Stock Float is one of those topics that most people just brush over when they talk about trading and investing, but the float is a vital piece of information.

It affects how liquid an instrument is, how volatile it is, and how easy it is to enter and exit positions.

Float refers to the number of shares available for trading in the open market, which differs from the total outstanding shares.

This distinction is crucial as it offers a more tangible measure of a stock’s liquidity and volatility.

For traders, understanding stock float is important because of the information that it provides.

Contents

Defining Stock Float The Role of Stock Float Stock Float and Investment Decisions Market Regime Impact And Stock Float Tools And Resources For Analyzing Stock Float ConclusionDefining Stock Float

Before discussing the uses for stock float, let’s give it a solid definition.

It represents the number of shares available for trading in the open market.

This figure differs from the total number of shares a company has issued, known as outstanding shares.

To calculate the float, one must subtract any closely held or restricted stocks from the total outstanding number, including insider ownership, major stakeholders, and employees with stock options, so basically any shares that are not often transacted.

The remaining shares, which are free to trade without restrictions, constitute the float. Another thing to note about the stock float is that it is dynamic.

As insiders buy and sell, companies initiate buybacks, and large funds adjust positions, the float will adjust and need to be recalculated.

As a result, most places calculate the float on short-term intervals from every quarter to as low as daily.

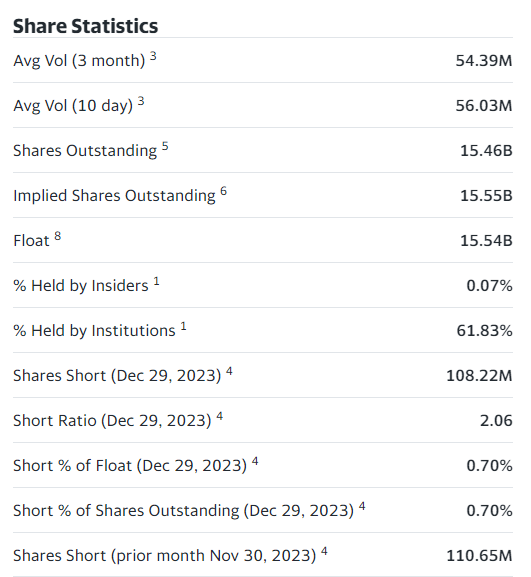

This information is usually available and pretty easy to find, like on Yahoo Finance, which you can see here.

The Role of Stock Float

Now that float has a definition, let’s discuss how it affects stocks and trading.

The float is often directly correlated to how much volatility it can experience.

A stock with a lower float, colloquially called “Low Floats” or sometimes “No Floats,” has a greater chance of violent movements due to the lack of available liquidity.

This can also lead to price manipulation.

A common form of this is the “Pump and Dump” scheme that most people know.

These low-float stocks are a favorite among many traders because of the movements that relatively small positions can start.

Conversely, stocks with a larger float are typically less volatile, attracting investors seeking more stable price movements.

Take Apple or Microsoft as an example of very large float stocks.

Outside of an economic event, the amount of shares one person would have to trade to manipulate its price would be massive.

This type of liquidity is very desirable to many traders who are more than happy to sacrifice the wild movements for the ability to trust the stock will not move erratically because someone opens a large order.

Stock Float and Investment Decisions

With a basic understanding of what stock float is and what its role in the market is, let’s look at how it impacts investment directions.

When considering a new investment, whether short or long-term, analyzing the float will give you many insights into how that ticker trades and what strategy could be best.

For instance, value investors often favor companies with a smaller float because they are smaller and occasionally undervalued.

This provides a unique challenge to the value investor, though, if they enter too large too quickly, the stock could squeeze higher, creating issues for their cost basis.

Additionally, once the stock has hit fair value and they want to exit, how much can the market handle before it moves the price?

Analyzing float and daily volumes will give this investor the best plan to enter and exit the position.

Other strategies like momentum, growth, and dividend collection often rely on larger companies with established histories.

These typically have much larger floats and daily volumes, allowing investors to enter and exit almost immediately.

As discussed above, these larger floats and volumes also help stabilize the stock price from rapid fluctuations.

These are just a few scenarios, but you can see why analyzing the float and volumes is vital to investors.

Access 9 Free Option Books

Market Regime Impact and Stock Float

The impact of stock float can be further amplified during different market regimes.

In bull markets, when investor sentiment is excessively positive, companies with a smaller float can see their stock prices rise rapidly, allowing them to potentially outperform stocks with larger floats.

However, this is a double-edged sword because once the fear creeps into the market, these stocks can experience large single-day losses due to the lack of liquidity available to absorb the selling.

In contrast to lower floats, stocks with a larger float tend to weather market downturns with more resilience due to the liquidity available to handle the selling.

Similar to the low float stocks, this is not without its cost, though larger float companies often experience slower price appreciation due to the sheer number of shares required to move the price.

It is up to the investor to determine what type of risk-reward they seek.

Another important thing to remember here is that float is on a spectrum; there are many levels to it, so it’s not an all-or-nothing decision on what type of market action one is comfortable with.

Tools And Resources for Analyzing Stock Float

For investors looking to utilize float in their decisions, there are numerous places to find the information.

Financial data platforms like Bloomberg, Reuters, FinViz, BarChart, and even Yahoo Finance offer detailed insights into a company’s stock float and countless other company and volume metrics.

The main difference is how quickly up-to-date data is needed.

Yahoo Finance may not update as regularly as Bloomberg, so if the float is an integral part of your trading, opting for a paid service might be better.

Most brokers also carry this information on their platform or their website.

In terms of education on float, in addition to this article, many places can contribute additional pieces of information, but for something like this, it’s often best to just observe how float impacts prices over time.

Given the ease of availability of information, making a watchlist and monitoring the prices and floats over time should be sufficient.

Conclusion

Stock float is a crucial yet often overlooked factor in trading and investment decisions.

Low-float stocks may offer rapid price movements but carry higher risks of volatility and market manipulation.

In contrast, higher float stocks generally provide more stability and predictability, suitable for investors who favor less volatile names.

Given the currently connected nature of the world, float information is now easily available online for free or with paid services, often update frequency being the only differentiating factor.

However you get the information, the float should be at the top of your list when looking at new equities to trade.

We hope you enjoyed this article on understanding stock float.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·