Traders, I look forward to sharing my top ideas for the upcoming week, including my entry and exit targets, and explaining the setups and scenarios I am looking for.

With the election just over a week away, my focus will shift to predominantly intraday move2move trading. While the market’s positioning is set up favorably for swing trades, with an election on the horizon, I expect some chop and lack of follow-through with large caps leading up to it.

So, let’s jump straight to this week’s watchlist without further ado!

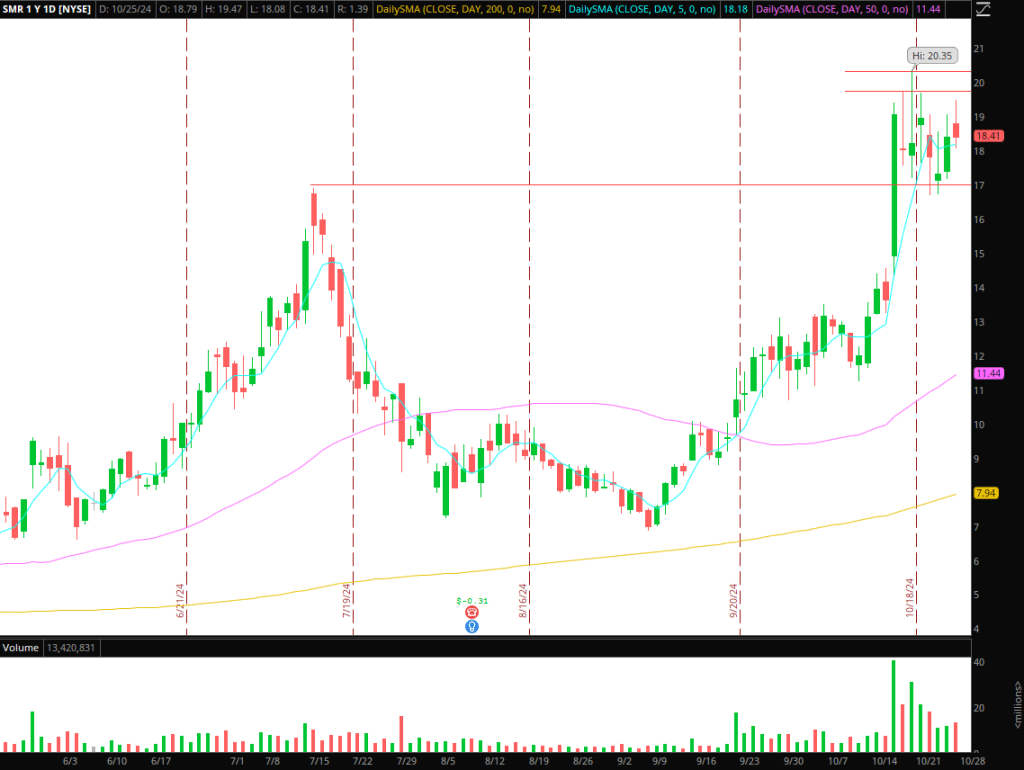

Consolidation Breakout in SMR

The Idea: OKLO, VST, and others are part of the nuclear energy theme. From a technical perspective, SMR is my favorite chart out of the many names. The name has elevated short interest, a reasonably small float, and is consolidating above previous resistance in a bullish formation.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

The Plan: As of right now, this is my only swing focus for the upcoming week ahead of the election. Support near the low $17s and resistance near $19 and $20 shine through across multiple timeframes. I’ll focus on dip buys as long as the stock does not begin to base below the 5-day SMA within this consolidation. If it starts to firm up above $19 on RVOL, I’ll look to add, targeting a 1 ATR move toward $20+ to take a piece off and begin trailing my position on higher lows on the 5-minute. Ultimately targeting a multi-ATR move above $20 if the stock breaks out and trail versus the previous higher low. Ideally, the range will be further contracted before breaking out.

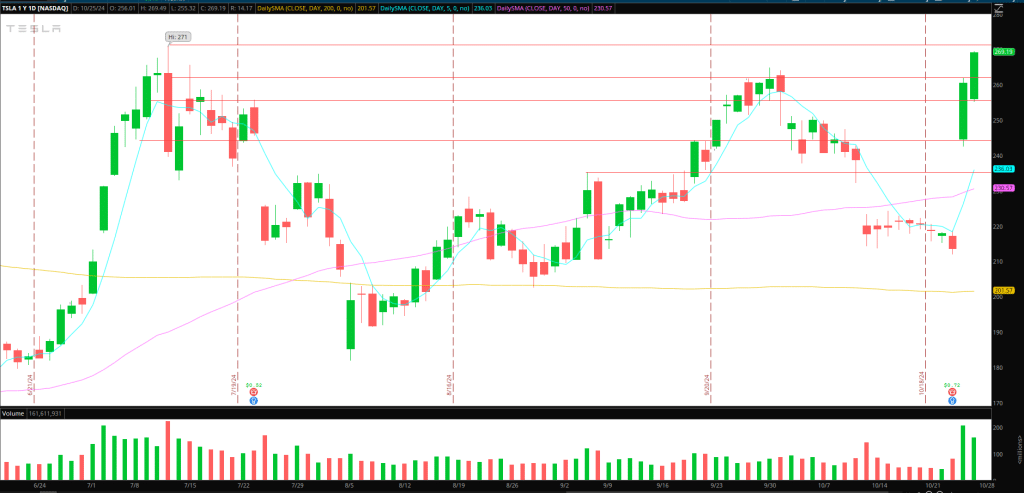

Day 3 Gap Trade in TSLA

The Idea: Short-term trade, ideally sets up on Monday. It’s not a swing trade. I’m bullish on the name in the long term, but in the short term, the stock is setting up well for a day 3 gap or failed follow-through short scalp. Tesla had its earnings gap and follow-through on day 1 and intense day 2 follow-through, and now I need to see either a gap on Monday above Friday’s close or a strong opening drive higher in the morning for further confirmation that the setup is forming.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

The Plan: If the stock stuffs or engulfs its opening-drive, or gives back its gap, I’ll look to go short on a lower high versus the HOD, targeting some profit-taking. The plan would be to capture up to 50% of an ATR, while trailing lower highs on a 5-minute timeframe, or exiting the position manually if the downtrend breaks and the stock begins to reclaim and base above its intraday VWAP.

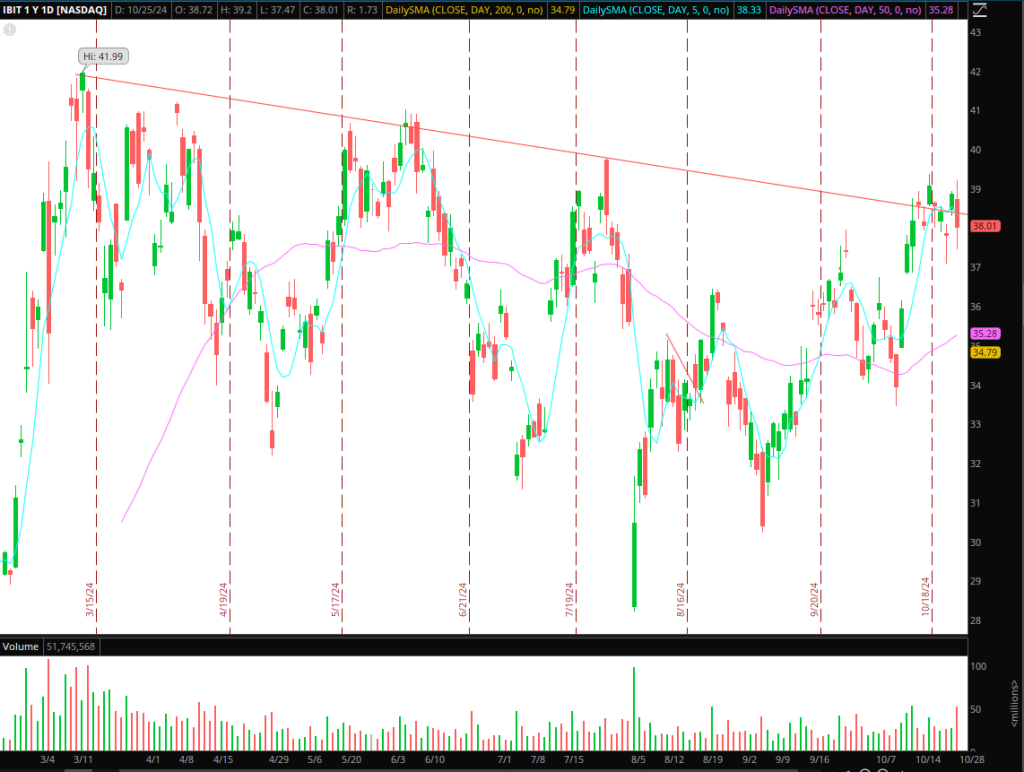

Bitcoin Continues to Form: Consolidation Breakout

The Idea: I’ve spoken about IBIT / Bitcoin at length in recent weeks. Now, it’s beginning to consolidate and shake out weak hands. For me, this is the ideal scenario, potentially setting up a consolidation breakout closer to the election. I do not plan on taking action in the coming days. Instead, I will continue to monitor IBIT / BTC and hope for further range and volume contraction as the election nears. Ideally, the range tightens, setting up a consolidation breakout opportunity above $39 for a multi-day breakout and test of highs. This is a bigger-picture idea that I will continue to monitor in the days and weeks ahead. What I don’t want to do is buy in this consolidation or chase intraday strength and get chopped up. Instead, I’m patiently waiting for the stars to better align for a consolidation breakout with confirmation.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

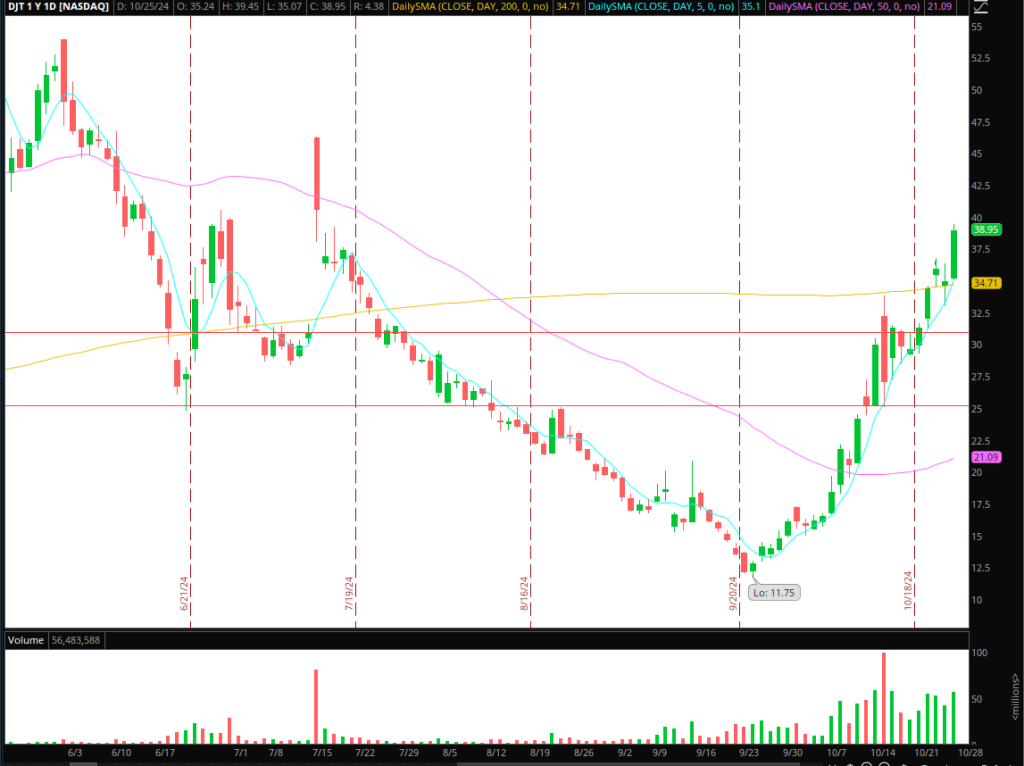

Additional Names on Watch:

Reversion in DJT: Of course, this is now a proxy and trading vehicle, potentially setting up for a significant sell-the-news opportunity on November 5 / post-election. However, before then, if the stock extends on a significant gap or intraday blow-off, I’ll be focused on an intraday mean reversion short or FRD setup. I will not be swing-focused until the election, however.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

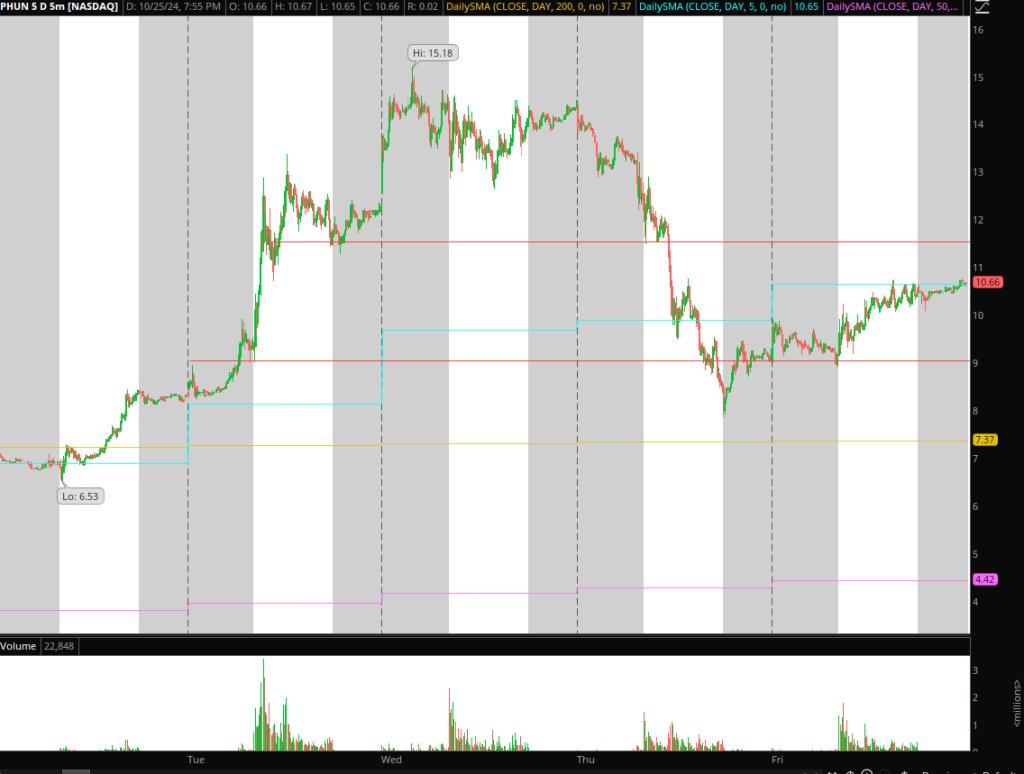

Lower-High Short in PHUN: Sympathy mover to DJT and arguably one of the top opps last week with the FRD setup on Thursday. Ideally, this pushes over $11 – $11.50 and comes into a potential supply and failure zone, failing to follow through, offering an opportunity to get short versus the HOD. If that transpires, and the stocks fails and holds weak, I’ll look to be short versus the HOD, targeting a move toward $9 with a 5-minute lower high trail.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

Get the SMB Swing Trading Evaluation Template Here!

The post The Weekly Trade Plan: Top Stock Ideas & In-Depth Execution Strategy – Week of October 28, 2024 appeared first on SMB Training Blog.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·