Let’s look at a hypothetical example where a broken-wing butterfly options structure can be turned into a black-swan hedge.

In the process, we can explore the concept to see if it is truly possible to have a free hedge.

Contents

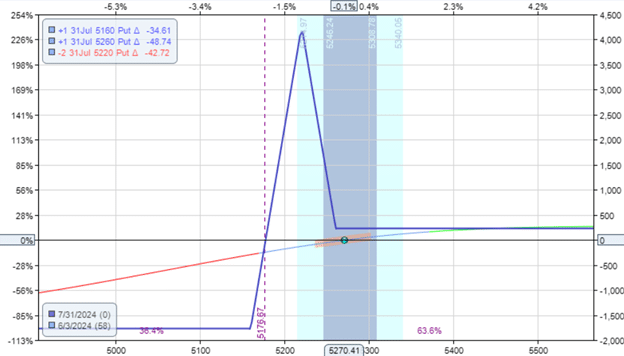

Converting To A Black Swan Hedge Is There Such A Thing As A Free Hedge? Final Thoughts ConclusionThe SPX trade starts off on June 3rd, 2024, by receiving a credit of $230 for this broken-wing butterfly with 58 days till expiration:

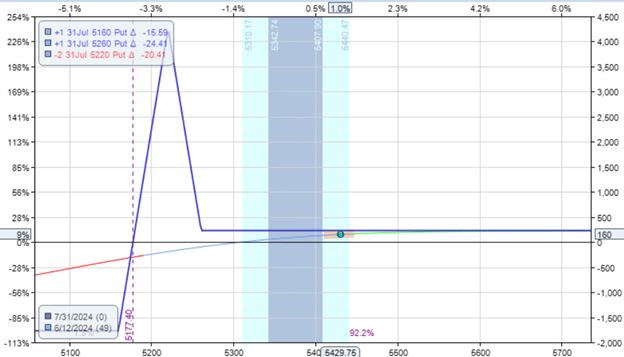

Nine days later, as the price of SPX moves up favorably, the trade captures a profit of $160:

The investor rolls the upper leg from 5260 to 5250 for a credit of $120.

This trade is done by selling the 5260 put option and buying a 5250 put option.

This results in more upside profit available:

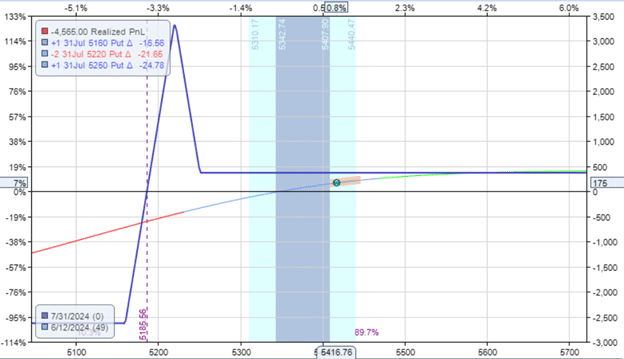

Ten days later, on June 26th, the investor made another similar roll – selling the 5250 strike to buy the 5240.

The investor is essentially selling a bull put credit spread for a credit of $85, resulting in the following:

Converting To A Black Swan Hedge

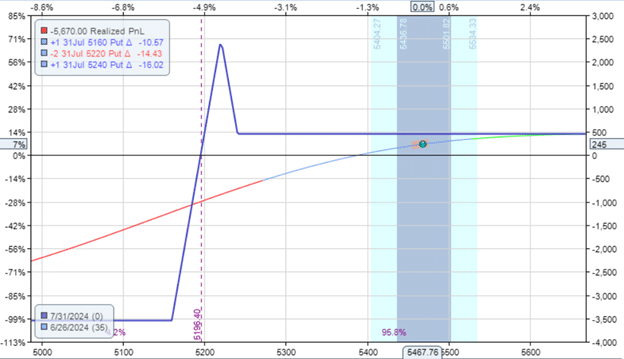

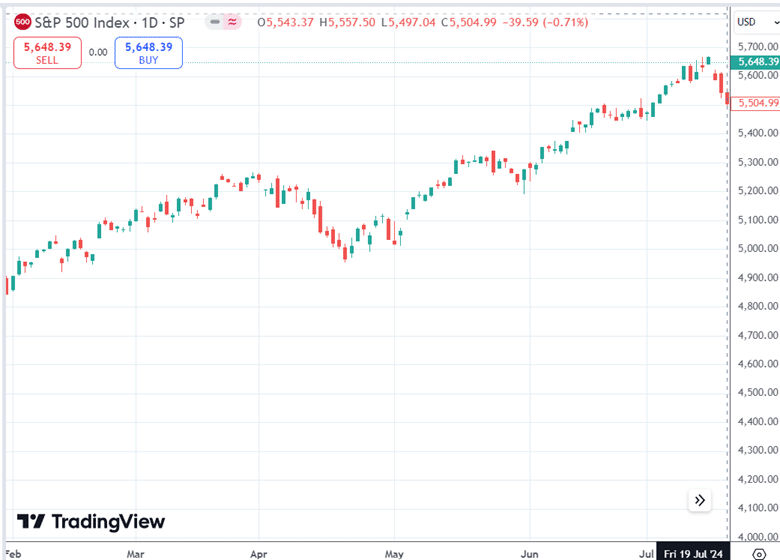

The SPX keeps going up:

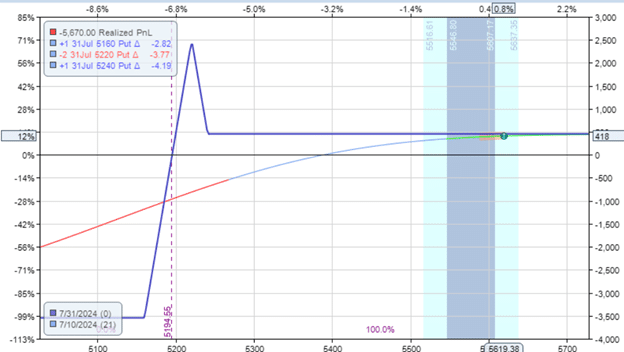

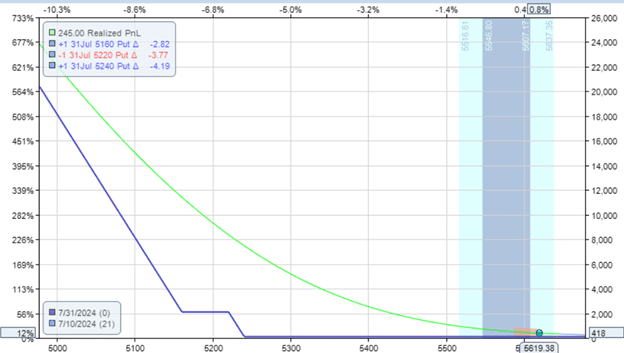

On July 10th, the trade had $418 of profits, looking like the following with very little upside profit left:

Covered Call Calculator Download

Because the price has moved so much away from the butterfly, the short options of the fly are at the four delta on the option chain (very far out-of-the-money).

The investor realizes that a short put at the 5220 strike can be purchased for a debit of $350.

The investor buys back one of the butterfly’s short put options.

By doing so, it resulted in two long puts and one short put remaining.

This creates a sort of ratio spread where the investor holds:

One long put at 5160 Another long put at 5240 One short put at 5220The risk graph looks like this:

Notice that there is no risk of loss in this trade; this is now a risk-free trade. It can also be seen as a black swan hedge. Because if the SPX market crashes within a week, the trade can profit even further.

The trade has 21 days till expiration with the following Greeks.

Delta: -3

Theta: -33

Vega: 80

Ideally, the investor should not hold till expiration.

If the market does not crash at that time, the trade at expiration would likely be a profit of only $68 ($418 – $350).

This is because this ratio spread has a theta of -$33 and loses $33 daily if SPX does not move.

If SPX continues to increase, the ratio spread will also lose money due to its negative delta.

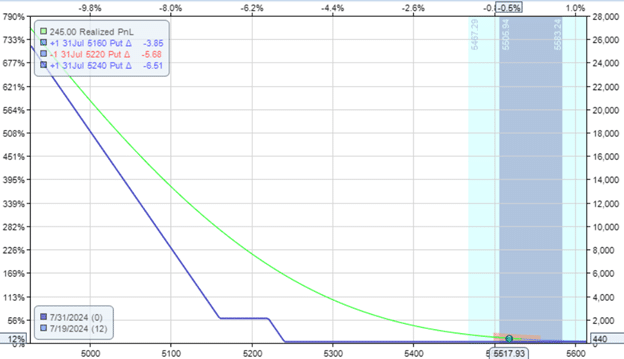

As it turns out, the market didn’t crash, but there was a pullback on July 19th,

which allowed the black swan hedge to profit a little bit:

With only 12 days left in the trade, the investor decides to close the trade for a final $440 profit.

Is There Such A Thing As A Free Hedge?

Some might say the investor has achieved a free black swan hedge.

But is there ever such a thing as a free hedge?

We submit that there is not.

There is no such thing as a free hedge.

In this example, the hedge was created by taking the $418 profits of the butterfly and paying $350 to buy back one of the short puts.

Had the butterfly not achieved the $418 profit, there would not have been a risk-free hedge.

Final Thoughts

This article looks at how an options trader can convert a broken-wing butterfly strategy into a black-swan hedge, effectively creating a risk-free position with the potential for further profits if a significant market drop occurs.

A question of debate is whether it is better to close the trade to keep the $418 profit or whether to create the black swan hedge.

That depends on how the underlying asset decides to move.

Each decision in options trading should be carefully weighed against the market conditions.

The black swan hedge would profit if there was a crash.

However, if SPX had continued up, it would have drained the $418 profit that had been accrued.

This illustrates that even risk-free trades come with opportunity costs and potential downsides.

This case study underscores the importance of understanding the nuances of options strategies and being mindful of the inherent risks and costs associated with so-called “risk-free” trades.

Conclusion

No hedge is truly free.

This opportunity to create a risk-free hedge would not have existed had the market not moved favorably earlier.

We hope you enjoyed this article on how to turn a butterfly into a Black Swan hedge.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·