While the company continues to highlight efforts to manage token supply and support XRP value, broader market trends suggest deeper structural challenges persist.

Ripple Locks 470M XRP to Ease Supply Pressure

On June 3, Ripple confirmed the escrow of 470 million XRP tokens—part of its regular supply management strategy aimed at reducing immediate circulation and potentially supporting Ripple XRP news sentiment. The move aligns with past efforts to create artificial scarcity, a method often employed in crypto markets to prop up prices.

Ripple has locked 470 million XRP, valued at over $1 billion, into escrow. Source: Whale Alert via X

However, analysts remain skeptical about its effectiveness given XRP’s extensive supply. With over 58 billion XRP currently in circulation and a total maximum supply of 100 billion, tokenomics experts argue that these periodic escrows may have minimal impact in shifting the XRP price long-term.

“Locking tokens is only part of the equation,” noted a market analyst. “Without sustained demand and a compelling investment narrative, reducing supply alone won’t move the needle significantly.”

Institutional Investors Withdraw as XRP Faces Downward Pressure

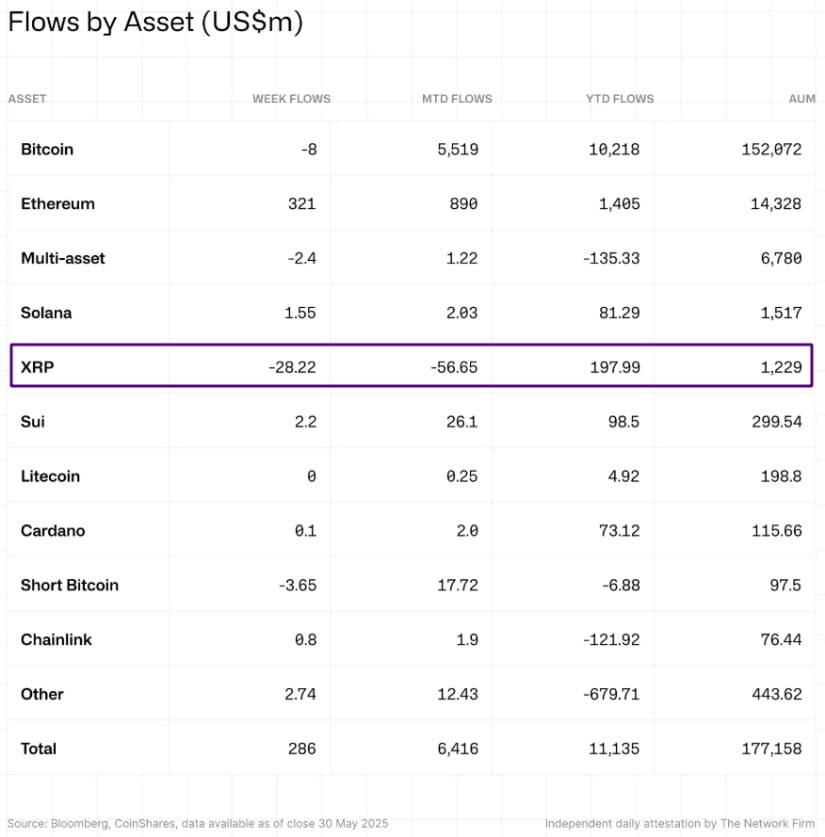

While Ripple aims to stabilize XRP through supply control, XRP investment products are witnessing notable outflows. According to CoinShares’ latest report, XRP funds saw $28.2 million in withdrawals over the past two weeks, marking a sharp contrast to the broader crypto market, which registered $286 million in inflows last week.

XRP investment products recorded their second consecutive week of outflows, totaling $28.2 million, highlighting continued investor caution. Source: Coinshares

This divergence underscores a growing sense of caution among institutional investors, especially amid broader macroeconomic concerns, including U.S. tariff uncertainties. Despite temporary recoveries in XRP price, sentiment has yet to meaningfully improve.

At the time of writing, XRP is trading around $2.20, up 1.6% in 24 hours, but remains stuck in a narrow range between $2.11 and $2.35. Technically, XRP is still trading below its 10-, 20-, 50-, and 100-day moving averages, indicating persistent short- to mid-term bearish momentum. Only the 200-day EMA signals potential longer-term support.

Trading Volume and Volatility Hint at a Tense Market

Despite declining institutional sentiment, XRP trading activity has picked up slightly. Spot volume surged over 24% in the past 24 hours to nearly $2 billion, and derivatives data on Coinglass shows a 1.33% rise in open interest and an 158% rise in volume. This indicates rising trader interest and positioning ahead of a potential breakout.

XRP Derivatives Data Analysis. Source: CoinGlass

However, technical indicators are presenting a watchful line. Relative Strength Index (RSI) stands at 43.5—on the verge of oversold levels—and MACD has signaled a bearish crossover. Bollinger Bands are consolidating, and a breakout is due, but in neither direction.

For bulls, a clean move above $2.35 with volume and short-term moving average crossover can be a launch pad for a rally to $2.50. A breakdown below $2.10 on high volume could lead the way to $2.00 or even $1.85.

Tokenomics and Holder Psychology Weigh on XRP Outlook

XRP’s tokenomics continue to present long-term valuation challenges. With nearly 70% of XRP holders having bought near the $3.40 peak, many are now underwater. The Market Value to Realized Value (MVRV) ratio, which tracks the profitability of token holders, has declined in recent weeks, suggesting shrinking profits and increasing risk of panic selling.

Despite being under a bullish momentum, XRP price could still test critical support levels below the $2 mark. Source: ESC2024 on TradingView

These underlying pressures could limit XRP value appreciation, despite Ripple’s efforts to control supply. Some tokenomics analysts argue that even in a highly bullish scenario—such as Bitcoin hitting $100 million—XRP’s maximum price might only reach $20 due to its enormous supply. Adjusted for inflation and market behavior, that figure could be much lower in today’s dollars.

Ripple’s Strategic Challenges Go Beyond Supply Management

Ripple, led by Brad Garlinghouse, continues to champion the utility of XRP in cross-border payments, boasting partnerships with major financial institutions. However, Ripple price performance remains underwhelming despite the network’s technological strength.

Ongoing regulatory uncertainties around the XRP lawsuit with the U.S. Securities and Exchange Commission (SEC) still cast a shadow. The evolving XRP SEC lawsuit developments continue to influence investor perception, although recent Ripple lawsuit updates suggest slow progress toward resolution.

XRP was trading at around $2.20, up 1.57% in the last 24 hours at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

Until significant regulatory clarity emerges or Ripple revises its tokenomics strategy, XRP may remain vulnerable to bearish pressure. Even Ripple’s relationship with large partners like Ripple Bank of America has yet to yield price-driving headlines.

Outlook: XRP Needs More Than Escrow Moves

The decision to lock 470 million XRP reflects Ripple’s intent to manage market liquidity and support XRP value. Yet, with XRP SEC lawsuits ongoing, diminishing investor profits, and institutional outflows growing, the impact of such moves may be limited in isolation.

For Ripple and XRP to escape their current rut, the ecosystem likely needs a combination of market catalysts, regulatory breakthroughs, and renewed investor confidence—none of which appear imminent.

In the short term, price action will hinge on whether XRP can break above resistance near $2.35 or hold the line above $2.10. Until then, investors may continue to tread cautiously in a market defined by more questions than answers.

1 month ago

18

1 month ago

18

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·