Traders,

I look forward to sharing my thoughts with you for the upcoming week.

First, my general thoughts after a constructive week in the market;

The market showed constructive action last week, shrugging off negative headlines and reclaiming key short-term moving averages like the 5- and 20-day. The Zweig Breadth Thrust also triggered for just the 17th time, with past signals leading to an average S&P gain of 16.35% over six months and nearly 24% over a year. Positive internals, price action above short-term moving averages, and intraday strength make a strong case for being bullish and net long; however, with ongoing trade war uncertainty, I remain cautiously optimistic.

I’m not chasing new highs here. Instead, I’m focusing on stocks that showed relative strength above their 200-day simple moving averages (SMAs) during the correction and are setting up with favorable risk-reward for potential second legs higher, if the market can base above its short-term moving averages (MAs).

Here’s a list of names I’ll be watching for consolidation breakouts, along with a few intraday setups. Patience is key: if the market holds above these moving averages and offers a healthy pullback or a higher low, I’ll look to get involved.

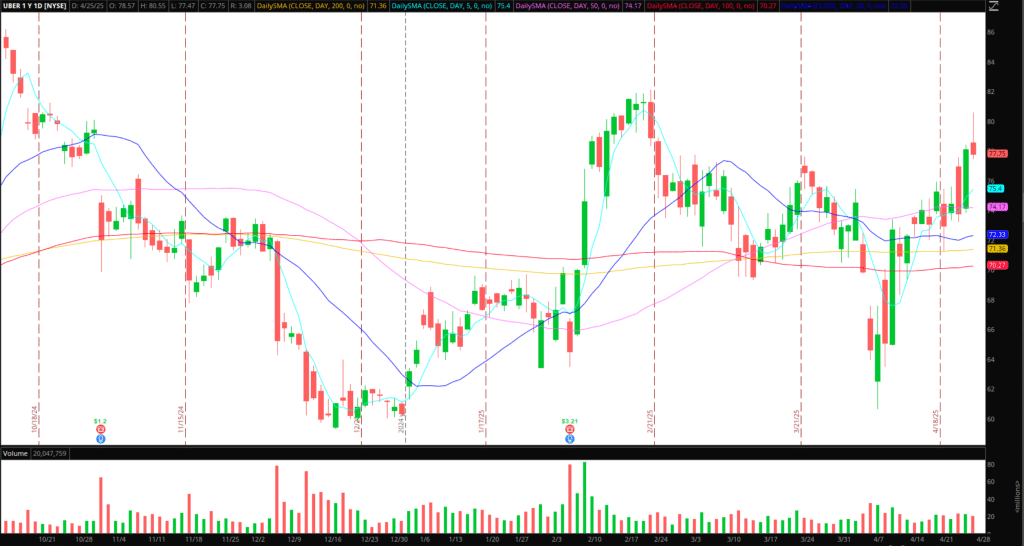

UBER: Shown impressive outperformance for several factors in recent months and YTD. Not looking to chase the highs with the stock approaching resistance on Friday. Instead, suppose the market proves itself in the coming days and weeks. In that case, I’ll be looking for a higher low toward $75, and a possible entry opportunity on a pullback or consolidation breakout. Earnings are coming up on May 7.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

PLTR: Incredible relative strength in recent weeks, which hasn’t gone unnoticed. Earnings May 5. Nothing to do right now, but given the outperformance, another stock I’m watching for a higher low or consolidation with range tightening, offering a skewed risk: reward for a breakout higher. Yet again, it’s dependent on continuation in the overall market and relative strength.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

HIMS: Earnings May 5, and like all names mentioned on the list, I wouldn’t be looking to hold through earnings. HIMS is on my radar from a pure technical analysis perspective. I like the risk-reward offered while the stock consolidates at its 5-day, 20-day, and 200-day moving averages. I’d be open to a long above last week’s high, with covers or adds, depending on the price action near R1 $30. If we hold above $30, I would look for a target of 1 ATR toward its 100-day moving average near $33, for a multi-day swing. With a LOD trail.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

SPOT: Fantastic relative strength and, of course, tariff resiliency. Nothing to do right now, given the move from sub-$500 to $ 620. The risk-reward isn’t there right now. However, if the stock spends a few days consolidating and tightening above $600, I would look for a consolidation breakout to initiate a multi-day swing higher with a LOD trail.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

OMEX: shifting gears to a small-cap now. Finally, a nice multi-day, low-priced small-cap runner, a part of the rare earth minerals theme. Nice blowout on Friday in the $1.80s, followed by some failed follow-through near $1.6, and support on day 2 in the $1.40s. For a position short, I’d need to see a push toward supply at $1.4 and fail to get short for a sub-1 move. Alternatively, a $1.6 – $1.8 exhaust and fail to short against HOD for a move back toward the low 1s. If it consolidates on declining volume over a couple of days, I’ll avoid it.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

Additional large-caps on watch for continuation if the market continues to firm: AXON, TSLA, RKLB, CELH, TGTX, MELI, HOOD, RBLX, EAT, BSX.

Get the SMB Swing Trading Evaluation Template Here!

The post The Weekly Trade Plan: Top Stock Ideas & In-Depth Execution Strategy – Week of April 28, 2025 appeared first on SMB Training Blog.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·