Sub-Saharan Africa is quietly becoming one of the hottest crypto frontiers.

The latest Chainalysis 2025 report shows that the region is now the third-fastest growing market for crypto adoption, with $205B in value received between July 2024 and June 2025 – a 50% jump year-on-year.

Unlike many regions where speculation dominates, activity here is split between grassroots retail use (with over 8% of transfers under $10K) and institutional flows, like multi-million stablecoin settlements powering trade.

That mix makes the continent a proving ground for crypto’s ‘real-world use’ story, and why scaling solutions like Bitcoin Hyper ($HYPER) are catching attention.

Retail Adoption & Economic Pressures

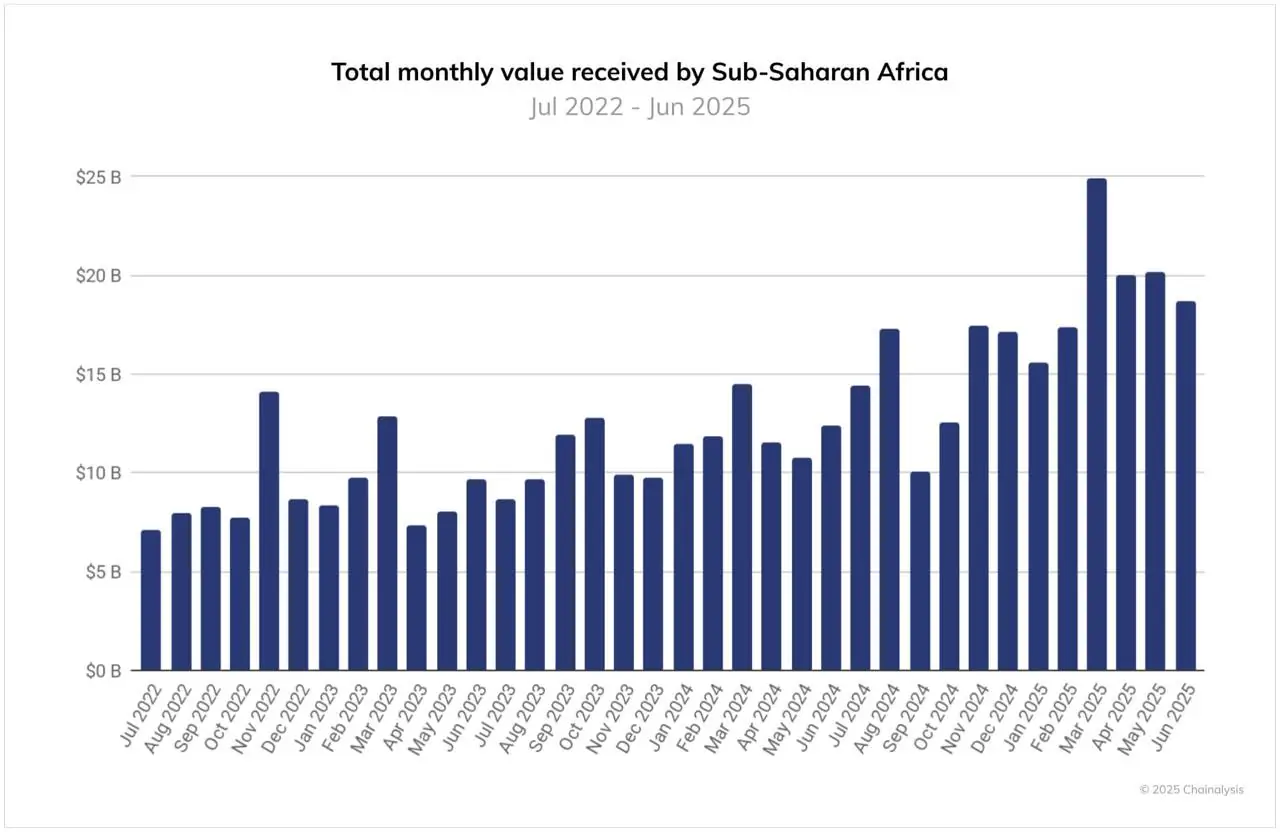

The clearest sign of sub-Saharan Africa’s retail-driven growth came in March 2025, when the region posted nearly $25B in on-chain volume in a single month.

Source: Chainalysis Report

Source: Chainalysis Report

That spike stood out globally, as other regions were cooling off. The trigger was Nigeria’s sharp currency devaluation, which forced people to look for alternatives.

Such shocks typically push crypto volumes higher in two ways: more citizens move towards digital assets to hedge against inflation; and the same amount of fiat buys less crypto, making nominal values surge.

Retail adoption is also visible in the transfer data. In sub-Saharan Africa, more than 8% of all crypto transactions were under $10K, compared to 6% across the rest of the world. This suggests that everyday use is a bigger factor here than speculative trading.

We must also consider the context: a region where many adults remain unbanked, but mobile money is already a part of daily life. For many Africans, crypto is a tool for payments, remittances, and savings when local currencies simply don’t hold up.

Institutional Flows & Regional Leaders

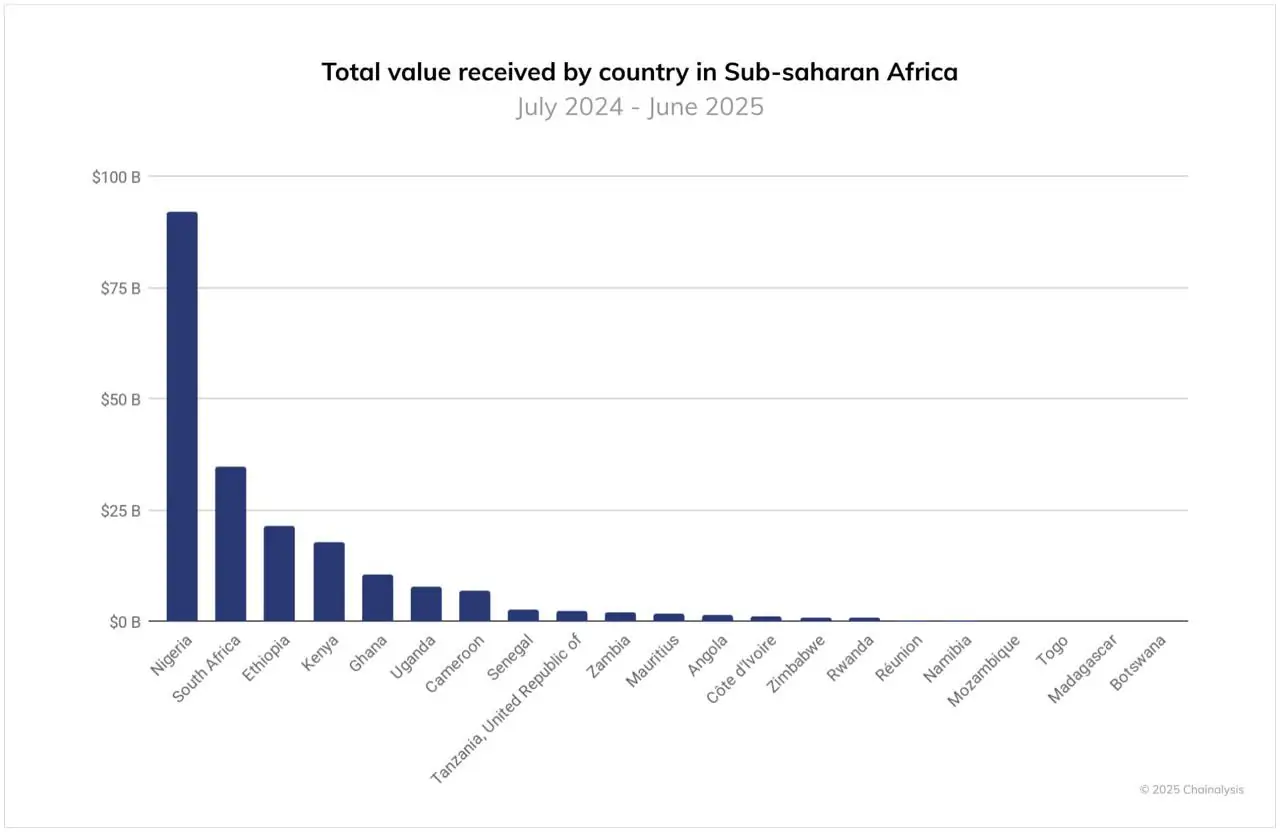

On the institutional side, Nigeria continues to dominate sub-Saharan Africa’s crypto flows. Between July 2024 and June 2025, the country received $92.1B+ in value, nearly triple South Africa’s intake.

Source: Chainalysis Report

Source: Chainalysis Report

Inflationary pressures and tight access to US dollars have pushed both retail and businesses toward $BTC and $USDT, with stablecoins in particular acting as a lifeline for dollar exposure.

South Africa, meanwhile, is carving out a different kind of leadership. According to the Chainanalysis report, South Africa’s advanced regulatory framework has already licensed hundreds of virtual asset service providers, giving institutions the certainty to engage.

Local banks, including Absa, are now piloting custody solutions and even exploring stablecoin issuance on an institutional level, shifting from it being an experimental tool to a mainstream financial product.

Cross-border flows tell another part of the story. Multi-million dollar stablecoin transfers now facilitate trade between Africa, the Middle East, and Asia, with energy and merchant payments leading the way.

Taken together, the region is building adoption from both ends – retail users on one side, and institutional rails on the other.

Bitcoin’s Influential Role

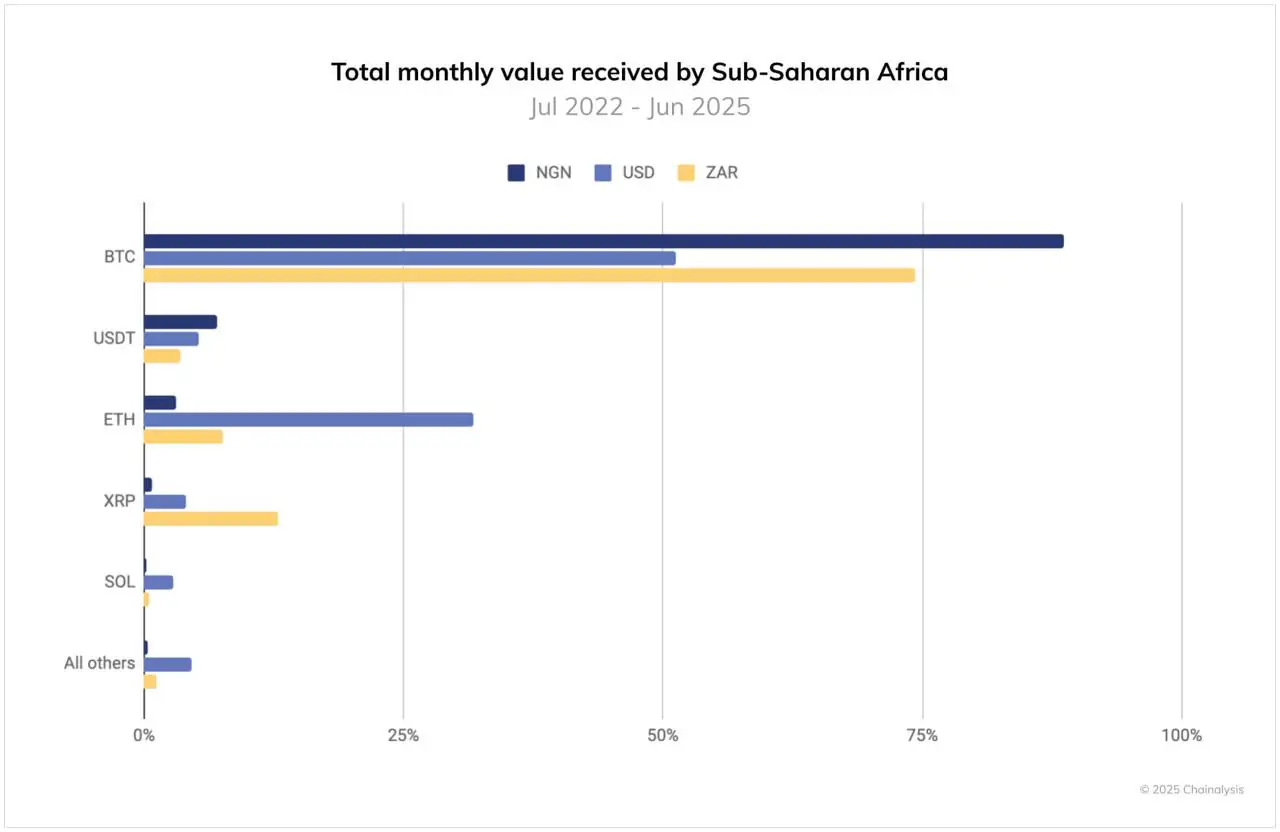

Bitcoin remains the dominant entry point into crypto across sub-Saharan Africa. In Nigeria, 89% of fiat purchases go into $BTC, while in South Africa the figure stands at 74%. Both are far higher than the 51% share seen in $USD markets.

Source: Chainalysis Report

Source: Chainalysis Report

The reasons are clear: in economies where inflation bites and dollar access is restricted, Bitcoin functions as both a hedge and a ‘digital dollar’ substitute. Stablecoins also play a key role, with $USDT making up 7% of purchases in Nigeria, compared to just 5% in US markets.

This dual purpose of Bitcoin being ‘digital gold’ and a practical financial tool underlines why adoption is so prevalent in the region. Yet $BTC’s biggest drawback remains speed and cost. That’s where scaling solutions like Bitcoin Hyper ($HYPER) aim to step in.

Bitcoin Hyper ($HYPER) – Bitcoin’s Execution Layer

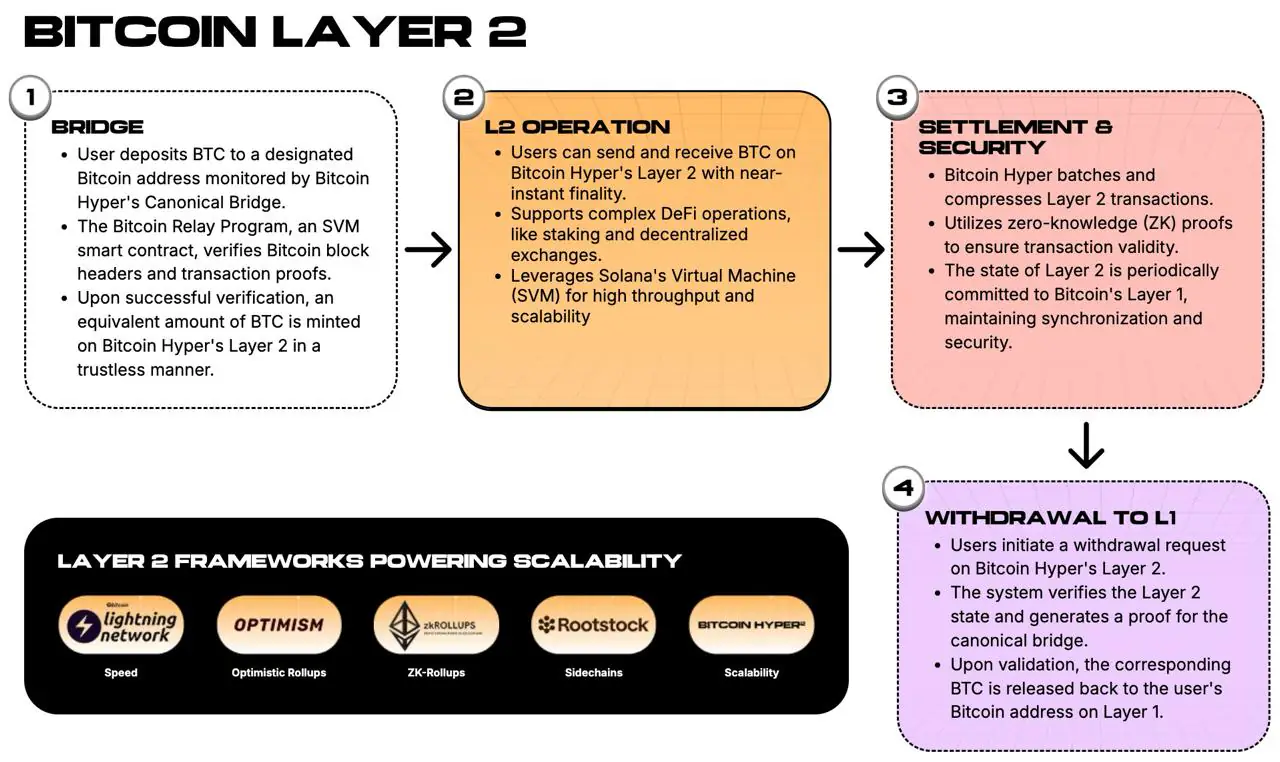

Bitcoin Hyper ($HYPER) is positioning itself as an innovative Bitcoin Layer-2 ecosystem that integrates the Solana Virtual Machine.

The project aims to give Bitcoin what it has always lacked: speed, low fees, and real programmability. On Hyper, $BTC can be bridged in, transacted instantly at near-zero cost, and settled back to Bitcoin’s base chain with zero-knowledge proofs.

It promises interoperability with Ethereum and Solana, making Bitcoin part of a broader multi-chain ecosystem. Bitcoin Hyper turns $BTC from static ‘digital gold’ into an execution layer where DeFi apps, meme coins, NFTs, and payments can actually run.

That unlocks the use cases already visible in sub-Saharan Africa (fast transfers, dollar substitutes, cross-border trade) but without today’s $BTC bottlenecks.

The $HYPER presale has gained a lot of investor attention, raising $15M+, with tokens priced at $0.012895 and staking yields hovering around 74% APY.

If Bitcoin is already functioning as money in places like Lagos and Cape Town, $HYPER could become the app store layered on top of it.

Remember, this article is not financial advice. Please do your own research before committing any capital.

This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned. Always do your

The post Sub-Saharan Africa Named Third-Fastest Crypto Adoption in Report – Can $HYPER Ride the Wave? appeared first on Coindoo.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·