Climate and Science Reporter

BBC

The inauguration of Donald Trump signifies a “major setback for global climate initiatives,” stated Christiana Figueres, the former UN climate chief, following his re-election in November.

Upon taking office, Trump withdrew the US from the Paris Climate Agreement, widely regarded as a pivotal global climate treaty. He has also allegedly obstructed US scientists from partaking in international climate research and dismantled national electric vehicle goals.

Furthermore, he dismissed his predecessor’s efforts at fostering green technology as a “green new scam.”

Despite his past stance on climate, Trump has expressed a keen interest in negotiating with the Ukrainian president regarding essential minerals, as well as showing significant interest in Greenland and Canada, both of which are rich in these resources.

Getty Images

President Trump is eager to finalize an agreement with the Ukrainian president regarding essential minerals

The procurement of critical minerals has been a central concern for Trump since he assumed the presidency. These minerals are vital for sectors like aerospace and defense, but they also play an essential role in developing green technology.

Could his emphasis on securing these minerals stimulate the US’s growth in the green technology arena?

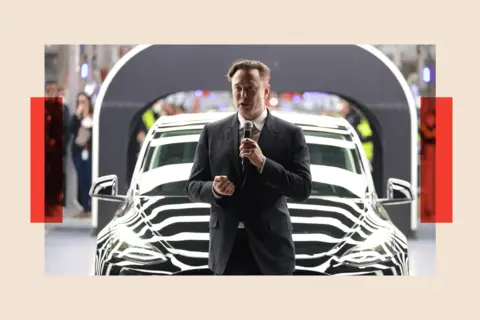

The Elon Musk Influence?

Trump’s closest advisor recognizes the significance of critical minerals in the transition to green technologies. Companies like SpaceX and Tesla, led by Elon Musk, heavily depend on materials such as graphite (for electric vehicles), lithium (for batteries), and nickel (for rockets).

Dr. Elizabeth Holley, an associate professor specializing in mining engineering at Colorado School of Mines, notes that each country maintains its list of critical minerals, typically comprising rare earth elements and other metals like lithium.

Demand is soaring, with lithium needs soaring 30% in 2023, largely propelled by the swift expansion of the clean energy and electric vehicle markets.

Getty Images

SpaceX and Tesla have substantial reliance on critical minerals

In the coming two decades, they are projected to account for nearly 90% of lithium demand, 70% of cobalt demand, and 40% of rare earth demand, as per the International Energy Agency.

Musk’s alarm over securing these minerals was evident three years ago when he tweeted about the “insane” price of lithium, suggesting that Tesla might need to directly engage in mining and refining unless costs improved.

He mentioned that, although lithium is plentiful, the extraction pace is sluggish.

The US’s Standing in the Global Arena

A December 2023 report by a US Government Select Committee highlighted the vulnerabilities tied to the nation’s reliance on rare earths and critical minerals (like cobalt and nickel). It emphasized the need for the US to reassess its strategy for critical minerals and rare earth supply chains, given the risks associated with dependency on the People’s Republic of China.

The report warned that neglecting to change course could result in “defense production coming to a standstill and hinder advanced technology manufacturing.”

China’s leadership in this sector stems from its early identification of the economic prospects linked to green technology.

“China made a strategic move a decade ago recognizing where the trends were heading, aggressively developing both renewables and electric vehicles, ultimately dominating the market,” states Bob Ward, policy director at the London School of Economics (LSE) Grantham Research Institute on Climate Change and the Environment.

Getty Images

China made strategic decisions years ago concerning market trends, according to one expert

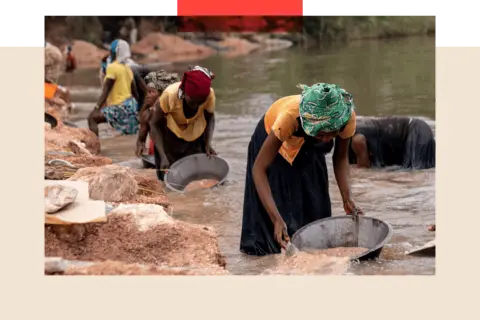

Daisy Jennings-Gray, head of pricing at Benchmark Mineral Intelligence, underlines that these minerals are termed critical due to geological restraints. “You can’t ensure that every country will have economically recoverable reserves,” she states.

While elements like lithium are widespread, they are often located in areas that are hard to access, making the logistics of mining these sites costly. Additionally, some nations disproportionately produce significant portions of global supply, such as cobalt from the Democratic Republic of Congo. Challenges like natural disasters or political disturbances can directly impact pricing, as highlighted by Jennings-Gray.

China has managed to secure supply chains through substantial investments in Africa and South America, yet its real strength lies in processing the minerals—separating them from other elements in the ore.

Getty Images

Some nations produce a significant share of certain minerals, like cobalt from the Democratic Republic of Congo

“China is responsible for 60% of the global rare earths output but processes around 90% of them,” says Gracelin Baskaran, director of the critical minerals security program at the Center for Strategic and International Studies in Washington, D.C.

She emphasizes that China’s understanding of the economic implications of this market is evident. After Trump levied tariffs against China, the latter retaliated by implementing export controls on over 20 critical minerals, including graphite and tungsten.

This concern is driven by a fear of falling behind, as argued by Christopher Knittel, a professor at MIT.

“This is largely due to China’s predominant role in processing, which is the most profitable phase of the industry,” he remarks. “It’s a fortunate coincidence that this push could also benefit green technologies.”

However, a crucial question remains: has the US missed the opportunity to fully leverage its potential in this sector?

A Cautionary Note for the US

Initially, the green transition was perceived as a burden for various nations, according to LSE’s Bob Ward.

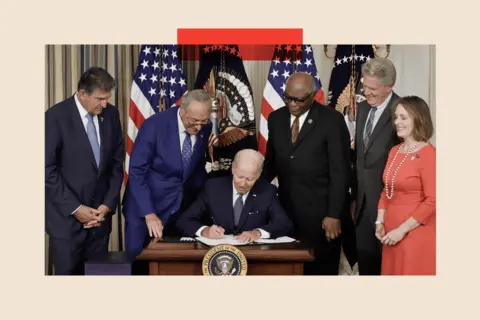

The Biden administration actively promoted green industries through the Inflation Reduction Act (IRA) introduced in August 2022, which provides tax incentives, loans, and other benefits for technologies that minimize greenhouse gas emissions—ranging from battery tech for electric cars to solar panels.

As of August 2024, it was anticipated to have attracted $493bn (£382bn) in investments towards the US green sector, as reported by Clean Investment Monitor.

Getty Images

The prior administration supported green technology sectors via the Inflation Reduction Act

Nonetheless, minimal effort was directed towards supporting upstream operations, such as sourcing critical minerals, according to Ms. Gray from Benchmark Intelligence. The Biden administration focused intensely on downstream manufacturing—getting products from the factory to retail.

Trump’s recent initiatives to acquire these minerals indicate a potential pivot towards prioritizing the upstream sector.

“The IRA implemented several laws to restrict trade and supply exclusively from allied nations.

“Trump appears to be shifting approach by seeking critical mineral agreements favorable to the US,” Ms. Gray notes.

Speculations of a New Executive Order

Further actions from Trump could be imminent. Industry insiders suggest that rumors suggest he may soon issue a “Critical Minerals Executive Order,” potentially channeling additional resources into this endeavor.

The specifics of the executive order remain ambiguous, but experts familiar with the matter believe it might include strategies to expedite mining in the US, such as fast-tracking permits or investment for processing facilities.

Despite these efforts toward mineral acquisition, Professor Willy Shih from Harvard Business School warns that the current administration may not fully grasp the technical complexities involved in establishing supply chains, emphasizing the significant time commitment required. “Constructing a new mine and processing plant could take a decade.”

Getty Images

In 2023, lithium requirements surged by 30%, with rare earths witnessing a 15% rise

Despite the IRA’s climate-positive stance, Trump has consistently voiced opposition to its continued support, fearing that it undermines economic focus. However, its effectiveness in benefiting red states has pushed numerous Republican senators to advocate for its retention in his forthcoming “big, beautiful bill”—a comprehensive policy initiative slated for unveiling this month.

Analysis from the Clean Investment Monitor shows that in the previous 18 months, states under Republican control have drawn 77% of the investments.

As Dr. Knittel from MIT points out, regions such as Georgia have become integral to the “battery belt,” benefitting from substantial battery manufacturing growth catalyzed by IRA incentives; these tax credits are essential for sustaining these industries.

Failure to maintain this support could constitute a genuine electoral risk for US politicians facing re-election in slightly under two years.

If Trump loses even a single seat to the Democrats in the upcoming 2026 mid-terms, he will cede control of the House, diminishing his ability to enact pivotal legislation.

Getty Images

Since taking office, Donald Trump has withdrawn the United States from the Paris Climate Agreement

Carl Fleming, former advisor to President Biden’s Renewable Energy and Energy Efficiency Advisory Committee and a partner at McDermott, Will & Emery, is currently assisting clients within the clean tech and energy sector. He notes that, amid uncertainty, investor confidence remains firm. “Recently, my practice has been exceptionally active, surpassing last year’s growth multiplied four times since the IRA’s implementation.”

He also believes there’s a consensus on the necessity to retain components of the IRA, even if it means including expansions of fossil fuel operations. “To be genuinely America-first and energy-secure, we must explore all avenues: continue solar and battery storage efforts while incorporating more natural gas to enhance the nation’s energy capabilities.”

Nonetheless, uncertainty regarding the US’s global role in climate initiatives is disheartening, asserts LSE’s Bob Ward. “When the US is engaged, it encourages progress in global climate actions, as exemplified by the Paris Climate Agreement.”

Though many in climate advocacy circles do not view Trump as an environmentalist, one thing is evident: he prioritizes establishing a legacy focused on economic issues rather than environmental ones, although he may recognize that environmental advancements can also stimulate the economy.

Top picture credit: Getty Images

BBC InDepth serves as the premier destination on the website and app for comprehensive analysis, presenting fresh perspectives that challenge standard assumptions and in-depth reporting on the most significant issues of the day. We also showcase thought-provoking content from BBC Sounds and iPlayer. Your feedback on the InDepth section is welcome through the button below.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·