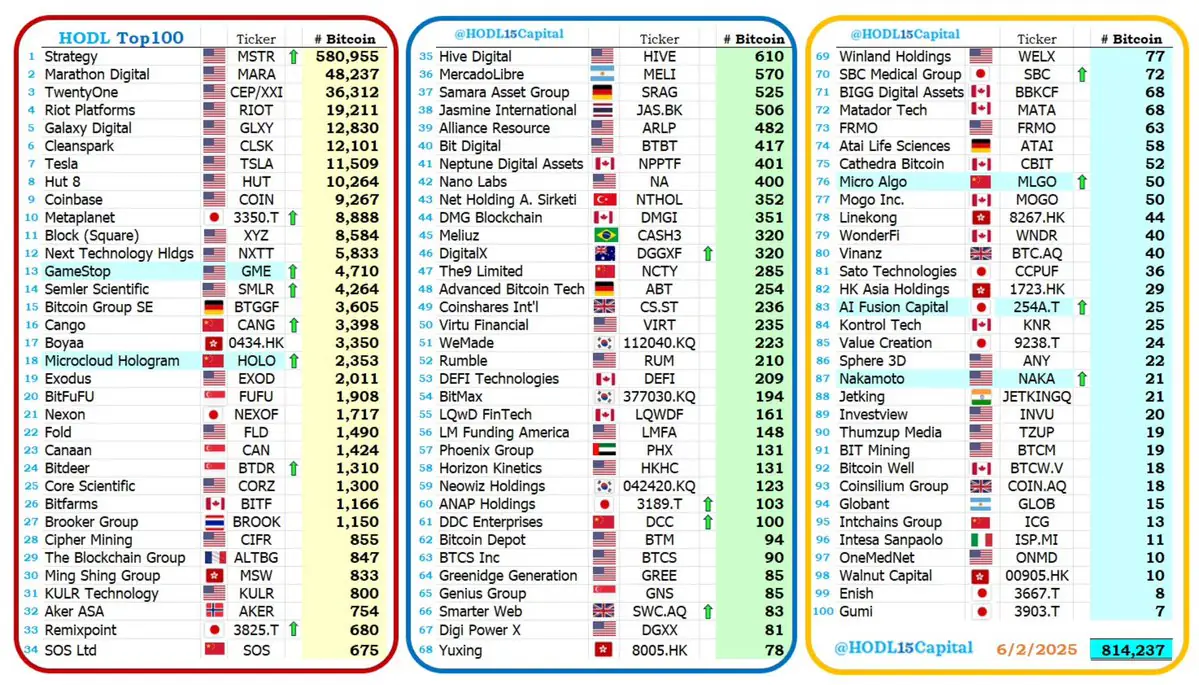

In a headline-making move, GameStop (GME) has officially entered the HODL Bitcoin Top 100 list, debuting at #13 with a treasury of 4,710 BTC. The addition underscores the company’s aggressive pivot into digital assets, following similar strategic moves from tech and fintech firms in recent months.

17 Companies Add to Bitcoin Reserves

Seventeen firms increased their Bitcoin holdings in this latest update, contributing an additional +9,500 BTC to the combined total. This wave of accumulation highlights growing corporate confidence in Bitcoin as a long-term reserve asset—even amidst market volatility.

Top Holders and Rankings

MicroStrategy (MSTR) retains the #1 spot with 186,550 BTC, continuing its role as the most influential corporate Bitcoin holder. Marathon Digital (MARA) and TwentyOne (CEP) follow with 48,237 BTC and 36,318 BTC, respectively. Block (Square), Coinbase, and Tesla remain in the top 10, reflecting sustained exposure to the crypto asset class.

Global and Sector-Wide Representation

The list features a diverse array of firms from tech, mining, finance, and even biotech sectors across North America, Asia, and Europe. Notably, Asia-based companies such as Metaplanet (3350.T) and NexTech AR (NTAR) also made gains, reflecting global corporate adoption trends.

Institutional Bitcoin Demand Still Growing

With the combined Bitcoin treasury of the Top 100 now exceeding 814,237 BTC, the list showcases a strong institutional belief in Bitcoin’s long-term value proposition. The increase in holdings, alongside new entries like GameStop, suggests that corporate accumulation is far from slowing down.

The post Top 100 Bitcoin-Holding Companies as Total HODL Reaches 814,000 BTC appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·