The forecast, shared by crypto analyst Costa, ties XRP’s future growth to the expected tokenization of global assets by 2030. If realized, this scenario could push XRP into uncharted territory and reshape its role in the financial system.

Analyst’s $473K XRP Price Forecast

Crypto analyst Costa recently shared one of the most bullish XRP price predictions to date, suggesting that the token could skyrocket to $473,214 if just 10% of global assets are tokenized on the XRP Ledger (XRPL). His projection aligns with Ripple’s own statement that 10% of the world’s assets are expected to be tokenized by 2030 — a market estimated at roughly $50 trillion.

Tokenizing 10% of global assets on XRPL would mark a game-changing moment for its adoption and market potential. Source: Costa via X

Costa broke down his analysis by explaining that for every $10 billion of inflows into XRPL, the XRP market cap could expand by 516x. According to his model, this would drive the market cap to approximately $5.3 trillion, potentially resulting in an XRP price of nearly half a million dollars per coin.

“This level of tokenization would create unprecedented demand for XRP, leading to what could be a historic supply shock,” Costa noted in his post. He acknowledged that the scenario remains hypothetical but stressed that the combination of utility and scarcity could dramatically alter the price of XRP in the coming decade.

Current XRP Price Trends

While these long-term projections excite the community, the XRP current price remains well below its all-time high. As of today, XRP is trading near $2.81, according to CoinMarketCap, after experiencing a modest 0.2% to 4% pullback in the last 24 hours. Key support lies in the $2.75–$2.80 range, with resistance between $2.90 and $3.00.

XRP was trading at around $2.81, up 0.35% in the last 24 hours at press time. Source: XRP price via Brave New Coin

Whale activity continues to provide some optimism for bulls. Over the past two weeks, major holders have accumulated roughly 340 million XRP, signaling confidence in the asset’s long-term value despite short-term selling pressure. However, this accumulation has been partially offset by institutional liquidations, with reports of $1.9 billion worth of Ripple XRP being sold since July.

Market Outlook and Monetary Policy

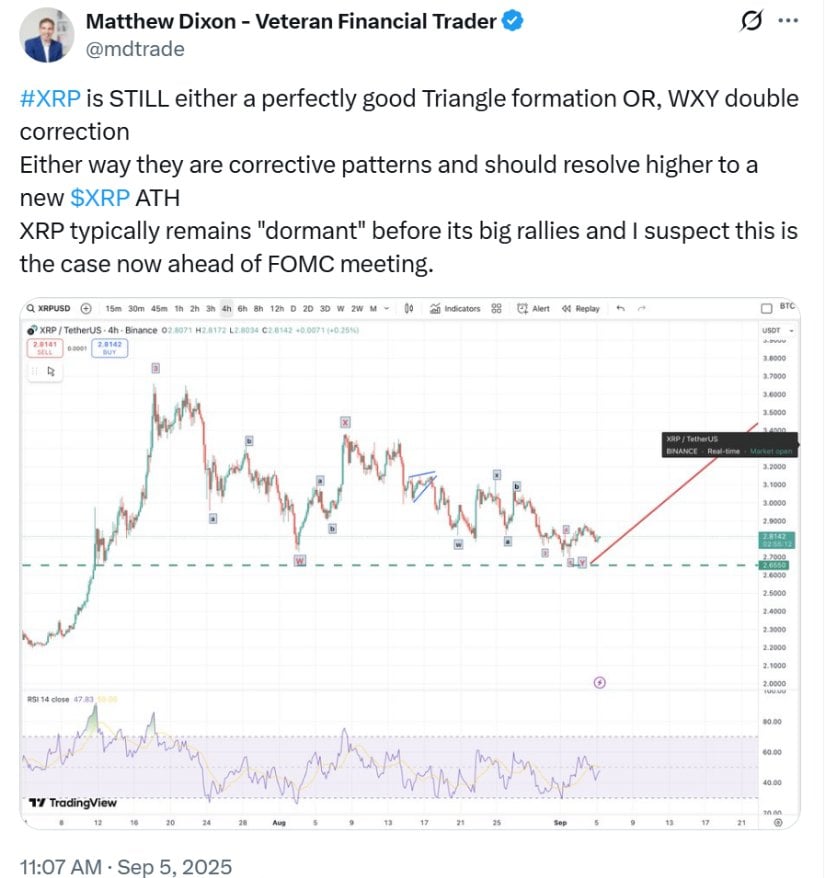

Some analysts believe the upcoming macroeconomic environment could serve as a catalyst for XRP’s next move. Crypto market commentator Matthew Dixon stated that the token’s price pattern appears corrective but should resolve to the upside, particularly as monetary conditions ease.

XRP’s current corrective pattern suggests a potential breakout to new highs, with price likely consolidating ahead of the upcoming FOMC meeting. Source: @mdtrade via X

“The expected 25-bps rate cut by the Federal Reserve could add liquidity to the market and potentially trigger a breakout above the current range,” Dixon said. Meanwhile, popular analyst Egrag Crypto suggested XRP could target $6 in the near term — provided it holds its present range and confirms a breakout.

Key Levels and Long-Term Projections

For traders watching the XRP price today, holding above $2.75 remains critical. A successful breakout above $3.00 could pave the way for a retest of the yearly highs, possibly setting the stage for a more sustained rally into 2025.

The XRP price is poised for a potential breakout from its triangle pattern, aiming for a rally above the $3 level despite the recent pullback. Source: Rogue1trader on TradingView

In the longer term, the tokenization narrative could play a pivotal role in XRP’s valuation. If even a fraction of Costa’s XRP price prediction 2030 proves accurate, Ripple’s native token could see its market cap rival some of the largest asset classes in the world.

Final Thoughts

While a $473K XRP price remains a highly speculative forecast, it underscores growing optimism around tokenization and Ripple’s expanding role in global finance. For now, traders and investors will keep a close eye on support and resistance zones, whale behavior, and macroeconomic shifts that could shape the next phase of XRP’s market cycle.

As always, volatility remains a core feature of the crypto market, and participants should approach these projections with both curiosity and caution.

3 months ago

50

3 months ago

50

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·