This milestone highlights the growing role of stablecoins in the evolving digital financial system.

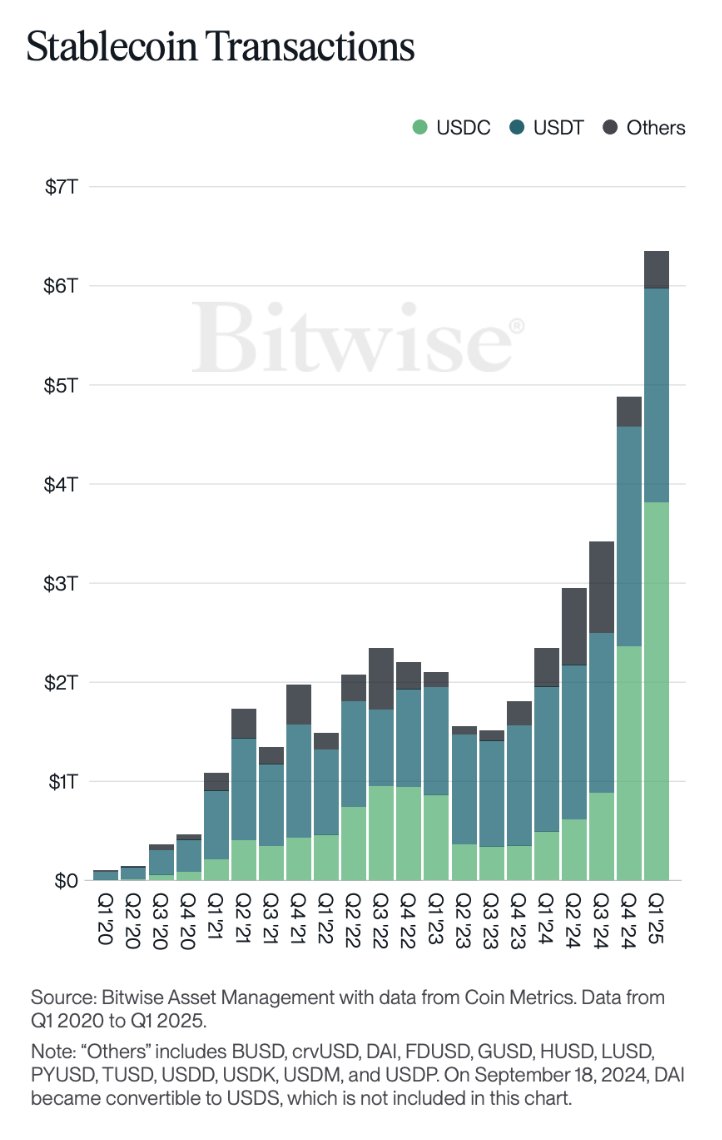

USDC and USDT continue to dominate the market. USDC has seen particularly strong growth since early 2023 and now leads in transaction volume. USDT also maintains significant usage, especially in international markets where it remains a preferred option despite regulatory scrutiny.

In addition to the two market leaders, alternative stablecoins are gaining traction. These include assets like BUSD, FDUSD, and others grouped under the “Others” category. While they represent a smaller portion of the total volume, their growth suggests increasing diversification in stablecoin adoption. It’s also worth noting that DAI became convertible to USDS as of September 18, 2024, and was therefore excluded from recent data.

Transaction volumes have been rising consistently since early 2023, following a slowdown in 2022. This reflects a renewed surge in demand and usage across a range of applications.

Stablecoins are now being used not just for crypto trading, but also for practical, real-world use cases such as remittances, decentralized finance (DeFi), international business payments, and on-chain payroll systems.

Finally, the steady increase in adoption comes as governments and institutions begin to seriously engage with digital asset legislation and infrastructure. In the U.S., proposals like the GENIUS Act are helping to pave the way for regulated stablecoin growth, further legitimizing the sector.

With each passing quarter, stablecoins are proving themselves to be a fundamental component of the modern financial system.

The post Stablecoin Transactions Surpass $6 Trillion in Q1 2025 appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·