Speculation is mounting over whether Ripple’s native token could soar to $27, a price level many once considered far-fetched. Analysts are now pointing to a combination of legal victories, bullish technical indicators, and institutional interest as the fuel behind these lofty forecasts.

XRP’s Future Price: “Already Locked In”?

Versan Aljarrah, a crypto analyst known by the moniker “Black Swan Capitalist,” recently made headlines with a striking claim: XRP’s future value may already be prearranged by institutional forces.

Versan Aljarrah claims XRP’s true value was determined by global institutions long before retail investors entered the market. Source: Versan | Black Swan Capitalist via X

According to Aljarrah, XRP’s true value isn’t accurately reflected by its current market price. He believes major financial institutions have already agreed upon a long-term valuation for XRP, likening it to pre-IPO pricing deals made before a company goes public. “They’ve settled on the future value of XRP years ago — we’re just not seeing it on the open market yet,” Aljarrah argued in a recent post.

He speculates that the internal valuation of XRP may sit somewhere in the three- to four-digit range. While this idea remains speculative and unconfirmed, it reflects a growing belief that XRP’s role in the global financial ecosystem could significantly expand.

Technical Signals Point to a Rally Toward $27

Alongside Aljarrah’s theory, respected crypto analyst EGRAG CRYPTO has issued a separate, data-backed XRP price prediction. He believes XRP could reach $27 in the near term, driven by a technical setup that closely resembles the token’s historic 2017 breakout.

XRP is expected to hit double digits by summer as Wave 3 ends, with Wave 4 unfolding over the next three years before a future cycle pushes it to triple digits. Source: EGRAG CRYPTO via X

EGRAG bases his prediction on Elliott Wave theory, suggesting that XRP is approaching the end of its third wave, which historically precedes a strong upward move. He emphasized that the token must stay above the 21-day Exponential Moving Average (EMA), currently ranging between $1.95 and $2.10, to maintain this bullish outlook.

XRP could hit $27 and eventually $120, as its current trajectory appears to mirror the 2017 cycle, though timing may vary. Source: EGRAG CRYPTO via X

“XRP is showing behavior very similar to its 2017 cycle,” he said, noting that if momentum holds, XRP could rally past $2.70 and make a run toward $27. Some even speculate that the token could hit $120 in a future long-term cycle.

XRP Market Activity Remains Resilient

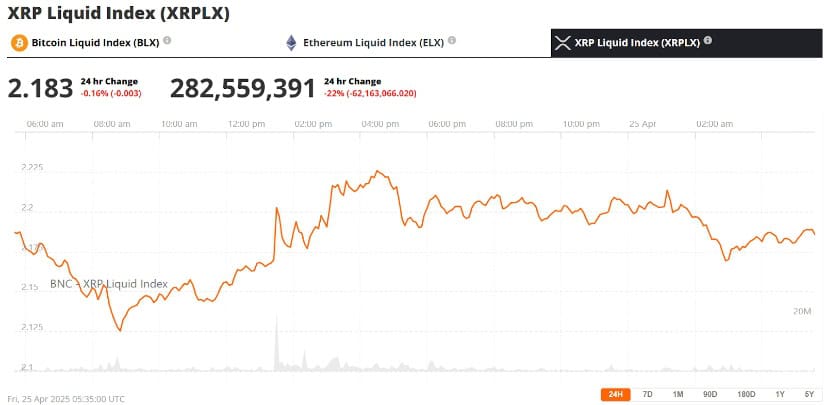

Despite this bullish sentiment, XRP price has seen some short-term struggles. The token recently failed to close above its key daily resistance at $2.23 — a level that also aligns with its 50-day EMA — and is currently trading around $2.17.

Ripple (XRP) was trading at around $2.18 at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

Still, analysts remain optimistic. Ali Martinez, another widely-followed crypto strategist, noted that XRP is forming an inverse head-and-shoulders pattern on the hourly chart — a structure typically viewed as bullish. If XRP can break above the $2.40 neckline, Martinez believes it could test $2.70 in the near term.

Year-to-date investment trends also support growing institutional interest. According to CoinShares, XRP-related products attracted $37.7 million in inflows over the past week, bringing its yearly total to $214 million — just shy of Ethereum’s figures. In contrast, Ethereum and Bitcoin products saw net outflows, suggesting XRP may be winning over more investors.

Ripple’s Legal Landscape Boosts Market Confidence

Much of this renewed optimism stems from Ripple’s recent legal triumphs. The SEC Ripple lawsuit — a major cloud over XRP for more than three years — ended with the SEC dropping its claims against Ripple Labs executives. With the Ripple lawsuit behind it, the company is now operating with far fewer regulatory overhangs.

If Ripple replaces SWIFT and overcomes legal and scalability hurdles, XRP’s value could rise significantly, according to ex-London fund manager DigitalG. Source: Sienna via X

Ripple CEO Brad Garlinghouse has expressed confidence that the company is well-positioned to expand further into traditional finance. With Ripple’s technology gaining recognition from entities such as the United Nations, and rumors swirling about deeper partnerships with firms like Bank of America, many believe Ripple is close to cementing its place in the global payments network.

Price Outlook: Key Levels to Watch

From a technical standpoint, traders are closely monitoring a few critical support and resistance zones:

Support: The next major level sits around $1.96, with deeper support seen near $1.82. A drop below $1.82 could indicate weakness and potentially open the door to a decline toward $1.33.

Resistance: On the upside, XRP must clear $2.23 convincingly to retest its March high of $2.50. A breakout above $2.70 would be a strong confirmation of a bullish trend.

As of Friday, XRP is trading in a narrow range around $2.18, lacking a decisive move in either direction. Analysts are waiting for stronger signals to confirm whether the token will break out or retrace further.

Final Thoughts

The future of Ripple XRP news continues to evolve rapidly. Whether driven by bold theories of hidden institutional pricing or well-established technical analysis, XRP remains at the center of intense speculation.

While predictions of a $27 Ripple currency price may seem optimistic, the convergence of regulatory clarity, institutional inflows, and technical momentum makes XRP one of the most closely watched tokens in the current Ripple market.

Investors, however, are reminded to remain cautious. As always in crypto, volatility remains the only certainty.

3 months ago

18

3 months ago

18

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·