USDT vs. USDC: Among them, USDT (Tether) and USDC (USD Coin) stand out as the most prominent. This article delves into their differences, similarities, and unique features to help you make informed decisions.

Understanding Stablecoins

Stablecoins are a category of digital assets designed to maintain a consistent value over time. Developers peg them to stable reserves, most commonly traditional fiat currencies like the U.S. dollar, euro, or yen. Some stablecoins even link to commodities such as gold.

Their primary goal is to offer the technological benefits of cryptocurrencies—including rapid global transactions, borderless access, and transparency—without the extreme volatility that often plagues assets like Bitcoin or Ethereum. By providing a stable medium of exchange, stablecoins help bridge the gap between traditional finance and the digital economy.

Users rely on stablecoins for a variety of reasons. Traders use them to quickly move funds between different cryptocurrencies without converting to fiat, minimizing exposure to sudden market swings. Businesses and individuals use stablecoins for payments, remittances, and even payroll, taking advantage of fast settlement times and lower fees compared to traditional banking systems.

In decentralized finance (DeFi), stablecoins serve as a vital building block, enabling lending, borrowing, and yield-generating activities with reduced risk. As blockchain technology continues to grow, stablecoins play an increasingly important role in supporting a more accessible and efficient financial ecosystem.

Overview of USDT (Tether)

Launched in 2014 by Tether Limited, USDT is the first and most widely adopted stablecoin in the cryptocurrency market. It operates across multiple blockchain networks, including Ethereum, Tron, EOS, Algorand, and others, offering users flexibility and fast transaction capabilities. With a market capitalization of approximately $150 billion, USDT dominates stablecoin trading volumes and serves as a crucial liquidity source across centralized and decentralized exchanges worldwide. Traders and businesses rely heavily on USDT to move funds quickly without the risks associated with price volatility in traditional cryptocurrencies.

Tether Limited, the company behind USDT, operates under the umbrella of iFinex Inc., the same parent company that owns the Bitfinex exchange. Paolo Ardoino currently serves as the CEO of Tether and Bitfinex, a role he assumed in 2023 after serving several years as Chief Technology Officer (CTO). Ardoino has positioned Tether as not just a stablecoin provider but also a significant player in the broader crypto infrastructure ecosystem. Tether often emphasizes its commitment to transparency, though the company has faced ongoing scrutiny from regulators and media regarding its reserve practices.

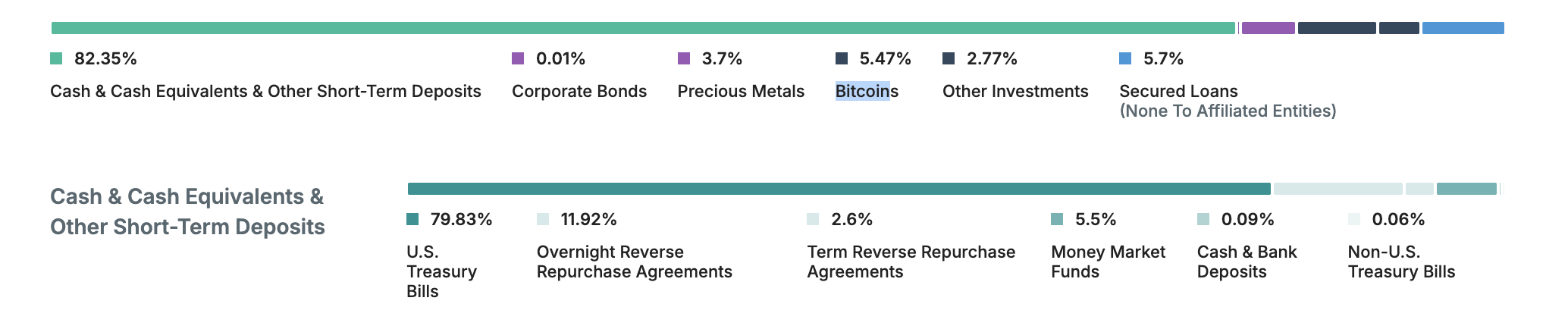

USDT claims to maintain its value through full backing by reserves. These reserves historically included a mixture of assets such as U.S. Treasury bills, commercial paper, secured loans, corporate bonds, and even precious metals. However, due to regulatory pressure and public demand for greater transparency, Tether has shifted its reserve composition heavily toward more conservative holdings, primarily short-term U.S. Treasury bills and cash equivalents. Tether publishes regular reserve reports, although these are attestations rather than full audits, which leaves some questions open regarding the granularity of the reserve breakdown. Despite past controversies, USDT remains a cornerstone of the global crypto economy, providing users with a simple, liquid, and stable digital dollar alternative.

Overview of USDC (USD Coin)

Introduced in 2018, USD Coin (USDC) quickly established itself as one of the leading stablecoins for users seeking transparency and regulatory assurance. The stablecoin is issued by the Centre Consortium, a partnership initially founded by Circle and Coinbase, two of the most recognized names in the American fintech and cryptocurrency industries. USDC operates on multiple blockchains, including Ethereum, Solana, Algorand, Stellar, and others, ensuring wide accessibility and fast transaction capabilities across different platforms. With a market capitalization around $30 billion, USDC has positioned itself as the stablecoin of choice for institutions, DeFi applications, and users focused on compliance and security.

Circle, the principal issuer of USDC, has made regulatory compliance and transparency central to its business model. Jeremy Allaire, co-founder and CEO of Circle, has emphasized that trust and clear regulation are critical for the future of stablecoins and digital assets. Circle operates under U.S. regulatory oversight as a registered money services business (MSB) and has recently taken steps to comply with the European Union’s Markets in Crypto-Assets (MiCA) regulation, making USDC one of the few stablecoins ready for the evolving global regulatory landscape. Circle’s leadership has positioned USDC as a bridge between traditional finance and the emerging world of blockchain-based assets.

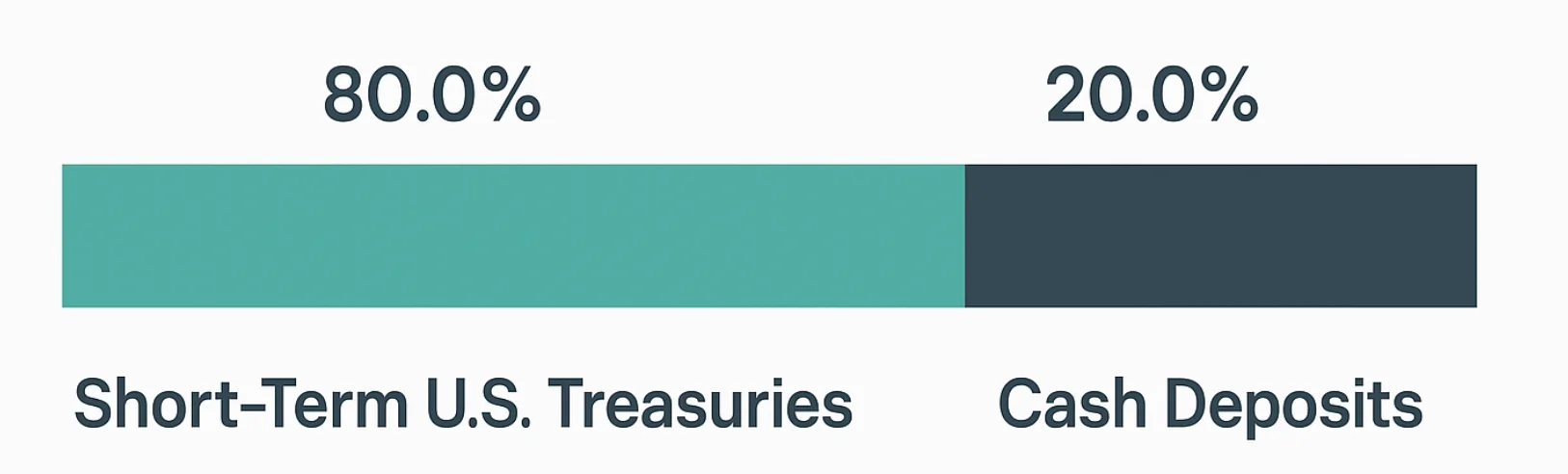

USDC’s backing is straightforward and fully transparent. Each USDC token is backed 1:1 with U.S. dollar-denominated reserves held in custody at regulated financial institutions. These reserves consist almost entirely of short-term U.S. Treasury bills and cash, offering users a high degree of confidence that every USDC token is fully redeemable. Circle publishes monthly attestation reports verified by independent accounting firms, providing clear visibility into the reserve holdings. Unlike USDT, which faced criticism for its past reliance on riskier assets, USDC’s reserve structure is built to meet both institutional standards and upcoming international regulations. As a result, USDC has become the preferred stablecoin for businesses, fintech platforms, and decentralized finance protocols that prioritize transparency, regulatory compliance, and long-term stability.

How USDT and USDC Handle Reserves

Tether’s Reserve Strategy

Tether initially backed USDT mostly with cash. As demand grew, Tether expanded into assets like commercial paper and corporate bonds. Critics warned that such assets carried liquidity risks, especially during financial turbulence.

Regulatory pressure forced Tether to shift its reserve model. Today, Tether holds around 80% of reserves in short-term U.S. Treasury bills. The company phased out commercial paper entirely by late 2022. Although Tether publishes quarterly reports, they remain attestations, not full audits, leaving some gaps in clarity.

USDC’s Conservative Approach

USDC maintains strict reserve standards. Circle backs each USDC token with U.S. cash or short-term Treasuries only. The company avoids riskier instruments like corporate bonds or private loans.

Circle releases monthly attestations verified by major firms like Deloitte. These reports confirm a clean 1:1 backing structure. This commitment appeals to institutions and platforms seeking maximum security and compliance.

While both stablecoins moved toward safer reserves, USDC’s transparency offers a clearer picture for risk-averse users.

Regulatory Actions and Stablecoin Compliance

Legal Challenges Faced by Tether

Tether encountered several regulatory hurdles. In 2021, the New York Attorney General fined Tether $18.5 million for reserve misrepresentations. Tether agreed to provide improved disclosure but continues to face skepticism in some markets.

The lack of formal licenses outside specific regions could limit Tether’s expansion if stricter global rules emerge.

Circle’s Regulatory Alignment

Circle embraced regulation early. USDC’s issuer operates as a registered money services business in the U.S. It works closely with authorities to maintain compliance.

With the arrival of MiCA in Europe, Circle became the first stablecoin issuer to secure a full license. This approval allows USDC to operate freely across the European Economic Area.

In contrast, Tether failed to meet MiCA’s licensing demands. As a result, several European exchanges began preparing to delist USDT to avoid regulatory penalties.

Future U.S. legislation could mirror MiCA’s standards. Circle appears ready for such developments, while Tether may need further adjustments to stay competitive.

USDT vs. USDC: Key Differences

Transparency and Auditing

USDT has faced scrutiny over the completeness of its reserve audits. While efforts have been made to improve transparency, concerns remain. In contrast, USDC provides monthly attestation reports by independent accounting firms, verifying that its reserves match the circulating supply.

Regulatory Compliance

USDT’s regulatory status is less clear, with past legal issues and fines. USDC adheres to U.S. money transmission laws, making it one of the most regulated stablecoins.

Reserve Composition

USDT’s reserves include a mix of assets like U.S. Treasury securities, cash, and other investments. USDC’s reserves consist solely of U.S. Treasury securities and cash, enhancing its appeal to risk-averse users.

Liquidity and Market Adoption

USDT boasts higher market capitalization and liquidity, making it widely accepted across numerous exchanges. While slightly less liquid, USDC is gaining traction due to its regulatory compliance and transparency.

MiCA Compliance and Its Impact

The Markets in Crypto-Assets (MiCA) regulation, introduced by the European Union, aims to provide a comprehensive regulatory framework for digital assets. MiCA requires stablecoin issuers to maintain full reserves, undergo regular audits, and secure EU approval.

USDC has achieved compliance with MiCA, reaffirming Circle’s commitment to regulatory best practices and building a sustainable digital asset ecosystem that prioritizes trust and transparency . On the other hand, USDT has not pursued MiCA compliance. Without a licensed entity authorized to issue USDT in the EU, exchanges that are MiCA-regulated have no choice but to halt its offering .

USDT vs. USDC: Advantages and Disadvantages

USDT

Offers extremely high liquidity across global markets.

Supports a very wide range of blockchains (Ethereum, Tron, Algorand, and others).

Publishes quarterly reserve attestations but no full independent audits.

Faces ongoing regulatory scrutiny and lacks full MiCA compliance.

Remains highly popular among traders, remittance users, and emerging markets.

USDC

Provides high liquidity, especially on U.S.-regulated and institutional platforms.

Maintains monthly attestation reports by leading accounting firms like Deloitte.

Holds full regulatory compliance in the U.S. and the European Union under MiCA.

Integrates deeply with DeFi platforms, fintech apps, and corporate payment systems.

Gains steady growth from businesses needing transparent and regulated stablecoin solutions.

How Traders and Institutions Use USDT and USDC

USDT: The Liquidity King

Traders often favor USDT for its unmatched liquidity. Almost every major exchange supports USDT trading pairs. High liquidity allows traders to enter or exit positions quickly without significant slippage.

Day traders and arbitrageurs use USDT to move capital across different platforms rapidly. Many DeFi platforms outside the U.S. also integrate USDT as their primary stablecoin. Tether’s availability across multiple blockchains like Tron and Ethereum strengthens its flexibility.

Remittance services in emerging markets rely on USDT too. Countries experiencing currency instability see USDT as a convenient digital dollar alternative.

Despite regulatory noise, Tether’s dominance remains unchallenged for now, especially in regions with less strict financial regulations.

USDC: The Choice for Compliance and DeFi

Institutions often pick USDC over USDT when compliance is essential. Regulated exchanges, fintech apps, and DeFi projects favor USDC for its transparent reserve structure.

Many lending and borrowing platforms in decentralized finance, like Aave and Compound, use USDC as a primary collateral asset. Businesses that want to offer crypto payments without regulatory headaches often prefer USDC.

USDC also powers newer financial products like tokenized bonds, treasury services, and blockchain-based savings accounts. Circle’s partnerships with banks and payment providers ensure USDC can move easily between blockchain systems and traditional banking rails.

Because USDC complies with U.S. regulations and MiCA, it offers future-proof utility for global financial applications.

USDT vs. USDC: Which Stablecoin Fits Your Needs?

USDT and USDC have built themselves into vital pillars of the crypto economy. Yet their paths, strategies, and reputations differ sharply.

Tether (USDT) leads the market in liquidity and adoption. Traders who prioritize speed, flexibility, and availability continue to choose USDT. It powers the largest trading volumes globally and supports dozens of blockchain networks.

However, USDT carries some historical baggage. Regulatory challenges and questions about reserve transparency make it riskier for institutions and compliance-focused users. Its lack of full MiCA compliance could also limit growth in regulated markets, especially within Europe.

Meanwhile, USDC offers clarity, consistency, and strict regulatory adherence. Circle’s commitment to monthly attestations, reserve safety, and licenses under U.S. and European law gives USDC a major advantage with regulators and institutions.

USDC users gain not just a stable digital dollar but a tool designed for the next generation of decentralized finance. Financial apps, corporate payments, and tokenized financial products increasingly turn to USDC when they need reliable, compliant infrastructure.

Ultimately, choosing between USDT and USDC depends on your priorities. If you need maximum liquidity and global trading access, USDT might still be the best choice. If you value transparency, regulation, and long-term trust, USDC offers a more secure foundation.

Both stablecoins continue to evolve rapidly. Watching how they adapt to new regulations and user demands will shape the future of stable value in crypto markets.

The post USDT vs. USDC: A Comprehensive Comparison of Leading Stablecoins appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·