The Layer 1 giant has climbed nearly 15% in the past two trading sessions, sparking fresh interest across both retail and institutional circles. With technicals firming up and momentum shifting, some are beginning to wonder if a larger breakout could be forming.

Solana’s MicroStrategy Moment

Solana just got a major vote of confidence. Sol Strategies has announced a $500 million convertible note to buy into SOL. This isn’t a minor headline; it’s a clear signal of conviction in Solana’s long-term potential. As institutions start treating Solana like a core asset rather than a speculative play, this kind of move helps shift the narrative from hype to serious capital deployment.

Sol Strategies’ $500M bet on Solana signals growing institutional confidence. Source: MisterCrypto via X

MisterCrypto highlights that Sol Strategies is now the MicroStrategy of Solana. The parallels are hard to ignore. Much like how MicroStrategy reshaped institutional sentiment around Bitcoin, Sol Strategies might be doing the same for Solana.

Solana’s Price Breaks Its Downtrend

After Sol Strategies’ bold move on Solana, the technical charts also started to reflect that optimism. Scott Melker, a famous analyst, points out that Solana price has printed its first higher high since the downtrend began in January. More importantly, the falling resistance line that capped price action for months has now been decisively broken.

Solana’s price breaks its downtrend as Scott Melker highlights the shift to higher highs. Source: Scott Melker via X.

According to Scott Melker, this move stands out not just because Solana printed a higher high, but because it did so with increasing volume. The previous level at $112 acted as a firm base, and now, with the breakout above $145, the market has shifted from lower lows to higher highs. As long as SOL Solana price holds above this reclaimed level, the structure favors continuation to the upside with $180 potentially back in play.

Solana’s On-Chain Strength Builds as Breakouts Align

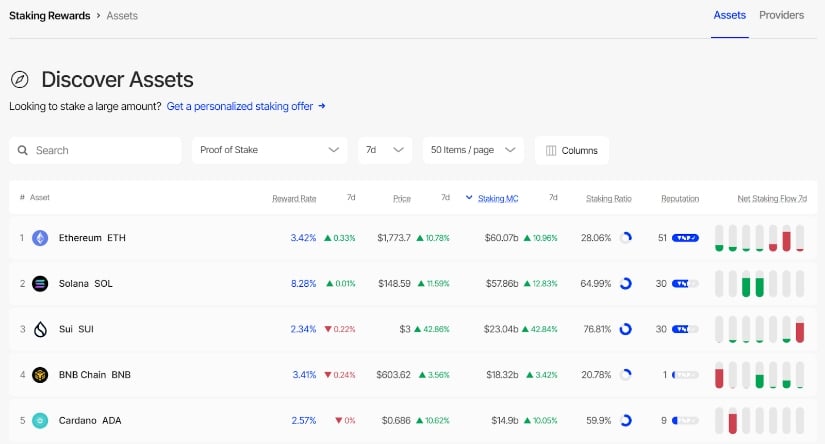

While price action and institutional interest are heating up for Solana, the on-chain activity is starting to uptick as well. Crypto analyst Jesse Peralta points out, Solana is holding its ground in the staking race with a massive $57.9 billion in staking market cap. That places it right behind Ethereum, but well ahead of most of its competitors. For a network that continues to be in the headlines for both price and progress, this staking strength adds a key layer of confidence for long-term holders.

Solana’s $57.9B staking strength boosts long-term outlook. Source: Jesse Peralta via X

Building on the recent breakout confirmed by Scott Melker and the $500M conviction play by Sol Strategies, Solana’s high staking market cap reflects more than just speculation. A large segment moving into token locks is reducing the circulating supply and shows confidence in the network’s future. Solana is heading in the right direction with its long-term plays.

Solana Price Prediction: Bullish Breakout Targets $320

Following a breakout and strong institutional backing, Solana’s technical setup is starting to catch attention. Trader Koala outlines a strong bullish momentum on charts, with $130 and $140 as the first area of interest, with room for more towards $180, and a higher target all the way up at $320. The structure shows higher lows holding firm, and momentum building above key moving averages.

Solana’s bullish breakout shows strong momentum, with a $320 target in sight. Source: Koala via X.

This fits neatly into the broader narrative building around Solana. From Sol Strategies’ $500M investment to the breakout confirmed by Scott Melker, Solana is stacking up signals of strength. The current Solana price prediction reflects that shift in sentiment, with upside targets suggesting a potential move of 30% from recent levels.

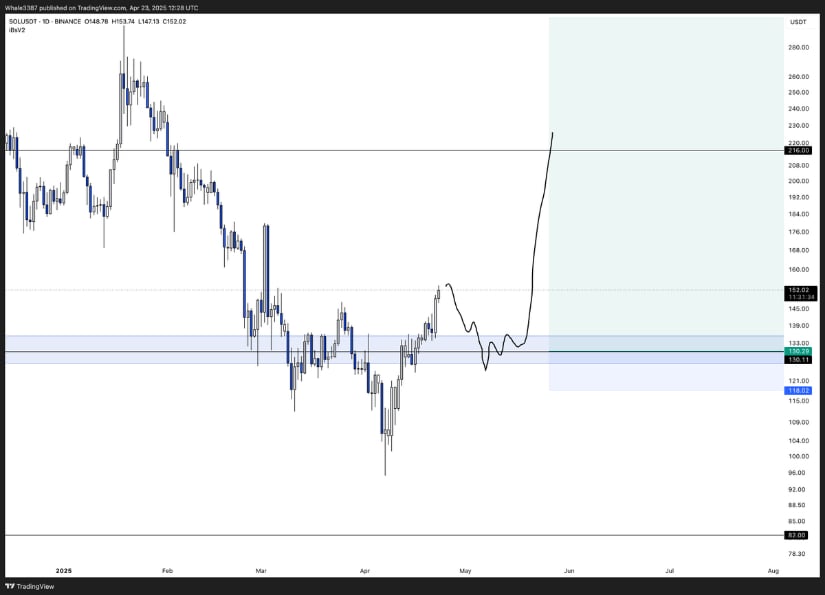

Diverse Views: Kevin Calls For a Temporary Short-Term Dip

While recent sentiment around Solana has been largely bullish, not every analyst is calling for a straight shot upward. Crypto analyst Kevin offers a more cautious view, highlighting the possibility of a short-term market pullback before any major rally unfolds. His chart points to a liquidity zone just below the $130 mark, where the price could briefly dip before regaining strength.

Kevin warns of a short-term pullback for Solana, before a bullish run towards $230 in the longer term. Source: Kevin via X

The longer-term outlook, however, remains constructive. After the potential retracement, Kevin expects Solana to rebuild momentum toward the $200 region, with a possible move as high as $230. This projection aligns with the broader views of analysts like Koala and Scott Melker. Solana’s price prediction might show short-term divergence, but the longer-term uptrend still appears to be intact.

Final Thoughts

SOL Solana price is starting to find its footing again. This time, not just through price action, but through a broader shift in sentiment. The major bet from Sol Strategies, the break in long-standing downtrend, and the strength in staking are all pointing to growing confidence in Solana’s long-term place in the market.

That said, while analysts like Koala and Scott Melker highlight strong upside potential, others like Kevin have shown the possibility for short-term pullbacks along the way. Solana price now seems to be entering a phase where dips are becoming opportunities rather than warning signs.

3 months ago

19

3 months ago

19

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·