As macroeconomic forces hold steady and institutional adoption expands, XRP finds itself at a critical juncture in both price movement and strategic relevance. These developments unfold amid mounting regulatory scrutiny and shifting macroeconomic signals from the U.S. Federal Reserve.

XRP Ledger Sees Record Transaction Volume

The XRP Ledger, developed by Ripple as a decentralized blockchain, experienced a dramatic surge in usage, with over one million transactions during the first week of May. XRPSCAN statistics highlight that payment activity reached new highs, indicating growing interest in the speedy, low-cost infrastructure of the network.

XRPSCAN reports that XRP Ledger transactions topped 1 million in early May 2025. Source: XRPSCAN

Despite previous lulls in March and April, this activity surge is a sign of growing real-world adoption of XRPL and could be a reflection of increasing institutional confidence,” said one blockchain analyst.

This boom comes after Ripple expands its use cases for utility through tokenization and DeFi integrations, including collaborations that focus on developers and financial institutions on the platform.

Ripple Whales Shift $782M in XRP

Whale Alert reported two massive XRP transfers totaling 370 million tokens. The first transaction involved 70 million XRP—worth approximately $148.3 million—sent from an unknown wallet. This was followed by a 300 million XRP movement, valued at around $633.7 million, sent from a Ripple-controlled address to another undisclosed wallet.

70 million XRP, worth $148.3 million, was moved between two unknown wallets. Source: Whale Alert via X

These back-to-back transfers have stirred speculation in the crypto community. Some believe it could be part of Ripple’s treasury rebalancing or internal strategic positioning. Others view it as possible preparation for large-scale institutional engagement.

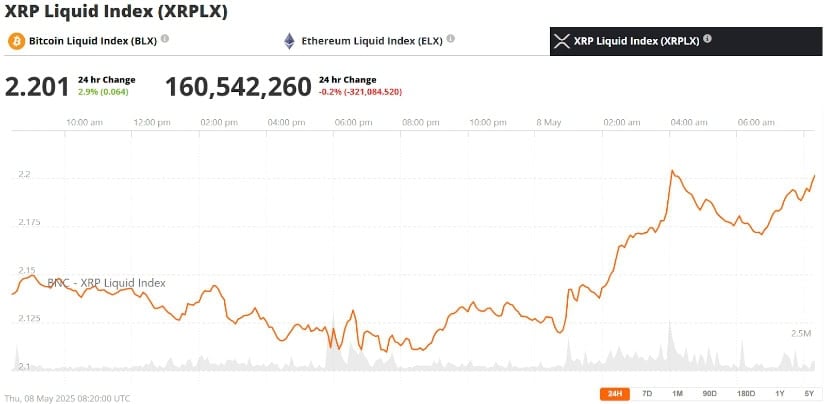

The XRP price, while slightly dipping to $2.12, has remained relatively stable during this period of high-volume movement. Trading activity, however, jumped significantly, up 62% to $3.79 billion, highlighting intensified market engagement.

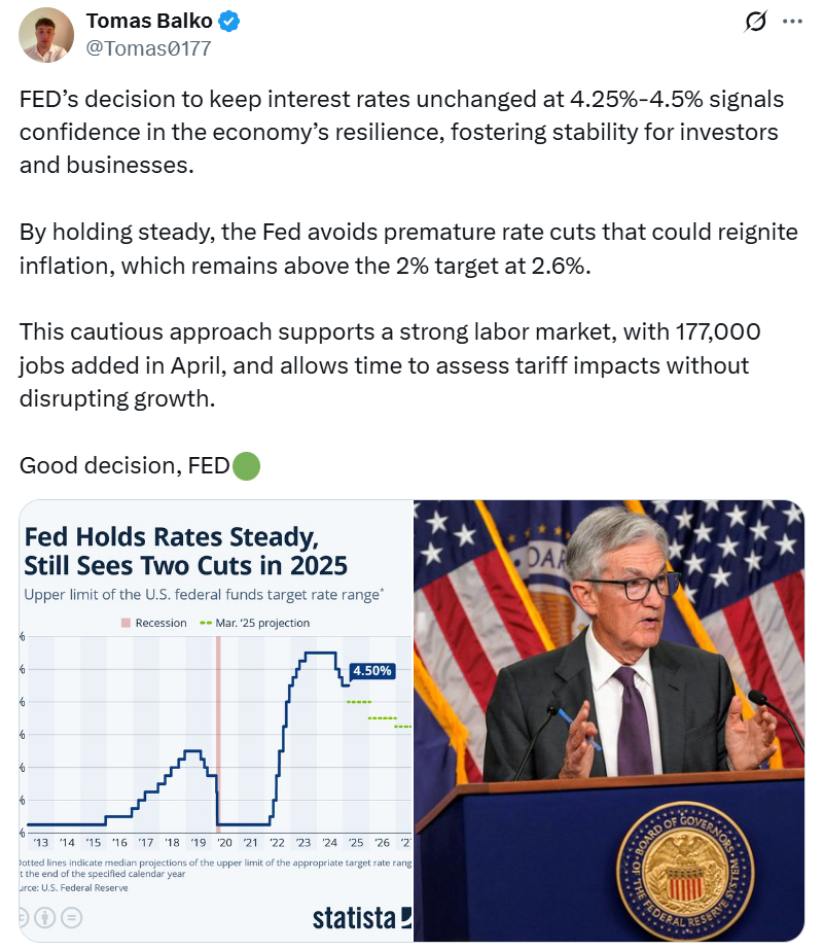

Fed Holds Rates Steady; XRP Holds Ground

The Federal Reserve’s decision to maintain interest rates had ripple effects across financial markets, including crypto. Chair Jerome Powell emphasized that current economic data did not justify a rate cut, leading to cautious sentiment among investors.

The Fed’s rate freeze at 4.25%–4.5% signals economic confidence and stability for markets. Source: Tomas Balko via X

In the crypto sector, higher rates often limit capital inflow as borrowing becomes more expensive. However, XRP defied the broader trend, showing resilience above the $2.10 mark.

“Ripple whales seem to be taking a long-term stance rather than reacting to short-term macro signals,” noted a market strategist.

Institutional Adoption: Ondo Finance Taps XRPL

In other Ripple XRP news, Ondo Finance announced plans to launch a tokenized U.S. Treasury fund on the XRP Ledger. Dubbed the Ondo Short-Term U.S. Government Treasuries (OUSG), the fund will utilize Ripple’s RLUSD stablecoin for transactions.

Set to go live within six months, the initiative promises 24/7 access to government-backed assets via blockchain, signaling a significant leap in institutional-grade offerings on XRPL. The partnership also reinforces Ripple’s strategy of bringing traditional finance onto decentralized platforms.

Whale Accumulation and Market Outlook

Beyond the headline whale transfers, Santiment data reveals that holders with 1 million to 10 million XRP tokens have expanded their stake in the circulating supply—from 8.24% in January to 9.44% in May. This quiet accumulation has fueled optimism about potential upward pressure on XRP value, even as broader price momentum has lagged.

XRP price hit $2.20 resistance, up 2.9% in the last 24 hours at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

Still, XRP price remains down 35% from its yearly peak and has only gained around 1% since the start of 2025. Analysts caution that while whale buying suggests bullish intent, it may not guarantee immediate price reversals.

“Accumulation doesn’t always translate to instant gains—especially in an environment clouded by regulatory uncertainty,” one crypto analyst said.

Ripple Lawsuit News: Legal Developments Continue

On the legal front, the XRP lawsuit with the United States Securities and Exchange Commission (SEC) remains a defining topic. While Ripple secured a partial victory in 2023 when a judge ruled that XRP does not qualify as a security if offered for sale to the general public, the broader regulatory battle is far from over.

New York Attorney General’s Office recently called on the SEC to submit an amicus brief in favor of the argument that Ethereum, just like XRP, is a security. Coinbase, on the other hand, has presented more than 10,000 documents to federal regulators as legal demands increase—pointing to increasing conflict between crypto exchanges and regulators.

Ripple also confirmed it would discontinue its quarterly market reports, citing misuse during legal proceedings. The move ends an eight-year transparency initiative and is seen as an effort to reduce regulatory exposure.

XRP Price Prediction: Key Levels to Watch

XRP is currently trading just above the $2.10 support zone. Technical analysis suggests primary support lies between $1.60 and $1.80, while resistance zones are forming near $2.40, with stronger barriers between $2.90 and $3.00.

XRP price chart highlighting major support and resistance zones. Source: Cypress Demanincor via X

If the 50-day Simple Moving Average crosses below the 200-day SMA—a pattern known as a “death cross”—further downward pressure could follow. However, some traders anticipate a bounce from the $1.85–$2.00 region if bullish sentiment returns.

Final Thoughts

The recent surge in XRP Ledger activity and whale movements underscores a period of heightened activity for Ripple. As the network scales and institutional products like tokenized treasuries emerge, Ripple continues to reinforce its relevance in the digital asset space. However, ongoing legal battles and macroeconomic uncertainties may shape the next chapter for XRP price and the broader Ripple market.

2 hours ago

1

2 hours ago

1

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·