With an expanding user base surpassing 16 million verified accounts and growing attention tied to AI-linked projects, the fundamentals are aligning with the technical breakout. The focus now turns to whether the token can extend its rally toward the $2.80 zone.

Breakout Retest Strengthens Bullish Structure

The recent breakout carried significant weight because it was fueled by heavy buying activity that confirmed market conviction. Once the price cleared the long-term descending trendline, it immediately shifted into a crucial support zone now undergoing retest.

This process is common in technical breakouts and often signals the start of larger rallies when buyers maintain control.

Source: X

Trading activity shows that the coin continues to hold firm around this support level, which is critical for sustaining momentum. Retests provide opportunities to measure market strength, and so far, $WLD has displayed resilience despite short-term fluctuations.

Volume accompanying this retest also reflects confidence among participants, who view the structure as part of a consolidation before continuation.

Market Data Confirms Uptrend Potential

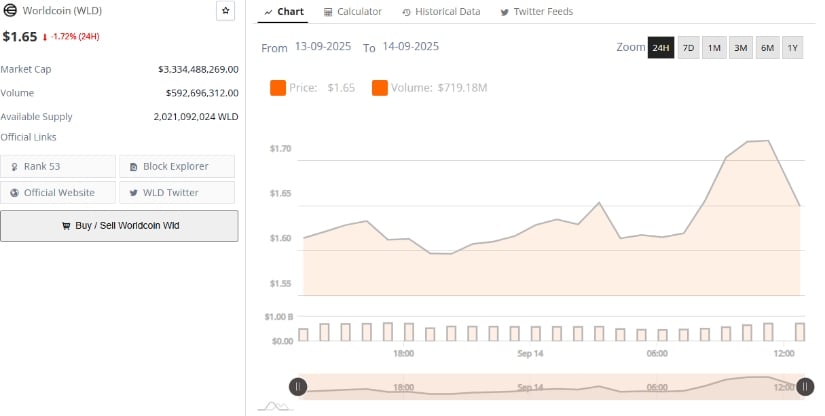

At press time, recent data shows Worldcoin trading at approximately $1.65, with a market capitalization of $3.33 billion. Despite a small 1.72% dip over the last 24 hours, the project maintains daily trading volume above $590 million, reflecting solid liquidity.

Such conditions support active participation from both retail and institutional sides, offering a stable backdrop for price discovery.

Source: BraveNewCoin

A key technical observation is that the token has exited a prolonged consolidation range between $1.35 and $1.65. The breakout from this accumulation zone indicates a shift in sentiment, where previous ceilings now act as new floors.

This structural change often sets the stage for stronger price momentum as buyers defend the reclaimed zone.

Technical Indicators Signal Continued Momentum

Momentum indicators further strengthen the bullish narrative for Worldcoin. The Chaikin Money Flow shows a positive reading of 0.22, pointing to steady capital inflows that support ongoing accumulation. In parallel, the MACD line has crossed above its signal line with a positive histogram, reinforcing short-term upward momentum. Together, these metrics highlight that buying pressure remains dominant.

Source: TradingView

Candlestick patterns also reflect the shift in market structure. The breakout from the descending trendline not only erased months of resistance but also set the stage for a broader rally phase. With increasing volume alongside this breakout, traders have more evidence that the move is sustainable rather than a temporary spike.

As long as these indicators remain aligned, the bullish case for the crypto holds strong. The ability to maintain support zones while building upward pressure suggests that the asset has the technical foundation for an extended rally. If momentum persists, advancing toward $2.80 becomes a realistic scenario backed by both volume and market structure.

3 months ago

25

3 months ago

25

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·