Traders, In this weekly watchlist, I’ll outline my top ideas for the week and provide my entry and exit plans.

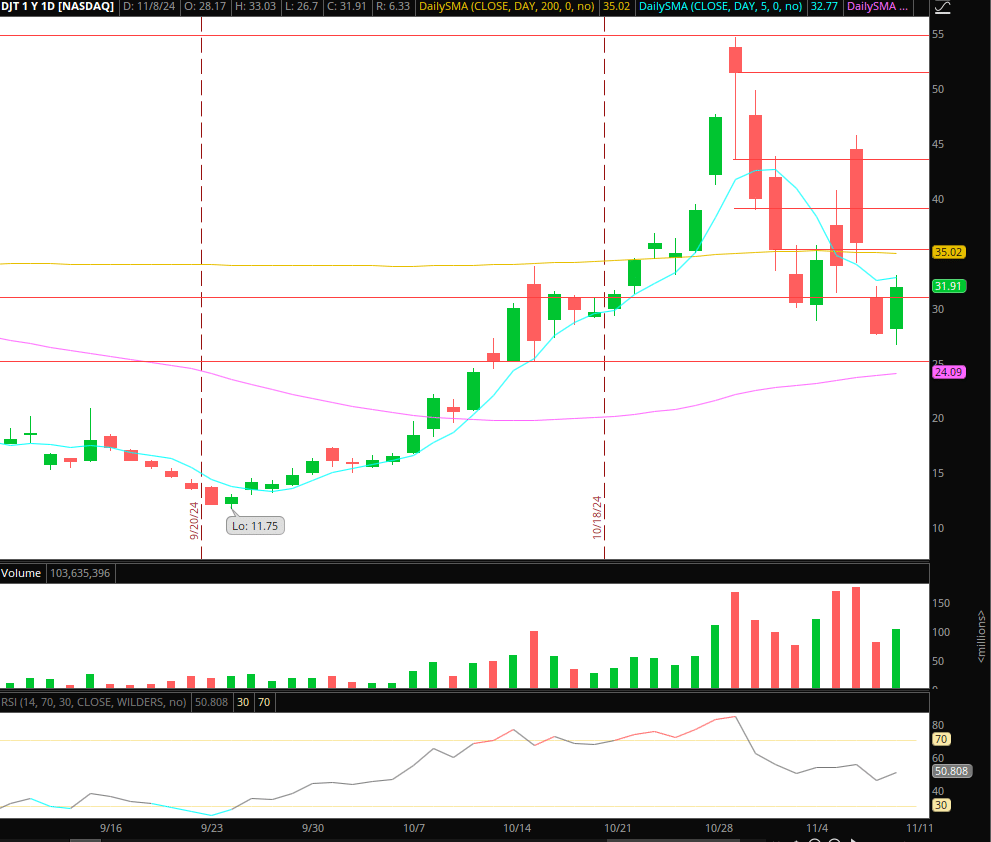

Now, last week was, of course, exceptionally eventful and opportunistic. As I went over in last week’s watchlist and reviewed it in great detail both before and after the trade in Inside Access, DJT was an A+ Sell the News opportunity. If you haven’t already done so, I urge you to review that opportunity in detail, along with the thoughts I shared before the event and the trade playing out. Here’s a helpful tip as well: Review the chart for July 15 in DJT compared to the November 6 sell-the-news event. History often repeats itself.

Alright, let’s get right into this week’s ideas! And on that note, I guess we can start it off with DJT.

Hands off DJT, Unless…

My Idea and Plan: Going forward, unless DJT makes a slightly outlier move to outer key areas of resistance or support, I will be hands-off and move on to better opportunities.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

So, while it’s been a great trader in recent weeks, once the vol dies down, it’s important to not always go back to the well. The only scenario(s) that interest me in DJT again would be a push toward potential supply and fail follow-through areas of $35 – $40 for a possible swing short entry. Similarly, any significant gap lower and fast washout toward the low $20s would interest me in a relief bounce to the long side. Anything in-between on decreased RVOL offers little to no edge for me, and therefore, it’s an avoid.

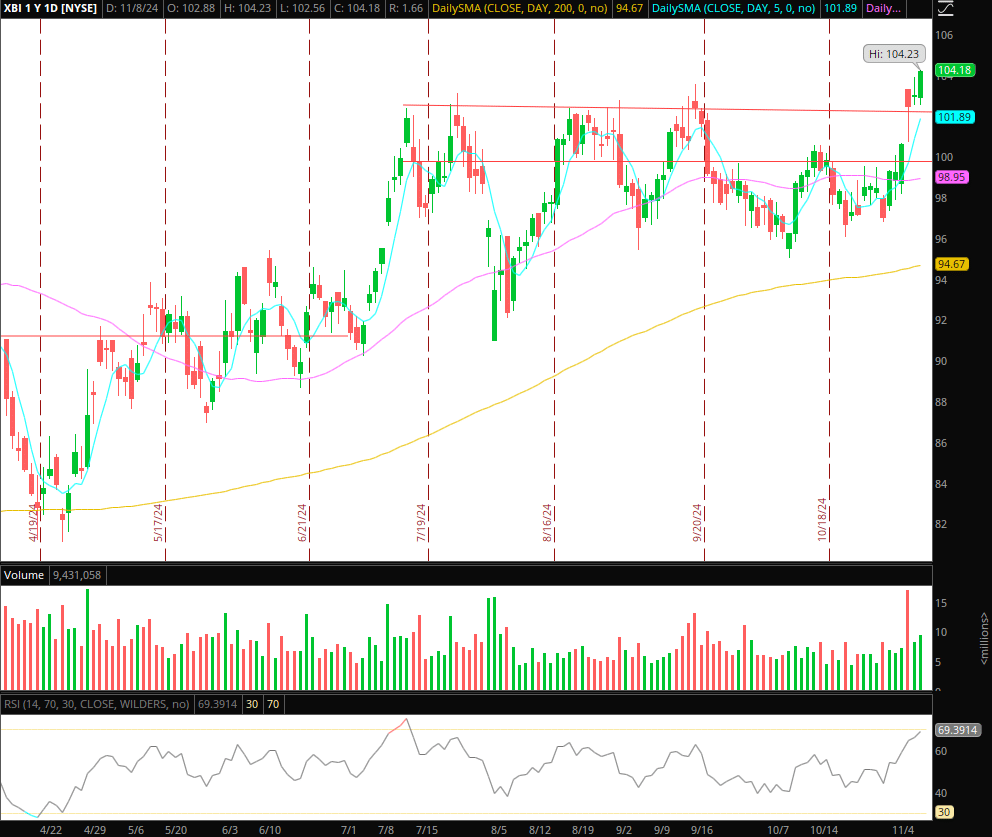

Continuation in XBI

My Idea and Plan: I’ve gone over my thoughts extensively on the sector and my outlook in Inside Access, so I won’t do that again. However, what I like most about the setup in XBI is that over the previous two days, it has firmly held above prior resistance and turned it into support. This clearly shows buyers stepping up and gives me the confidence to now look for a long swing and continuation. On a weekly chart, the stock bears significant similarities to the IWM formation and multi-year breakout above resistance.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

I am looking to buy a higher low / dips in the XBI, ideally toward $103, with a stop below the $102 mark, as I would not want to see the ETF re-enter its range after breaking above resistance and holding above. I’ll be looking to scale out of my position systematically using ATR up moves and trailing my stop to the previous day’s low for a potential week + position.

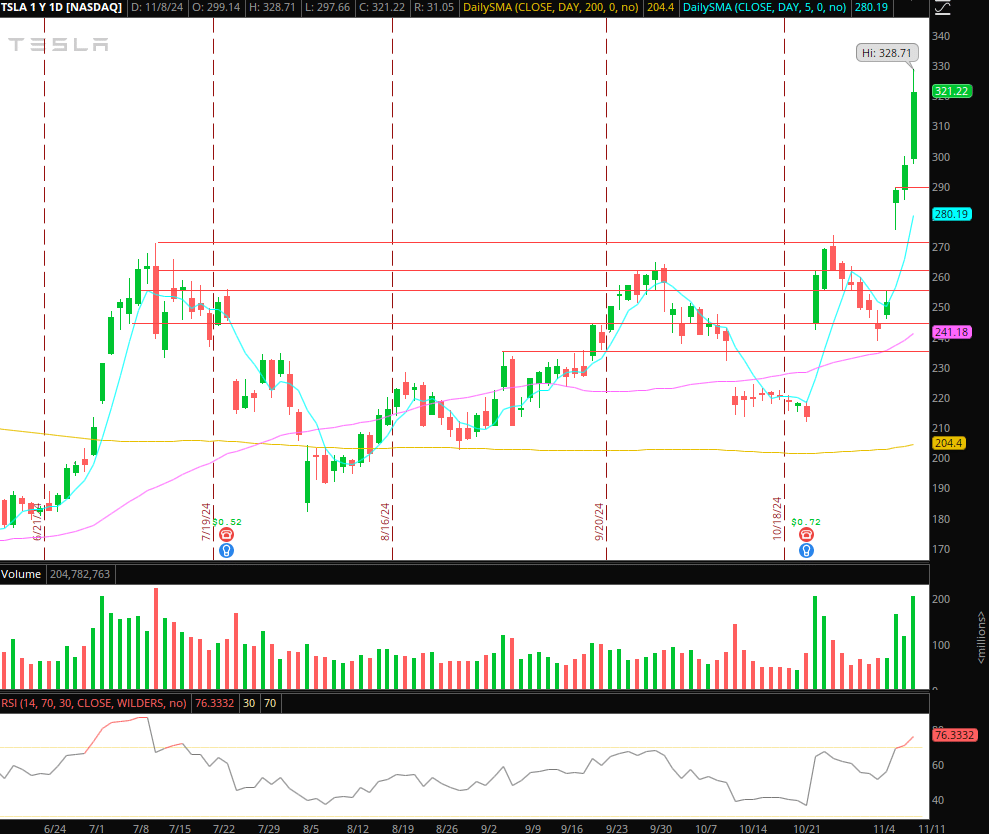

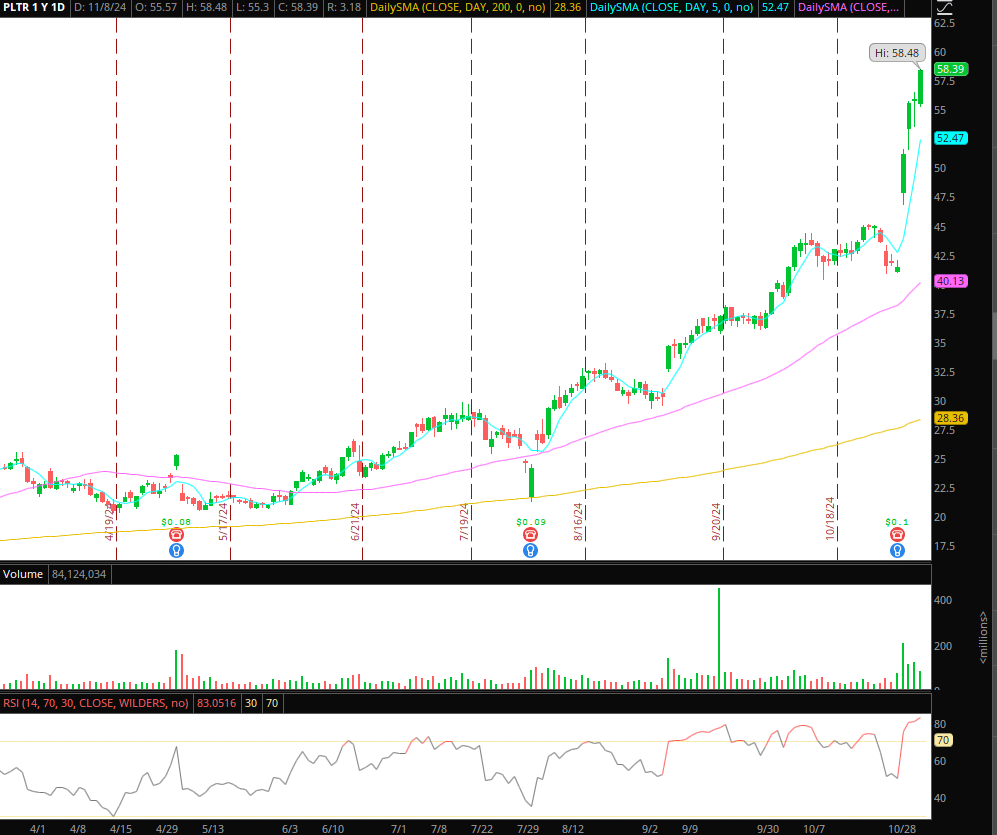

Intraday Reversion TSLA and PLTR

My Idea and Plan: I am bullish on both companies in the long term. Still, there’s no denying that in the immediate term, both might be likely and highly susceptible to a pullback given the stretched move to the upside, which likely has now diminished the risk: reward for the momentum longs in the short-term.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

So, as is the case with reversion ideas and opportunities. Rule number one is always not to battle the frontside, be it in TSLA or PLTR. Instead, wait for confirmation, relative weakness, and a change of character before getting involved. I will not look for a swing but rather just an intraday pullback.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

Specifically, as it relates to both names, I will be looking for entry setups similar to the ones we have gone over recently in Inside Access. For example, FRD – first red day or intraday blow-off. So, for a first red day, for example, the stock opens up red, fails to reclaim green, and displays a notable shift in character and relative weakness to its sector and market. In that case, I would look for a short on a lower high, or VWAP fail, consolidation breakdown, or failed red to-green move versus the high of day. I’d target up to an ATR down move and exit my position on a higher low or vwap reclaim intraday.

2 Additional Names on Watch

FOXO: Impressive volume and failed follow-through on Friday. Going forward, I’ll set alerts in case it pushes back toward $0.8 – $0.9 for potential re-do on the short side or a significant reclaim near highs and breakout over $1. The volume in small-caps and penny stocks has been immense since the election and will likely continue, given the IWM breakout, so I’ll be focusing significantly more on small-caps given the widening range and exceptional liquidity.

SNAP: Consolidating with its 200-day acting as significant resistance. Looking for a breakout above $12.5 and elevated RVOL for a long swing risking versus the LOD.

Get the SMB Swing Trading Evaluation Template Here!

The post The Weekly Trade Plan: Top Stock Ideas & In-Depth Execution Strategy – Week of November 11, 2024 appeared first on SMB Training Blog.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·