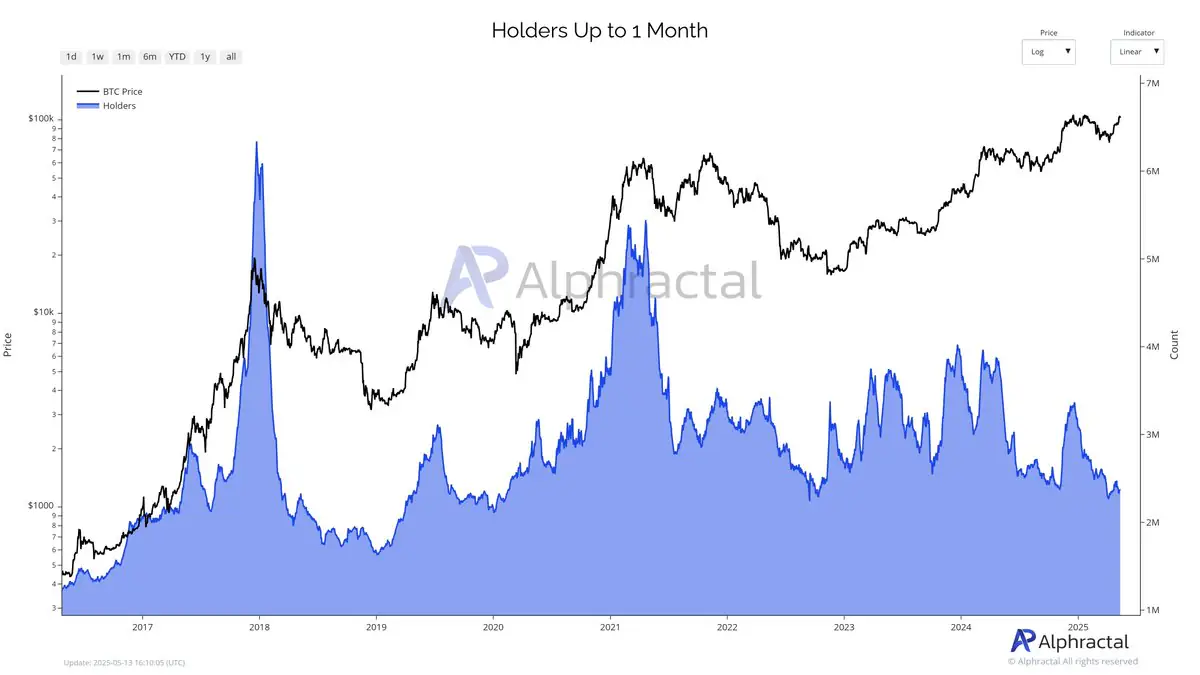

Currently, short-term holders control just 2.36 million BTC, a stark drop from previous peaks:

March 2024: 3.94M BTC

April 2021 (market euphoria): 5.44M BTC

This lower level of short-term ownership aligns more closely with bear market behavior, where retail and speculative interest tends to cool, and broader sentiment is subdued.

What It Signals

Historically, these investors rush in during bullish breakouts, amplifying price momentum. Their current absence implies that the market might still be in a “disbelief” phase, even as prices hover near or above historical highs.

Rather than rushing in during rallies, as they did in 2021, many short-term traders appear hesitant—perhaps uncertain about sustainability or awaiting confirmation of a true breakout.

The Bigger Picture

This divergence between price performance and investor participation raises questions:

Are we still early in the cycle?

Could an inflow of short-term holders signal the start of euphoria?

Until then, the market remains in a state of cautious optimism—driven more by longer-term conviction than by short-term speculative mania.

The post Short-Term Bitcoin Holders Exit the Scene — What This Says About Market Sentiment appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·