The event is fueling concerns that the Trump family trust, which holds a significant portion of the coin, may soon liquidate its holdings, potentially deepening the coin’s decline.

$300 Million Unlock Stirs Volatility Concerns

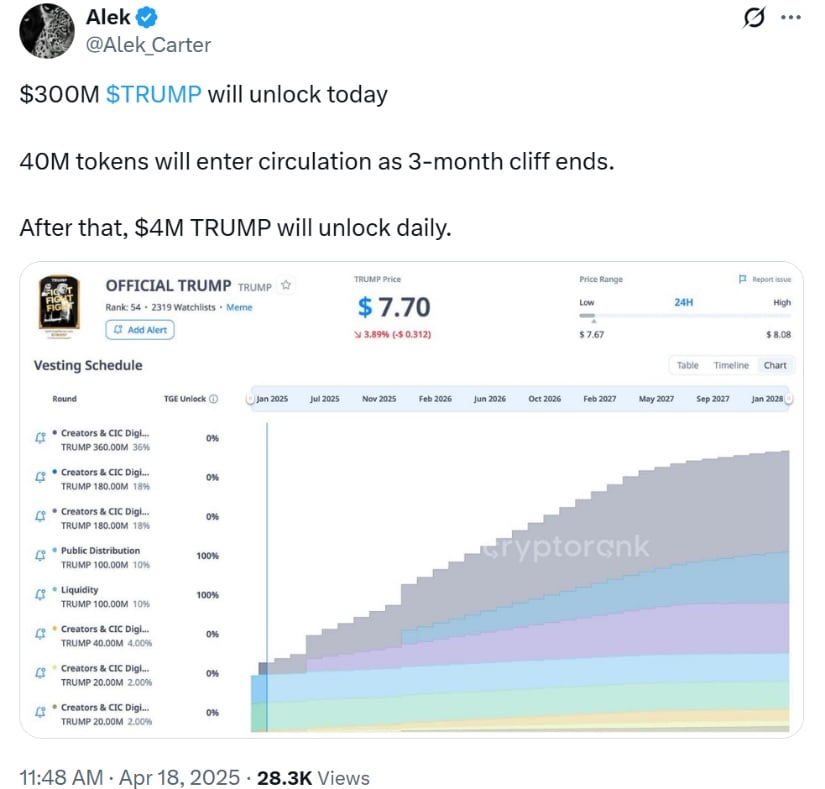

On April 17, 40 million Trump digital tokens—recently valued at approximately $300 million—were released from lock-up restrictions. These coins are now eligible for sale on major platforms like Coinbase, Robinhood, or decentralized exchanges. Among the beneficiaries is CIC Digital LLC, a firm tied to the Trump Organization and controlled by the Donald J. Trump Revocable Trust.

A $300M $TRUMP token unlock occurred as 40 million tokens entered circulation following the end of a 3-month cliff, with $4M worth set to unlock daily thereafter. Source: Alek via X

The Trump coin, launched days before President Trump’s January inauguration, saw an explosive debut, soaring to a peak of $73.43 on January 19. However, it has since cratered to about $7.50, with Thursday’s 3% dip adding to ongoing bearish momentum. According to CoinGecko, the token’s market cap now hovers around $1.6 billion, down sharply from its initial highs.

Trump Coin ($TRUMP) Technical Analysis

Despite the fanfare around the unlock, $TRUMP has shown little bullish response. Analysts point to a deteriorating technical structure. The coin remains firmly below the Ichimoku Cloud, a widely used indicator that signals trend direction. Moreover, the short-term EMA (Exponential Moving Average) continues to trail below the long-term ones, indicating a sustained bearish trend.

held the $7 weekly low for 13 days despite a major unlock, signaling potential accumulation and a possible rebound. Source: HamadaMark on TradingView

Further dampening sentiment is the BBTrend indicator, which flipped sharply into negative territory at -6.93 this week, down from a mildly positive 2.35 earlier. This suggests any recent upward momentum has stalled, and sellers are firmly back in control.

“The failure to reclaim the cloud and ongoing EMA misalignment signals that bulls have a steep hill to climb,” said one technical analyst tracking the coin.

Trump’s Trust in Focus

Fueling speculation is the possibility that Trump’s revocable trust, which holds stakes in CIC Digital, may offload some of its newly unlocked coins. According to Trump’s financial disclosure, the trust is overseen by his children and can make transactions under the guidance of an ethics attorney. Still, even a partial sell-off could apply immense pressure to the already fragile market.

Adding to investor concerns, data from Chainalysis reveals that wallets linked to the token’s developers have already pulled in over $350 million—mostly by depositing unlocked coins into liquidity pools, allowing for indirect sales in exchange for USDC. These developers also earned an estimated $35 million in trading fees as liquidity providers.

“This setup makes it easy to gradually cash out while avoiding direct exchange listings,” noted a Chainalysis analyst.

Political Heat and Regulatory Loopholes

The Trump coin’s launch—and its subsequent plunge—has triggered backlash from lawmakers. Democratic Rep. Sam Liccardo is now backing the MEME Act, a proposed bill aimed at banning federal officials and their families from profiting off meme coins.

“The First Family is exploiting the public through meme coins,” Liccardo wrote. “This loophole invites insider trading and foreign influence.”

Despite these concerns, the SEC has so far stayed on the sidelines. Since $TRUMP is not classified as a security, it remains outside the agency’s jurisdiction, sparking renewed calls for regulatory clarity around meme coins.

High Risk, High Drama

The broader crypto community remains divided over $TRUMP’s future. While President Trump has embraced his role as the “crypto president,” backing multiple blockchain ventures and even signing executive orders to shape federal digital asset policy, critics argue this dual role represents a clear conflict of interest.

After holding steady at $7 for 13 days post-unlock, $TRUMP appears to have bottomed out and could be ready for a rebound. Source: Captain Faibik via X

“There’s absolutely a conflict,” said Ann Koppuzha, a business law professor at Santa Clara University. “Trump’s policies could directly benefit his own crypto ventures.”

Meanwhile, 94% of $TRUMP tokens are reportedly concentrated in just 40 wallets. This high concentration raises the risk of sudden dumps by large holders, making retail investors particularly vulnerable.

What Comes Next?

The unlocking schedule will continue in the months ahead, with over 800 million $TRUMP tokens set to be released in stages through 2027. While a price recovery is not impossible, it would require a dramatic shift in sentiment and sustained buying pressure—neither of which is currently in sight.

Crypto analyst HENRI.SOL commented on X, “Trump is shilling $TRUMP coin on Truth Social… Looks like exit liquidity before the unlock.”

Whether Trump’s meme coin survives the turbulence or succumbs to mounting political and market pressures remains to be seen. But one thing is certain: the intersection of crypto, politics, and personality has never been more volatile.

1 month ago

13

1 month ago

13

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·