BBC News, Mumbai

Getty Images

Millions of Americans could see their medicine costs rise sharply if Trump implements tariffs on Indian pharmaceuticals

As the potential tariffs from Donald Trump on Indian goods approach next month, many Americans may have to prepare for higher healthcare expenses.

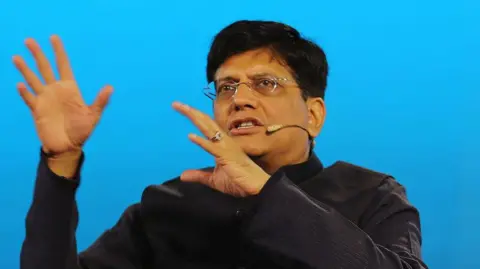

Recently, Indian Commerce Minister Piyush Goyal took an unplanned trip to the United States for discussions with officials, aiming to negotiate a trade agreement.

This follows Trump’s announcement that tariffs on India will take effect by 2 April, a move in retaliation for India’s own tariffs on American products.

Goyal is striving to avert tax hikes on India’s key export sectors, particularly pharmaceuticals.

Almost half of the unbranded medications consumed in the United States are sourced from India. Generic medications from India constitute around 90% of prescriptions filled in the U.S.

This has resulted in billions of dollars in savings for the federal government. In 2022, the total savings from the use of Indian generics reached an impressive $219 billion (£169 billion), as per a study conducted by consulting firm IQVIA.

Experts warn that without a trade agreement, Trump’s tariffs could render certain Indian generics nonviable, possibly pushing companies out of the market and worsening existing drug shortages.

According to Dr. Melissa Barber, a drug pricing expert from Yale University, tariffs could “intensify supply-demand discrepancies,” leaving uninsured and low-income individuals to bear the financial burden.

The consequences could affect individuals dealing with various health issues.

More than 60% of prescriptions for hypertension and mental health conditions in the United States are filled with drugs manufactured in India, as indicated by an IQVIA study sponsored by the Indian Pharmaceutical Alliance (IPA).

Sertraline, the most commonly prescribed antidepressant in the U.S., exemplifies the dependency on Indian supplies for crucial medications.

Many of these drugs are priced significantly lower than those from non-Indian manufacturers.

Peter Maybarduk, an attorney with Public Citizens, a consumer advocacy organization promoting access to medicines, expresses concern, noting that one in four American consumers already struggle to afford their medications.

Trump is reportedly feeling pressure from U.S. hospitals and generic drug manufacturers regarding his tariffs on imports from China.

Notably, 87% of the raw materials for drugs available in the U.S. are sourced from abroad, with China supplying roughly 40% of the global market.

As tariffs on China imports have increased by 20% since Trump’s tenure began, the price of raw materials for pharmaceuticals has already risen.

Getty Images

Approximately 60% of prescriptions for hypertension and mental health issues in the U.S. are fulfilled with medicines manufactured in India

Trump is encouraging companies to relocate production to the U.S. to evade his tariffs.

Major pharmaceutical corporations such as Pfizer and Eli Lilly have expressed commitment to shift some production domestically.

However, the economic feasibility of manufacturing low-cost drugs in the U.S. remains dubious.

Dilip Shanghvi, chairman of India’s largest pharmaceutical company, Sun Pharma, mentioned at a recent industry event that his firm offers medications for between $1 and $5 per bottle in the U.S., and shifting production to the U.S. due to tariffs “is not justifiable.”

“Producing in India is at least three to four times more cost-effective than in the U.S.,” stated Sudarshan Jain from the IPA.

A rapid relocation would be incredibly challenging. Establishing a new manufacturing plant could take up to $2 billion and 5 to 10 years to become operational, according to the lobbying group PhRMA.

Getty Images

In light of Trump’s anticipated tariffs, Indian Commerce Minister Piyush Goyal’s impromptu visit to the U.S. occurred last week

Local pharmaceutical companies in India could also suffer significantly due to the tariffs.

The pharmaceutical sector is India’s leading industrial export, according to GTRI, a trade research organization.

India exports approximately $12.7 billion worth of pharmaceuticals annually to the U.S. and pays minimal taxes. However, drugs imported from the U.S. incur a 10.91% custom duty.

This creates a “trade differential” of 10.9%. If the U.S. imposes reciprocal tariffs, costs for both generic and specialty medications would escalate, as noted by GTRI.

GTRI identifies pharmaceuticals as a sector highly susceptible to price hikes in the U.S. marketplace.

Indian companies primarily focusing on generic drugs already operate on narrow profit margins and may find it difficult to absorb substantial tax increases.

They price their products significantly lower than competitors and have consistently captured market share in the areas of cardiovascular, mental health, dermatology, and women’s health medications in the largest pharmaceutical market globally.

“We can manage small tariff increases through cost reductions, but any larger hikes will need to be passed onto consumers,” stated the finance head of a prominent Indian drug manufacturer, requesting anonymity in a conversation with the BBC.

North America serves as their primary revenue source, accounting for about one-third of the earnings and profitability for most enterprises.

“This market is expanding rapidly and is vital for us. Although we are aiming to diversify into other markets, it cannot compensate for potential losses in the U.S.,” the finance head remarked.

Umang Vohra, CEO of Cipla—India’s third-largest pharmaceutical company—recently mentioned in a public forum that tariffs should not dictate business strategies, “as there’s a risk that those tariffs might be lifted in four years.”

However, four years is a considerable timeframe that could determine the fate of numerous businesses.

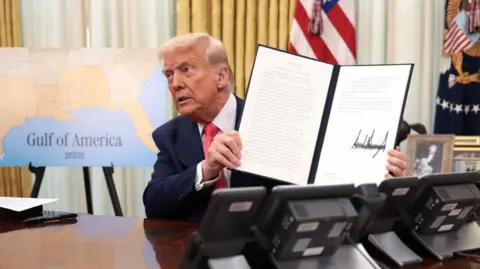

Getty Images

India has reportedly agreed to significantly reduce its tariffs, according to Donald Trump

To prevent these consequences, “India should simply eliminate its tariffs on pharmaceutical products,” advised Ajay Bagga, a seasoned market expert, during an interview with the BBC. “The impact would be minimal since U.S. drug exports to India are under half a billion dollars.”

The IPA, which includes India’s major pharmaceutical companies, has also suggested that there should be no duty on U.S. drug imports to minimize adverse repercussions from reciprocal tariffs.

In a recent budget update, Prime Minister Narendra Modi’s administration included 36 life-saving drugs that would be exempt from basic customs duties. Furthermore, President Trump hinted last week that India might be conceding to his demands.

Trump stated that India has committed to lowering tariffs “considerably,” asserting that “somebody is finally holding them accountable for their actions.”

While Delhi has yet to respond, pharmaceutical stakeholders in both nations are anxiously watching for details on a trade agreement that could significantly influence health and livelihood.

“In the short term, there may be some discomfort due to new tariffs, but I anticipate they will reach substantial progress by this fall regarding a preliminary [trade] agreement,” Mark Linscott, a former U.S. trade representative, stated in a BBC interview, emphasizing that neither nation could risk a breakdown in pharmaceutical supply chains.

Follow BBC News India on Instagram, YouTube, X and Facebook.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·