Exchange-traded funds (ETFs) are investment instruments that combine the advantages of mutual funds and the benefits of individual stocks.

They trade on stock exchanges, offering a lot of liquidity, ease of access, and even potential optionability.

With over 2,000 ETFs in the U.S. market and total assets under management in the trillions, they can offer a huge advantage to the inverter and trader.

ETFs also provide tax benefits through their unique structure. H

owever, they carry risks such as market volatility and tracking errors.

Understanding how they work, how they trade, and potential tax implications is vital for making informed investment decisions.

Let’s look deeper into what an ETF is, how it trades, and if it’s right for you.

Contents

What Are ETFs And How Do They Work? Risks Associated With ETFs Types Of ETFs Tax Implications Of ETFs ConclusionWhat Are ETFs And How Do They Work?

Exchange-traded funds have surged in popularity recently because they are flexible investment vehicles that can have a diverse range of uses.

They can be categorized into various types, including equity, bond, commodity, and thematic ETFs.

Some examples of these include the Spdr Gold ETF (GLD), the income-focused ones like the Wheel strategy ETF (WEEL) from Peerless or JP Morgan Active Income ETF (JEPI), or they can be broadly market-focused like the Spdr S&P ETF (SPY).

ETFs have several important features, the first being their cost-effectiveness.

ETFs typically offer lower expense ratios than traditional mutual funds or other actively managed products. Second is the exposure they provide.

ETFs allow smaller investors to buy into huge baskets of stocks or commodities without needing the capital to own all underlying assets in the correct ratios.

Lastly, ETFs can provide notable tax benefits due to their unique structure and status.

This can help boost after-tax returns and can be particularly important for older investors looking to create income in a tax-advantaged way.

As mentioned above, ETFs often allow the investor to buy into a basket of assets that the fund manager manages.

For example, the Spdr S&P500 ETF (SPY) allows an investor to buy a fractional piece of all of the companies listed on the S&P 500 index in a correctly weighted fashion.

The trade-off for this ease of use is that most funds charge an expense ratio fee.

Usually, it is less than 1% for actively managed ETFs and less than 0.1% for many passive ETFs like the SPY.

These expense ratios are important to pay attention to because, depending on the return of the ETF, they can eat a lot into the potential profit or add to a potential loss.

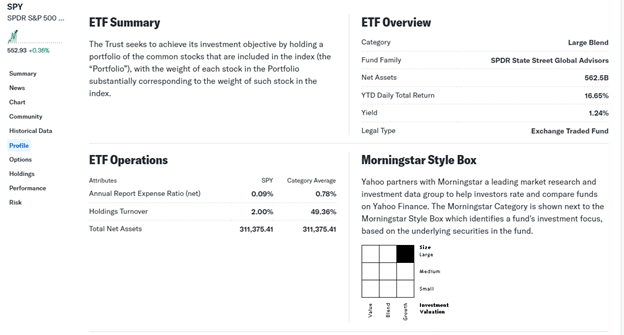

To find the expense ratio, look up an ETF in a free tool like Yahoo Finance and move to the profile page.

Here, you can see the Summary, the Category, and most importantly, the Operations.

This will tell you the expense ratio and how it compares to others in the same ETF category.

Some other useful information here is the Yield, Total return (including price appreciation), and the holdings turnover.

Risks Associated With ETFs

As with everything in investing, there are always risks associated with an investment.

This is no different with ETFs.

One of the larger risks has to do with trading an ETF.

Since they are listed on an exchange, they are affected by the same factors as regular stocks.

One of the largest of these is liquidity.

While popular funds like the SPY may have a lot of intraday trading, making liquidity an afterthought, some funds like VanEcks Oil Services (OIH) have a lot less intraday trading volume, making the ability to enter and exit a position more difficult depending on size.

Tracking errors is another risk consideration.

An ETF’s performance may deviate slightly from its benchmark, but there is a potential risk that the underlying instruments are not purchased or sold in the correct quantities at the correct time.

As an investor, this creates the possibility that you are no longer trading an instrument that mirrors your desired exposure.

This risk is less likely in passively managed funds, but it is still worth considering.

The last type of risk associated with an ETF is management risk.

This is a fairly uncommon risk, but similar to tracking errors, it is something to be aware of.

This is the risk that the management of the ETF deviates from the stated goal and starts to trade in a manner that does not align with the prospectus.

This could also be when management increases their expense fee and suddenly starts charging more for the same fund.

One of these is more serious than the other, but both are incredibly uncommon, given the amount of oversight the SEC has on these instruments.

Join the 5 Day Options Trading Bootcamp

Types Of ETFs

Now that we have a basic understanding of what an ETF is, how it works, and some of its associated risks, let’s break down the different types of ETFs in more detail.

The first type of ETF we will look at is the basket ETF.

This is an ETF that invests strictly in baskets of stocks.

These types of ETFs are also known as market basket or sector ETFs.

Examples of these include the Spdr ETFs like the SPY, OIH, and XLF.

These exist to give exposure to certain market sectors and often have lower expense ratios because they are a more passively managed fund.

Commodity ETFs are the next type we will be looking at, and as the name suggests, these involve an index that tracts a specific commodity or group of commodities.

GLD is one of the more common, but almost every commodity has its own ETF.

The last type of ETF is the Active or Strategy ETF.

These often have a higher expense ratio and a significantly higher asset turnover due to the active nature of the underlying fund.

An example here would be either a Smart Beta fund or an Income Fund.

Other examples include the Yieldmax suite of ETFs and almost any options-based ETF.

Each type of ETF has a specific function and, when combined, can form a well-rounded portfolio that helps achieve almost any goal.

Tax Implications Of ETFs

Taxes are where almost everyone looks for any advantage they can find, and investing is no different.

As discussed above, this is a huge advantage for ETFs in that, depending on the asset turnover, the dividends can be taxed at a lower rate.

These dividends are called Qualified dividends and, in the U.S., are taxed at a rate of 0%-20% depending on the income bracket.

If a dividend is not qualified, such as an actively managed fund, then its income is taxed at your ordinary tax rate.

In addition to how the fund holds its securities, here are some other points to pay attention to involving the tax treatment of an ETF dividend:

Net Investment Income Tax: High-income earners may be subject to an additional 3.8% tax on investment income, including dividends Dividend Source: The tax treatment often depends on the underlying holdings of the ETF: Dividends from stocks held by the ETF generally flow through as qualified dividends (if holding period requirements are met) Interest from bonds held by the ETF is typically treated as ordinary dividends ETF Provider Reporting: Your ETF provider will specify which type of dividends you received on your Form 1099-DIV Foreign Dividends: Dividends from foreign investments may be subject to different tax treatment and potential foreign tax withholdingConclusion

Exchange-traded Funds (ETFs) offer a versatile and efficient way to gain exposure to a wide range of asset classes while benefiting from liquidity, diversification, and potential tax advantages.

However, like any investment, they are not without risks, ranging from liquidity concerns on lesser-known ETFs and tracking errors to management deviations.

By understanding how ETFs function, the types available, and the tax implications, investors can strategically incorporate these vehicles into their portfolios to meet specific financial goals.

Whether seeking broad market exposure, targeted sector plays, or income generation, ETFs provide a flexible toolset for long-term investors and active traders.

As with any investment, careful research and due diligence are essential to maximizing the benefits while minimizing the risks inherent to these financial instruments.

We hope you enjoyed this guide to ETFs.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·