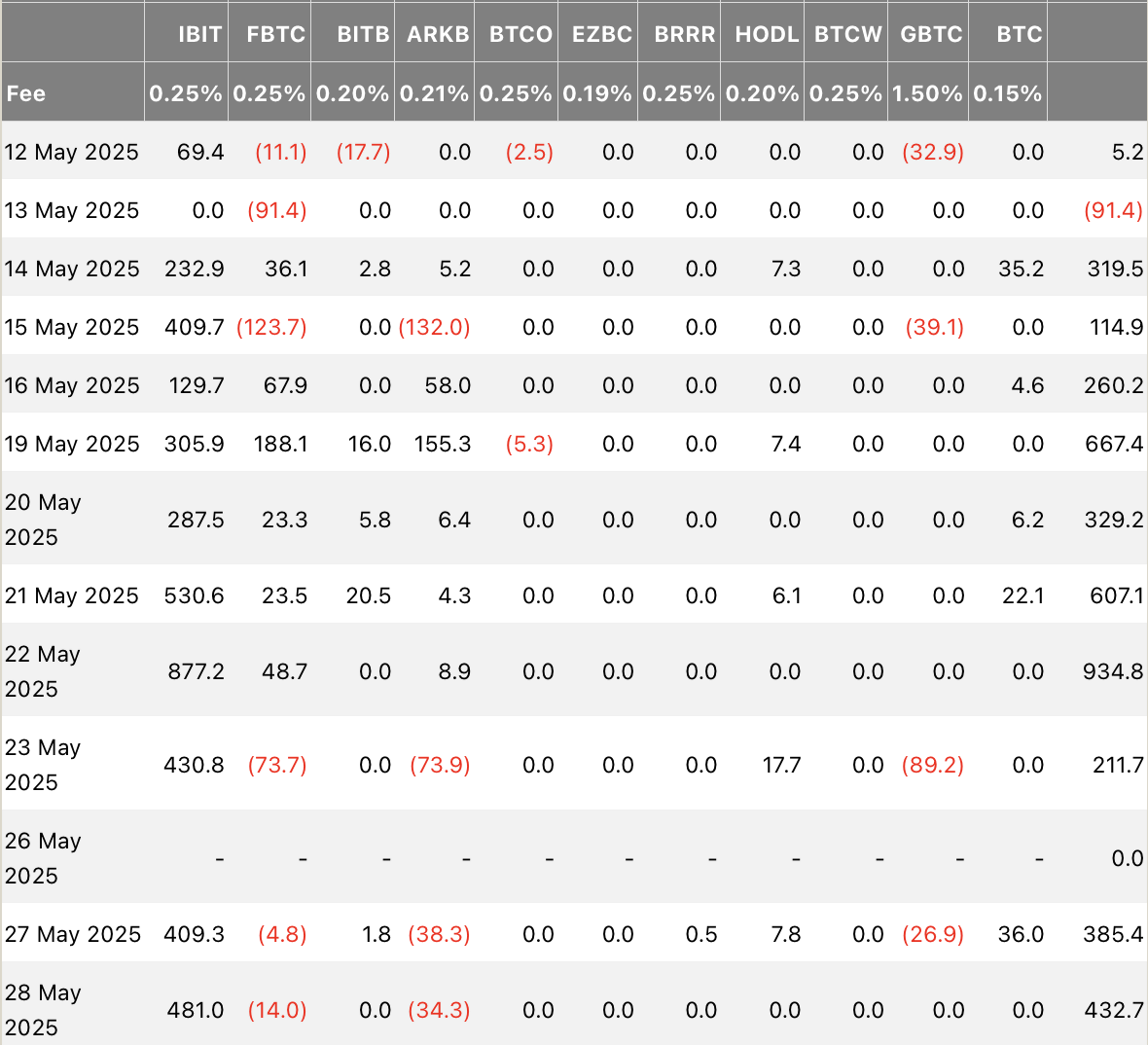

According to data compiled by Farside Investors, the ETFs recorded $432.7 million in net inflows on Wednesday alone. Notably, BlackRock’s iShares Bitcoin Trust (IBIT) accounted for the entirety of those gains with a $481 million inflow, while other funds saw redemptions or stagnant flows.

ARKB (Ark Invest) and FBTC (Fidelity) posted net outflows of $34.3 million and $14 million, respectively. The remaining ETFs registered no activity for the day.

IBIT has proven to be the driving force behind this momentum. Over the current 10-day streak, BlackRock’s fund contributed a staggering $4.09 billion, representing approximately 96% of the total inflows.

Since launching in January 2024, IBIT has attracted $49 billion in total inflows — more than the entire sector’s cumulative $45.6 billion, excluding Grayscale’s converted GBTC.

Despite the broader market impact of $23.1 billion in net outflows from Grayscale’s higher-fee GBTC, IBIT’s continued strength reinforces its dominant position among spot BTC ETFs and its growing appeal to institutional and retail investors alike.

The post Spot Bitcoin ETFs Extend Inflow Streak to $4.26B Over 10 Days appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·