Trders, I look forward to sharing my top ideas for the upcoming week, including my precise entry and exit targets, and explaining the exact setups and scenarios I am looking for.

So, without further ado, let’s jump straight to this week’s watchlist!

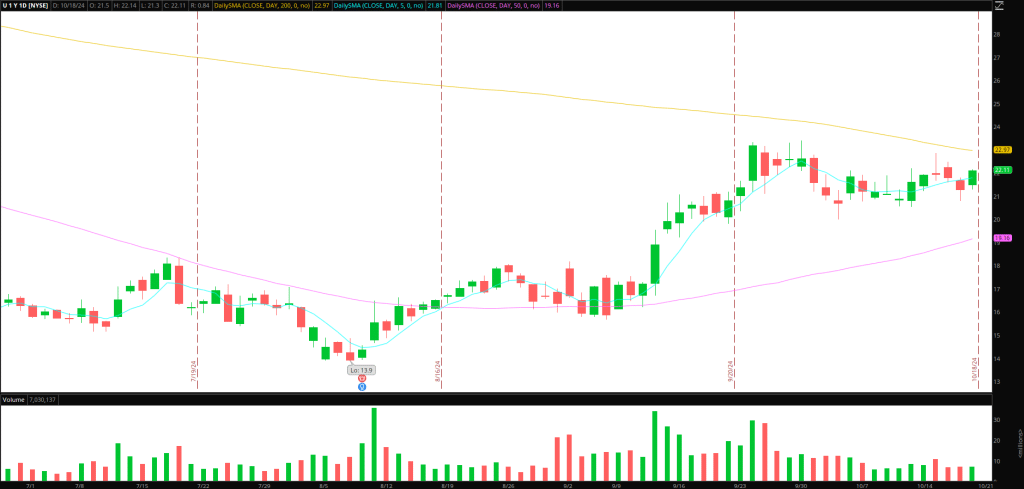

Consolidation Breakout in U

The Idea: Lengthy consolidation above a rising 5-day and 50-day SMA. With the decreasing volume and a contracting range, and its 200-day near $23 acting as resistance and aligning with the consolidations resistance, it has formed a bullish consolidation, resulting in a potential breakout.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

The Plan: If the stock can break above last week’s high, near its 200-day, along with an uptick in volume / RVOL, I will look for a long entry. That entry might be a consolidation above its VWAP intraday and then looking to set a stop either at the LOD or below the consolidation breakout. The stop will be trailed on higher lows after that on a 5-minute timeframe. As higher highs are formed and extended from VWAP, I would scale out of the position, ultimately targeting multiple ATRs.

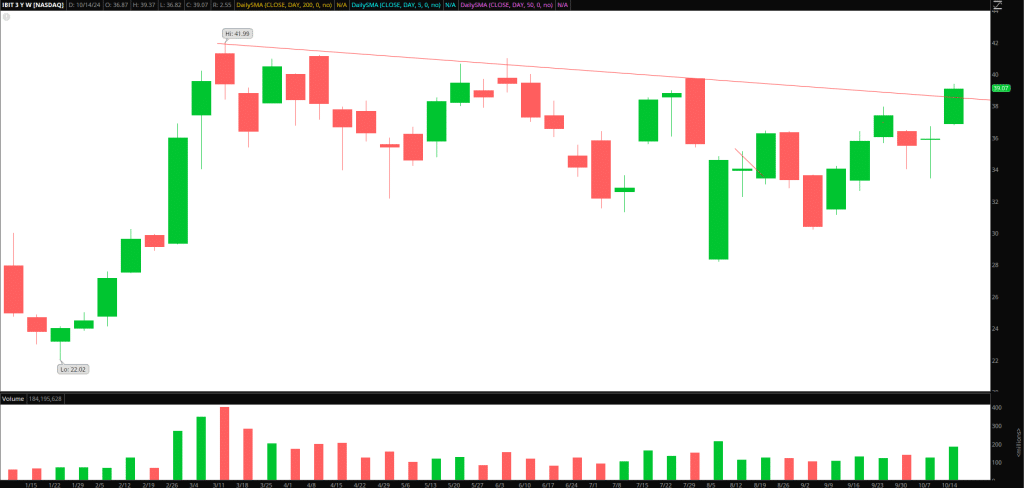

Continuation in Bitcoin (IBIT)

The Idea: Near record flows recently into bitcoin ETFs as bitcoin prices in a Trump victory, and it’s undoubtedly risk-on in general right now for the asset class. The ideal entry was Friday, as laid out the previous day in my Inside Access meeting. For a recap and clear outline of the idea ahead of Friday’s move, I urge members to go back and listen to that meeting again.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

The Plan: Of course, it depends on the action in the underlying. In the short term, I would look for higher lows on the daily chart in IBIT and a fresh entry if Bitcoin holds firm and IBIT provides a clean higher low or holds above Friday’s high. The position would be trimmed on ATR extensions above VWAP. Ultimately, after a multi-day extension, I would close the position and look for multiple days of consolidation for re-entry.

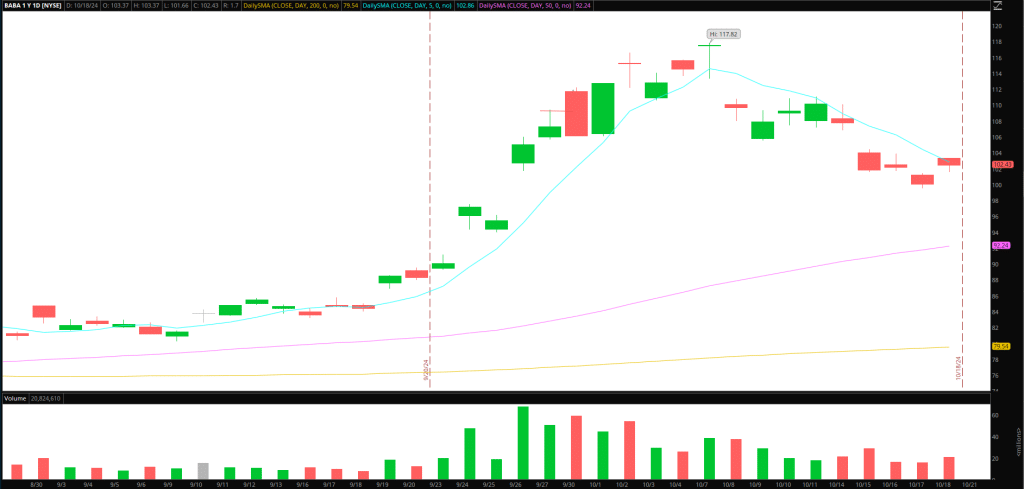

Continuation in China Stocks, Namely BABA

The Idea: Of course, the move was originally sparked by extensive stimulus and easing announced by China. Then, last Friday, it’s short-term downtrend broke after positive economic data was released. The move follows a measured pullback from the $117.82 highs in BABA, setting up a potential second upmove.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

The Plan: If BABA can stabilize above $102 and build above its declining 5-day SMA, I would look for an entry long versus the day’s low. This position will be trailed on an hourly timeframe versus higher lows, initially targeting a push toward resistance near $105 – $107. After that, the remainder would be trailed versus the previous day’s low.

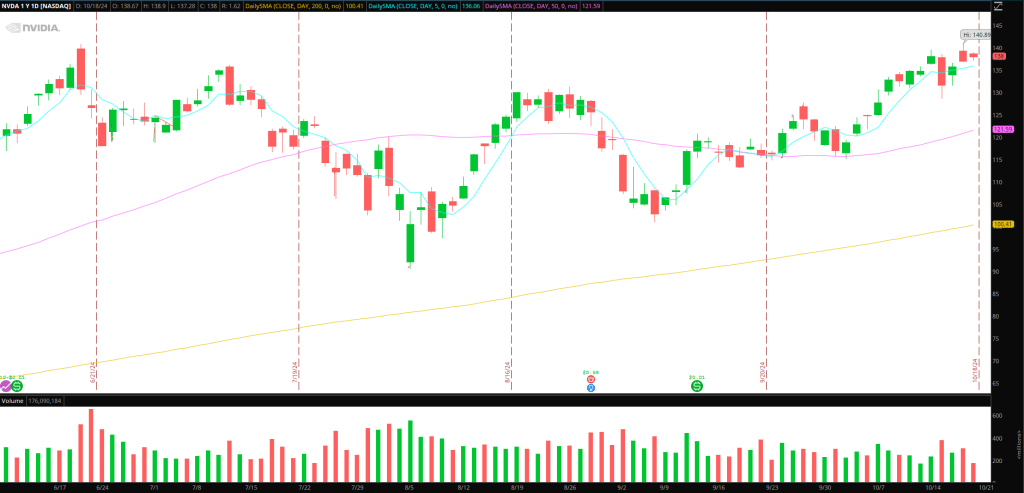

NVDA $140 Breakout

The Plan: After one failed attempt last week, I want to see NVDA build a base on the hourly timeframe of just under $140. This would firmly set up a momentum breakout above $140 for a multi-day move toward $145 – $150. I’ll be watching this closely in the near-term for the base to align on multiple timeframes, setting up a potential ATH breakout.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

Additional Names on Watch:

VTAK: On watch for a potential short if the stock can push back toward its 2-day VWAP and fail.

NUZE: If $2 continues to fail, I would be open to a short versus the day’s high, targeting a move back toward $1. However, like VTAK, if it bases above resistance, hands off as a liquidity trap and short squeeze could play out.

ROKU: Remains on watch, similar to last week’s plan. Importantly, I need to see this firm up above $80 before entering long for a multi-day breakout.

Get the SMB Swing Trading Evaluation Template Here!

The post The Weekly Trade Plan: Top Stock Ideas & In-Depth Execution Strategy – Week of October 21, 2024 appeared first on SMB Training Blog.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·