Trump’s remarks, posted on Truth Social, hinted at XRP potentially rivaling the U.S. dollar—a comment that ignited strong reactions across political and cryptocurrency circles.

Trump’s Endorsement Sparks Political and Crypto Debate

Sources close to the endorsement incident say Trump may have been misinformed by advisors or pro-XRP influencers promoting the token as a government-backed digital asset. “This could be an example of how misinformation in the crypto space can sway powerful figures,” said one analyst. The move stirred debate not only over XRP’s suitability for such a role but also over the growing influence of digital assets in political discourse.

Trump’s announcement adding XRP to the U.S. strategic reserve sends shockwaves through the crypto market. Source: Brett via X

Critics argue that Trump may not fully understand the ongoing legal complexities facing Ripple. The XRP lawsuit with the U.S. Securities and Exchange Commission (SEC) remains unresolved, even after a partial settlement. Trump’s support, while potentially bullish for XRP value, has triggered regulatory concerns and may complicate Ripple’s standing with compliance bodies.

Ripple Price Falters Amid Profit-Taking and Legal Backlash

Despite the endorsement, XRP price failed to sustain its upward momentum over the weekend. On Sunday, May 11, XRP dropped 2.7% to $2.41, underperforming the broader crypto market, where Bitcoin and Solana saw notable gains. The XRP/BTC ratio also slipped 3%, indicating waning institutional confidence.

XRPUSD has repeatedly bounced off weekly support, forming bullish candles that indicate strengthening buyer momentum and possible upward continuation. Source: Amitrading on TradingView

Market data shows that the price rejection around the $2.50 resistance level—tested multiple times in recent weeks—led to aggressive profit-taking. Analysts estimate that this resulted in over $360 million being pulled from the XRP trading market within 24 hours. The broader Ripple market saw sentiment shift swiftly from optimism to caution, particularly after the token’s unexpected appearance in a draft policy document related to U.S. strategic reserves.

“The legal system doesn’t react well to political noise, especially when it involves unresolved litigation,” said a compliance expert. Following the report, legal-risk-sensitive trading desks reduced exposure, and regulatory bodies reportedly reopened due diligence reviews concerning XRP’s legal profile.

XRP Lawsuit Update Reignites Regulatory Concerns

Just days before the Trump incident, Ripple had finalized a $50 million settlement in one aspect of its long-running battle with the SEC. The announcement briefly lifted Ripple XRP news into the bullish spotlight, with traders speculating that regulatory clarity was near.

However, the latest developments may have reignited fears around SEC Ripple scrutiny. As speculation mounted that lobbying efforts had influenced policy drafts, XRP lawsuit news re-entered public discourse. According to Capitol Hill insiders, the inclusion of XRP in the strategic reserve draft was “premature” and not aligned with current U.S. regulatory frameworks.

As a result, XRP SEC lawsuits are once again casting a shadow over Ripple’s progress. Some fear that the political entanglement could extend the timeline for regulatory resolution and invite further investigations.

Technical Outlook: XRP Holds Key Support Zone

Despite the turbulence, XRP has managed to hold its ground above a critical support level at $2.36. This zone aligns with the midline of the Keltner Channel, a technical indicator often used to track momentum and volatility. Maintaining this support is crucial to preserving XRP’s broader bullish structure formed since late April.

If XRP’s price breakout follows the symmetrical triangle pattern, it could target $15. Source: Ali Martinez via X

“Buyers still have control above $2.36, but losing this level could invite a sharp correction toward $2.09,” warned a technical analyst. If XRP price rebounds, the upper Keltner Channel near $2.47 and the psychological $2.50 barrier will be the next major targets.

Data from LunarCrush and CFGI.io shows a dip in social sentiment and a drop in the Fear and Greed Index from 78 to 63, suggesting that traders are growing cautious. Weekly RSI has also declined from overbought territory, signaling loss of momentum.

Derivative Markets Show Defensive Stance

In the derivatives market, traders appear to be bracing for further volatility. Open Interest on major exchanges like Binance and Deribit dropped 4.7% over the weekend, reflecting reduced leveraged exposure. Meanwhile, the funding rate on perpetual futures has normalized to neutral levels, down from the positive premium seen last week.

“Without a new catalyst, XRP may consolidate below $2.40 or even test lower support zones,” said a derivatives strategist. If the XRP price prediction holds and bulls defend the current structure, a rebound toward $2.70 remains on the table. But failure to hold the $2.36–$2.25 support range could lead to cascading sell-offs.

XRP Price Recovers Modestly on Monday

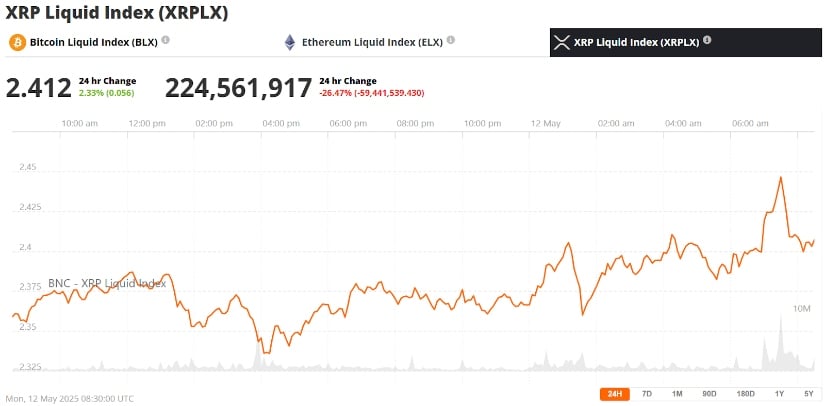

As of Monday, May 12, XRP showed signs of stabilizing. The Ripple crypto token climbed 2.77% to $2.44 in the past 24 hours, according to market data. However, trading volume dipped 18.25%, suggesting waning interest. XRP has gained over 12% in the past week and maintains a strong market capitalization of more than $142 billion.

XRP was trading at around $2.41, up 2.33% in the last 24 hours at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

Despite short-term setbacks, Ripple currency price remains structurally bullish—provided legal noise does not derail market confidence further. Continued strength in Bitcoin may also help Ripple exchange sentiment, as XRP often correlates with BTC’s broader moves.

Final Thoughts: Ripple Navigates a Delicate Crossroad

The combination of political endorsement, legal ambiguity, and profit-taking has thrown XRP into a high-stakes balancing act. While Trump’s support has undeniably raised the token’s profile, it also underscores how vulnerable digital assets can be to misinformation and political optics.

For now, traders and analysts alike will keep a close eye on the Ripple ledger, technical indicators, and any XRP lawsuit updates from the SEC. The next few weeks may prove pivotal in determining whether XRP can retest higher levels or face further headwinds amid renewed regulatory scrutiny.

2 months ago

15

2 months ago

15

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·