As the Layer 1 blockchain token faces strong resistance and market uncertainty, investors are watching closely to determine whether this is a mere correction—or a shift in trend.

Sui’s Price Breakout and Pullback: A Technical Tug-of-War

The recent Sui price analysis reveals a dramatic sequence of movements. After rallying from $1.71 to $4.30, fueled by a golden cross pattern on the daily chart, the SUI token has now settled near the $3.29 mark. According to GeckoTerminal data, SUI is trying to break above the key resistance level of $3.2944 after escaping a descending price channel.

Sui (SUI) price is currently holding the $3.30 support level, igniting hope for a bullish rally above $4. Source: CaptainMilo on TradingView

If this SUI price breakout sustains, the next immediate target lies at $4.2047. But a rejection at current levels may invalidate the bullish scenario and trigger a drop toward the SUI support level near $2.9084. Such price action reflects the ongoing battle between bullish optimism and bearish caution within the Sui market outlook.

Technical Indicators Signal a Mixed Trend

Sui technical analysis presents both promise and uncertainty. The MACD line on the daily chart is approaching a crossover above the signal line, a classic indicator of bullish momentum. Additionally, the Relative Strength Index (RSI) has climbed from deeply oversold territory to the high 40s, suggesting recovering buyer interest.

If the SUI price breakout holds, a move toward $4 is likely, while a rejection could lead to a pullback toward the $2.9 support level. Source: BlackMarketButcher on TradingView

Still, the RSI’s position below 50 indicates the trend remains fragile. A firm push above resistance could confirm a bullish shift, but hesitation at this level might reintroduce a bearish outlook in the short term.

Token Unlock Adds Pressure to Sui’s Trajectory

Adding complexity to the SUI coin forecast is the recent $215 million token unlock on June 1. Historically, such large unlocks increase supply and weigh down token prices, especially when investor demand is insufficient to absorb the influx. In Sui’s case, support levels around $3.40–$3.43 are being tested as the market digests this new supply.

Analyst Sir Richard previously noted that SUI might reach as high as $7.56 following the golden cross rally. However, he also cautioned that technical risks such as a bearish EMA crossover could slow momentum. “We’re at a critical pivot—if support doesn’t hold, SUI could retest lows near $2.33,” he explained.

Network Fundamentals Remain Robust

Despite price volatility, the broader Sui network continues to demonstrate strength. With over $40 billion in aggregator volume and a 24% increase in user activity over the past 30 days, Sui’s on-chain metrics remain strong. The DeFi ecosystem is also flourishing, with Sui’s total value locked (TVL) surpassing $2.08 billion and daily DEX volume reaching $304 million earlier this year.

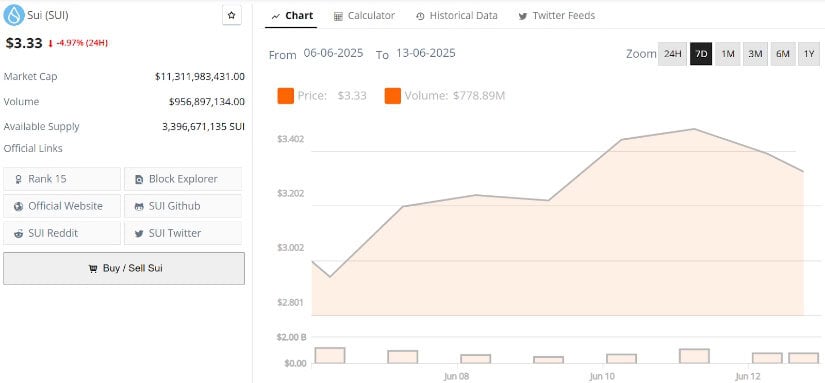

Sui (SUI) was trading at around $3.30, down 4.97% in the last 24 hours at press time. Source: Brave New Coin

Much of this activity is driven by applications like FanTV and RECRD, which have attracted nearly 1 million daily active users (DAUs). The expanding Sui DeFi ecosystem and SocialFi adoption signal real-world use cases that could bolster long-term investor sentiment.

A Fast-Evolving Blockchain with Cutting-Edge Tech

Sui’s evolution as a high-speed Layer 1 blockchain has also strengthened its position in the market. Major protocol upgrades—including Mysticeti v2, DeepBook 3.1, and the Move VM 2.0—have pushed the boundaries of scalability and developer accessibility.

Walrus, a new blockchain-based storage solution, has already filled 17.5% of its 4 petabyte capacity since launching in March, illustrating growing ecosystem demand. Meanwhile, tools like the Move Registry and Pilotfish are enhancing smart contract deployment and validator efficiency.

Such innovations reinforce Sui’s value proposition: a modular, low-latency platform geared toward DeFi, gaming, and Web3 infrastructure.

Learning from Setbacks: The Cetus Protocol Exploit

Not all developments have been smooth. On May 22, Sui faced a major security challenge when hackers exploited a vulnerability in Cetus Protocol, draining $220 million in liquidity. The Sui Foundation responded swiftly by freezing the attacker’s wallet—containing roughly $160 million—and announcing a compensation plan.

While the incident briefly dented SUI token price momentum, the rapid recovery afterward signals strong community resilience. Still, the event serves as a reminder that even cutting-edge platforms must prioritize security to sustain user trust.

SUI Price Prediction 2026: What Lies Ahead?

As of now, SUI trades at $3.44 with a 24-hour trading volume of $1.67 billion and a market cap exceeding $8 billion. Forecasts for the SUI token price target in 2026 vary widely, but most analysts agree on a broad range between $5 and $8, assuming continued ecosystem expansion and technical progress.

Following a corrective pullback into the $3.3–$2.7 demand zone, SUI is rebounding and potentially gearing up for a confirmed breakout. Source: AlienOvichO on TradingView

According to analysts, achieving this target depends on Sui’s ability to break its previous all-time high of $5.35 and maintain upward momentum. “A sustained move above $4.117 could be the first real step toward a new ATH,” noted crypto strategist Liam Miller.

Conservative estimates, on the other hand, place SUI’s floor near $3.46, suggesting modest growth based on stable network fundamentals and incremental user adoption.

Final Thoughts: SUI Trend Reversal or Correction?

The Sui crypto story remains one of high potential mixed with near-term risk. While the recent pullback after a 150% rally has sparked debate over whether this is a trend reversal or correction, the underlying fundamentals of the Sui network appear resilient.

Whether Sui breaks out toward a bullish continuation or retraces to test lower support zones, the market is watching closely. With robust developer activity, growing user adoption, and a roadmap focused on speed, scalability, and security, Sui remains a significant player in the evolving crypto landscape.

For now, traders and long-term investors alike are weighing one central question: Can SUI defy the odds again and reclaim its upward trajectory?

3 weeks ago

11

3 weeks ago

11

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·