for XRP price, identifying an inverse head and shoulders pattern on the chart—a classical signal of a potential trend reversal. If the pattern plays out, XRP could break out toward the $2.70 mark, a move that aligns with broader market recovery trends.

XRP is showing an inverse head and shoulders pattern, hinting at a possible breakout toward $2.70. Source: Ali Martinez via X

Martinez isn’t the only voice pointing to a bullish future for XRP. Another analyst known as “Dark Defender” recently projected an even more ambitious target, suggesting XRP could reach as high as $3.75 if momentum holds. His analysis was based on strong RSI (Relative Strength Index) readings and the coin’s recent break above key resistance levels.

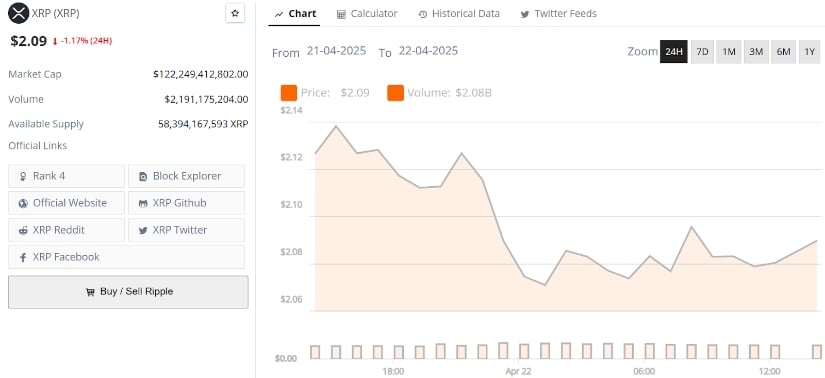

Currently trading around $2.08, XRP has been consolidating in a narrow range between $2.00 and $2.10. While the price dipped slightly by 1% over the past 24 hours, analysts remain optimistic, pointing to historical breakouts following similar setups—such as the 490% surge from $0.49 to $2.90 seen in late 2024.

Ripple Network Activity Sees Significant Surge

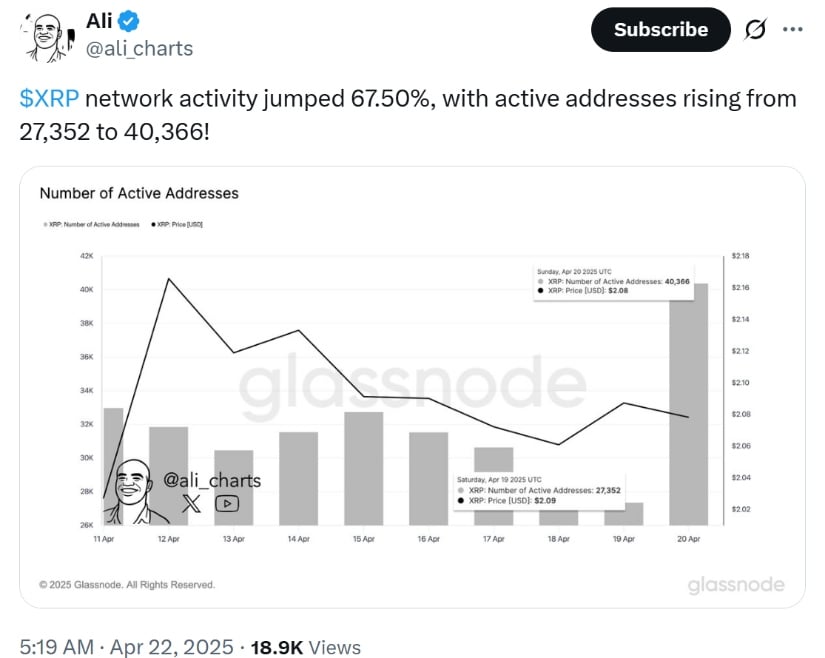

Fueling bullish sentiment is a noticeable jump in Ripple network activity. On April 22, the number of active addresses on the XRP Ledger spiked by over 67%, reaching more than 40,000, according to data shared by Martinez. This marked a sharp increase from just over 27,000 addresses the previous day.

XRP network activity surged 67.5%, as active addresses climbed from 27,352 to 40,366. Source: Ali Martinez via X

The uptick in on-chain interaction suggests growing user engagement with the Ripple blockchain, a signal that often precedes price rallies. While network activity remains far below the March peak of 612,000 daily active addresses, the recent rebound offers a glimmer of optimism for the XRP community.

Whale Accumulation Signals Investor Confidence

Another strong bullish indicator is the consistent whale accumulation of XRP. Santiment statistics show that the accounts with 10 million to 100 million XRP now own 11.83% of the total supply—up from 10.91% at the start of April. Even larger wallets, with more than 1 billion XRP, have also grown their holding, now holding more than 39% of the total supply.

XRP Ledger Exchange Inflow. Source: CryptoQuant

This steady expansion signals increasing investor confidence in the worth of XRP and an implicit long-term bet on the asset’s ultimate appreciation. “These whales are not just speculating—they’re positioning themselves for a big move,” noted a market analyst.

Moreover, exchange inflows have significantly declined. At the start of the year, XRP inflows to exchanges peaked at 2.7 billion tokens. As of April 22, the figure stands at just 74 million per day. The drop in inflows suggests a reduced intent to sell and a broader sentiment shift toward holding XRP, often a precursor to a price surge.

Technical Resistance and Support Levels in Focus

Despite encouraging fundamentals, Ripple price is still resting on major technical levels. The $2.00 handle is still an overbearing support line, and upward spikes are capped at below $2.22—a region that conveniently overlaps the 100-day Exponential Moving Average.

XRP price keeps consolidating between major support and resistance levels. Source: MarketIntel on TradingView

The RSI on the daily chart is just below the midline, and this indicates cautious optimism but potential resistance to further move ahead. A confirmed break above $2.22 could set the stage for XRP to test $2.70 and possibly higher, while a failure to hold the $2.00 support could trigger a pullback to $1.96 or lower.

Development Activity and Market Sentiment

Behind the scenes, Ripple developers remain highly active, with XRP ranking among the top three crypto projects for development growth, according to Chain Broker. This aligns with Ripple’s ongoing efforts to expand institutional use cases, including partnerships with banks and payment platforms. In the long term, such development could significantly influence Ripple XRP news cycles and investor sentiment.

XRP was trading at around $2.09 at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

Meanwhile, the market remains cautiously optimistic. The Ripple market sentiment, as measured by the Fear and Greed Index, currently stands at 52—neutral territory, but leaning bullish.

Outlook: $2.70 in Sight, But Eyes on Resistance

In the context of an evolving legal battle with the SEC Ripple lawsuit and broader crypto regulatory shifts, XRP’s short-term trajectory remains uncertain. However, growing Ripple ledger activity, declining exchange inflows, and whale accumulation paint a constructive picture.

Whether XRP reaches $2.70 in the coming days or faces a temporary pullback, the token is clearly in a phase of renewed interest. With multiple analysts forecasting higher targets—and with Ripple crypto developments continuing in the background—the market could be setting up for a pivotal breakout.

As Brad Garlinghouse and the Ripple team continue to build through volatility, all eyes are on XRP’s next move. Traders and investors alike would do well to watch support at $2.00 and resistance at $2.22 as potential breakout zones that could define the path to the next milestone.

4 months ago

15

4 months ago

15

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·