Yes, I know we are late with our September 2025 Home Budget update, but it’s better late than never.

Like most families, our times get super busy, and we are no exception, especially since the back-to-school season in the fall.

It seems like everything went from easy summer days to chaos for us as our son transitioned to grade six.

Typically, everything goes smoothly, but this year the school played a fast one on us and moved our son to a split class two weeks into grade six.

If you’re a parent to a neurodivergent child, you will understand when I say how traumatizing this can be, especially after they acclimate to their new environment.

In my recent blog newsletter, I briefly explained that the first month consisted mainly of meetings with the principal and resource teacher.

Sour emails went back and forth with other parents of neurodivergent children who were also moved to the split class.

We are still convinced that they created the split so the resource teacher could accommodate more children with Individual Education Plans (IEP) at once.

Our son’s school has only two resource teachers, and from what I’ve heard, many children need assistance.

None of the parents were informed about the move or asked to consult a doctor beforehand.

The email arrived on a Friday stating that our son would be moving on Monday.

We had to spend all weekend and to this day explaining why he had to move to a new class away from his friends.

In the end, even after the superintendent was consulted, all that was taken from the experience was lessons for the principal and resource teacher.

Moving forward, if this were to occur again, the transition would be conducted differently, as they have a duty to accommodate each child.

As of November, he seems to be doing okay, but we have parent-teacher interviews coming up at the end of the month.

Home and Blog Update

From there, I had to get the community garden sorted and plant around 300 garlic bulbs for harvest next July.

It was one thing after another, and working on the blog was becoming increasingly challenging, especially when I had to deal with problems behind the scenes.

Since transitioning to the new blog layout, I’ve had issues ranging from missing or incorrect recipes in blog posts.

Other issues stem from not having a cover photo on blog posts, to layout issues, and finally broken links.

I’m still working on fixing broken links, but as a community, please let me know if you come across one so I can address it.

Blog Status

Blogging is fun and started that way 13 years ago, but now with AI, ChatGPT, Vloggers, TikTok, and other social influencers, it’s tough.

Being anonymous limits what I can do with this blog, so I take the hits and continue, hoping it will survive.

I have a small area on the web that was once very busy but has declined over the years due to the reasons above.

In my earlier years, I recall bloggers earning substantial amounts of money and quitting their day jobs.

These days, many of them have either quit blogging or are making a concerted effort to earn a living online.

I’m glad I didn’t have enough money to make that decision, because it would have been a tough choice.

Ultimately, I likely would have said no because I’m a forward-thinker and know that every business needs to evolve to make money and stay relevant.

Fortunately, I have a community of faithful readers of CBB, which is why I work as hard as I can to earn enough money to keep it running.

I’ve gone from having a five-figure earning potential to being lucky enough to reach a level where I can pay the bills.

I know at times I might sound like a broken record, but believe it or not, besides subscribing to CBB, I need your support one step further.

Reading comments is always the highlight of my day, and it also helps other readers and tells Google that people find the content interesting.

Also, on social media, if you could Like, Share, or Comment on anything CBB related, it would make a world of difference.

For example, I earn little money on Facebook, but that small payment helps cover the $15 USD verification charge.

Getting 2026 Home Budget Ready

I appreciate your patience.

As the year comes to a close, I’ll have the 2026 Excel Budget Spreadsheet ready very soon.

Also, if you have any suggestions for budget binder printables, please let me know so I can start working on them.

Budget 2025: Canada Strong

Lastly, if you’re on my Facebook page, you might notice that I’ve been posting about politics lately, which is 100% important to Canadians and their personal budgets.

I don’t vote as I’m still a permanent resident of Canada, and I don’t discuss who I would vote for, nor take sides.

The idea is to discuss topics that will impact Canadians and their monthly budgets.

As you may know, groceries, rent, petrol, utilities, retirement, and other expenses are hot topics, especially with the new Budget 2025: Canada Strong that the Liberals just released.

I believe that Canadians should become more involved in politics, as we are all paying for it through taxes.

It’s our money, so like budgeting, we need to know where the money is being spent.

I wouldn’t hand my income to someone and tell them to sort our monthly budget without knowing what was happening with my money.

Political FIRE In The House

However, I know politics can get heated, but I do my best to weed out the people who can’t have an adult chat session on Facebook.

Never let online bullies fuel how you feel, especially when it comes to your money.

No matter what political party you support, your opinion is valid.

I’m not a fan of the mainstream media because the Liberal government pays for it.

Unfortunately, this is the state of Canada, and politics is, and will always be, a nasty game until someone is elected who genuinely cares for Canada.

I prefer to educate myself with facts (such as the budget) and social media journalists or influencers who provide proof and receipts.

As we age, Mrs. CBB and I worry about our future health, and our son after we are gone, especially since he is autistic.

Maybe we are worry warts, but it’s better to be proactive, engage, and educate so we know we’ve done the best we can as parents.

Okay, let’s review the September 2025 Home budget numbers.

Thanks for reading.

Mr. CBB

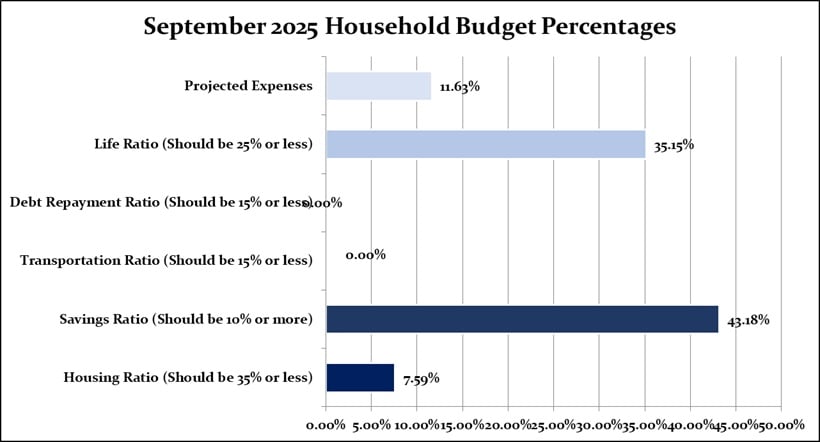

September 2025 Home Budget Household Percentages

September 2025 Household Percentages

September 2025 Household Percentages

Savings of 43.18% include investments and savings based on our net income.

Our life ratio is 35.15%, which includes all variable expenses, such as groceries, entertainment, miscellaneous items, health/beauty products, clothing, and more.

Transportation is covered at 0%, which includes our vehicle’s gas, insurance, and maintenance, and we hold no debt.

I keep the two spare gas cans filled with petrol throughout the year, mainly for the snowblower, lawn mower, power washer, and weed wacker. In September, I did not fill up the truck with petrol.

Our house and vehicle are paid off with zero debt; however, we still pay property taxes and maintenance fees.

For our housing, we came in at 7.59% for September.

The projected expenses of 11.63% can change based on what we encounter monthly, such as a new item we need to save for.

September 2025 Home Budget Estimation and Actual Budget

Below are two tables: the September 2025 Home Budget and our Actual Home Budget.

September 2025 Monthly Budgeted Amount

September 2025 Monthly Budgeted Amount

We may not need all the money we budgeted for in each category; however, remember that the number is only an estimate based on the actual expenses from the previous year.

Don’t forget to budget for projected expenses, as your entire month can fail if you don’t plan accordingly.

Actual September 2025 Home Budget

September 2025 Monthly Actual Amount

September 2025 Monthly Actual Amount

Current Canadian Banks We Use

Chequing– This is the bank account from which we pay our household bills. We use Simplii Financial, TD Canada Trust, and Tangerine Bank. Join Simplii Financial today! Read more about the best Canadian online virtual banks. Emergency Savings Account– This money is in a high-interest savings account (HISA) High-Interest Savings Account (HISA)– This savings account holds our projected expenses.September 2025 Home Budget Year-To-Date

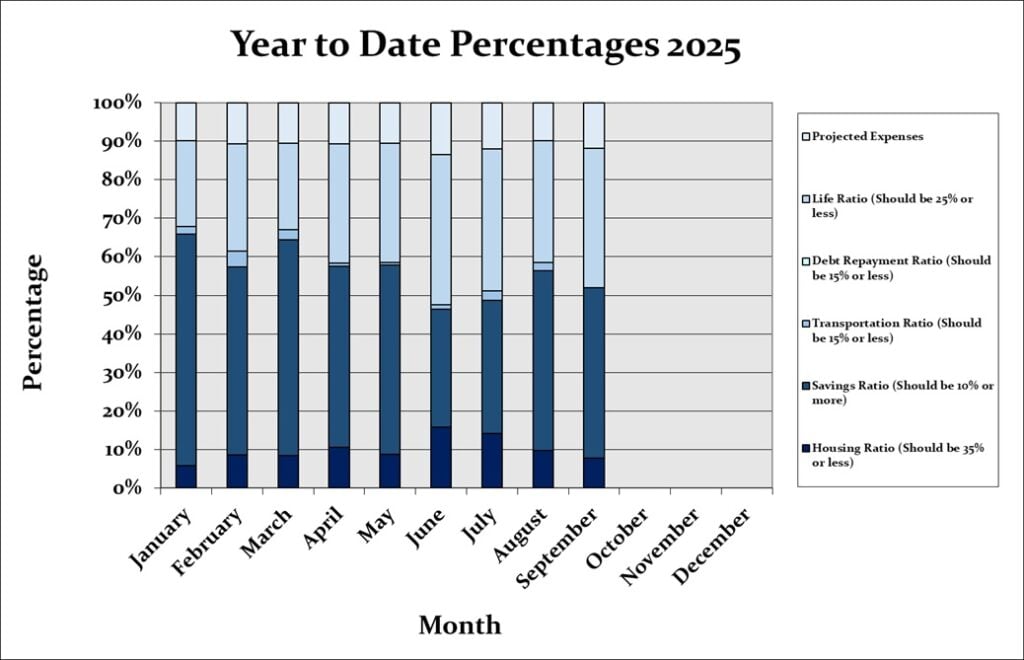

September 2025 Month by Month

September 2025 Month by Month

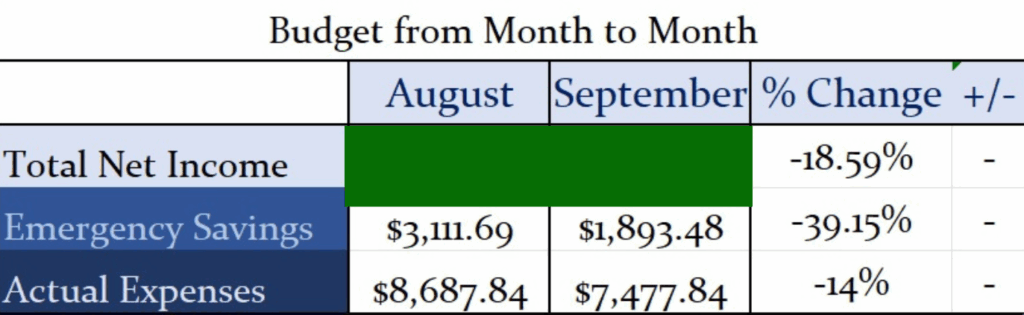

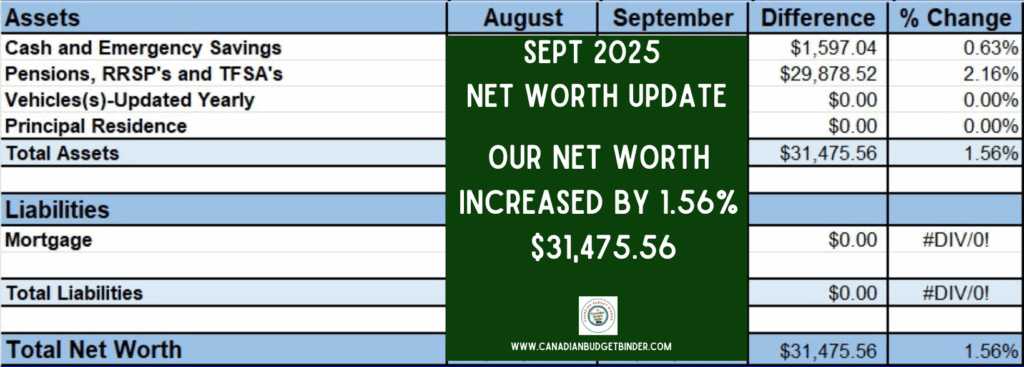

Although our net worth increased by $31,475.56 in September, we decreased our emergency fund savings opportunity by 39.15% by spending more.

Month-to-Month Home Budget September 2025

Budget From Month to Month September 2025

Budget From Month to Month September 2025

Our emergency savings decreased by 39.15%, meaning we saved more in September than we did in August.

Always expect to see changes from month to month, as that’s normal since money is being spent and, in some cases, more than anticipated.

Between August and September, we experienced a -14% decrease in actual expenses, indicating that we spent less money than in the previous month.

Also, our net income in September decreased by 18.59% compared to August.

Breakdown- September 2025 Home Budget Categories

Below are some of our variable expenses from August 2025 that I will discuss.

Please let me know if you would like me to explain or include any additional information in the next budget update.

Grocery Expenses September

Please find all the online groceries we purchase in the CBB Amazon Storefront.

September 2025 Grocery Budget Challenge Update Part 2

September 2025 Grocery Budget Challenge Update Part 2

Our monthly grocery budget is $960, plus a $25 stockpile budget; we spent $ 1,802.93 in September.

We spent $842.93 over budget for the month, which was not surprising given the amount of food we purchased.

Our current grocery overspend for 2025: $ 1,550.81 + $ 600.07 + $206.08 = $2,356.96 + $842.93 = $3199.89, to catch up.

There are months in the year when we spend less, so we hope we’ll be up to date during these months.

If not, the overage will be considered next year when we create our grocery budget.

With prices rising so much at the grocery store, it’s becoming challenging, as is our desire to find reduced products.

Our running total as of September 2025 is $12,273.78 for two adults and one child.

In 2024, our monthly grocery budget was $900, but with price increases, we calculated an additional $60 per month, totaling $720 per year.

I was reflecting on our grocery budget over the years, and in 2012, we were spending $190 monthly.

You do the math!

Below are photos of our groceries from July, excluding items purchased through Flashfood or Amazon.

CBB Food Budget Challenge Update

We blew our grocery budget out of the park in September, doubling our monthly budget allocation.

Here is where the $1800 worth of groceries went:

Costco Blog Recipe Creations Resale on Amazon Halloween Chocolate Flashfood purchases Shoppers Drug Mart 20x points (all deals and best prices only).Typically, a Costco run will already put us over budget by around $400-$ 500; however, with the amount of resale groceries we bought, the expenses added up significantly.

For Halloween, we went a bit overboard and gave out 40 packages of Oreo cookies that we bought for $1.23 on Amazon.

However, we also bought full-size chocolate bars, caramels, and boxes of mini chocolate bars before deciding to purchase the Oreos.

Yes, we have lots of chocolate left, and perhaps we could have reconsidered, but the kids loved it.

Thankfully, Amazon resale for groceries has slowed down to a turtle’s pace, and we don’t check it nearly as often.

Learning self-control is hard, especially when grocery prices are so high at the shops.

Grocery Shopping September 2025

Grocery Shopping September 2025

In December, I shared a blog post about our upcoming 2025 Food Budget Challenge and was looking for fans who wanted to join us.

One CBB reader is participating in the challenge, and their grocery expenses are at the end of this blog post.

I complete a grocery update monthly so you can follow along to see how she is doing with their food budget challenge.

Food Price Changes Over The Years

With only a few months left in 2025, I’m pretty sure we won’t balance our grocery budget for the year.

Since we started tracking our grocery shopping in 2012, we’ve always carried any overspending to the following month.

Unfortunately, no budget balances itself, and with rising costs and overspending, it’s been a tough year for us.

What changes should we make in 2026?

How do we stop buying amazing deals that we know we will eat or drink?

The hardest part is knowing that we are debt-free and have the money to spend, and I think that is a significant issue for us.

There are definitely some goals and questions Mrs. CBB and I have to discuss for 2026.

Our grocery goals for 2025 included staying on budget, which we’ve failed to achieve, and saving as much as possible by buying from Flashfood or reduced-price products.

Types of Groceries Purchased

The two grocery stores we shop at most are Zehrs and Food Basics. Also, we buy grocery items from Amazon Canada and Flashfood.

Check out my new post, where I explain how to find reduced-cost groceries on Amazon.

For example, Mrs. CBB bought a case of 12 Crispy Minis for $12 and a case of avocado oil for $122 from Amazon Canada overstock.

Like most families, we tend to buy the same products, although I do enjoy experimenting with recipes for the blog.

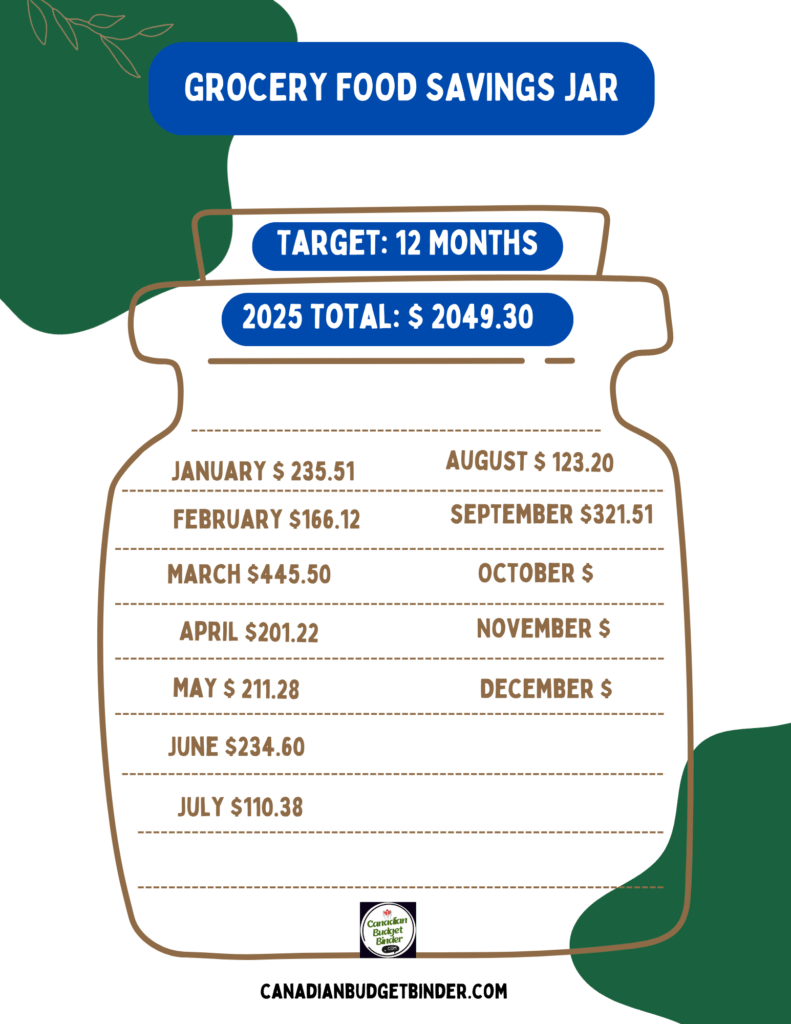

September 2025 Grocery Food Savings Jar

We have officially saved $ 2,450 this year from Flashfood and coupons, which is fantastic, especially since we don’t typically use many coupons.

In 2024, we saved $1,712.87 by using coupons and purchasing reduced-price products at local grocery stores.

Throughout 2025, we plan to track our grocery food savings, which include the following;

Coupons Discounts Free Stuff (ex, using SCOP) Rewards Points redemptionIf you’d like a copy of the Grocery Savings Jar, you can find it on the Free Resources page.

In December, I shared a blog post about our upcoming 2025 Food Budget Challenge and was looking for fans who wanted to join us.

One CBB reader is participating in the challenge, and their grocery expenses are at the end of this blog post.

I complete a grocery update monthly so you can follow along to see how she is doing with their food budget challenge.

Food Price Changes Over The Years

Although we spent under budget in August, we need to stay on track.

It’s easy to buy those deals that pop up, and yes, they will help us save money in the long term, but it’s hard to see that on our budget.

Sometimes, we have to remind ourselves that as long as we aren’t building a mountain of food stockpile like we used to, we’re ok.

Years ago, we had far too much food and ended up donating a significant amount of it, which was a good action on our part. However, financially, we could have saved money.

Also, I purchase food to create blog recipes, which I don’t get any tax breaks on, and I rely on my readers to like, comment, and share.

Being a blogger is becoming increasingly expensive, and if we don’t help CBBit, it could mean closing the doors, as I won’t run at a deficit.

I plan to write a blog post about our grocery budget from 2012 to the present to see the changes.

We’ve since modified part of our diet, incorporating higher-protein foods and adopting a low-carb lifestyle.

Since tracking our grocery shopping in 2012, we’ve always carried any overspending to the following month.

Where We Grocery Shop

The two grocery stores we shop at most are Zehrs and Food Basics. Also, we buy grocery items from Shoppers Drug Mart, Amazon Canada, and Flashfood.

Check out my new post, where I explain how to find reduced-cost groceries on Amazon.

Related: The Cheapest Grocery Stores In Canada

September 2025 Grocery Food Savings Jar

Grocery Food Savings Jar 2025 September

Grocery Food Savings Jar 2025 September

We have officially saved $2049.30 this year from Flashfood and coupons, which is fantastic, especially since we don’t use many coupons.

In 2024, we saved $1,712.87 by using coupons and purchasing reduced-price products at local grocery stores.

Throughout 2025, we plan to track our grocery food savings, which include the following;

Coupons Discounts Free Stuff (ex, using SCOP) Rewards Points redemptionIf you’d like a copy of the Grocery Savings Jar, you can find it on the Free Resources page.

Our Flashfood Savings Last Year

For 2024, using the Flashfood App saved our family $992.60!

The total amount saved in 2025 is $2349 using Flashfood.

Combining the Flashfood savings with our grocery savings jar, we saved $2705.47 in 2024

I’ll tally it up again at the end of 2025 to see how much we save on groceries.

We continue to use Flashfood because we save so much money. Please consider signing up using my affiliate code below.

Sign up for Free with FlashFood and earn a $5 Credit.

As you do, you’ll receive $5 free when you place your first order. It’s a win-win for both of us.

Every person who signs up gets a $5 credit, a freebie Flashfood offers for new app customers.

Also, Flashfood has added a small service fee to every order, which I find acceptable.

Use my referral code, MOCD28ZN4, for a $5 credit.

Your first purchase must be over $15.

Flashfood Orders September 2025

Flashfood September 2025 Purchases

Flashfood September 2025 Purchases

In September, we made five Flashfood purchases that included the following products.

Cottage Cheese Milk Sausages Pork Sausages Frozen BananasPet Expenses

Two-Cats-Pets-Budget-Category

Two-Cats-Pets-Budget-Category

We’ve created a $350 monthly budget for our two cats, which we feed premium dry cat food and a higher-end wet cat food.

Our pet expenses for September 2025 totaled $260, which is $90 under budget. It sounds nice, but don’t get too comfortable with that number, as October expenses can be brutal!

Below is a photo of our black cat, who spent a few hours in the cat hut outside. He was so tired that he passed out face-first on the bed. Haha, it was too funny not to share with all of you.

Our cat is sleeping face-first on the bed

Our cat is sleeping face-first on the bed

PC Optimum Rewards Points September 2025

Shoppers Drug Mart September 2025 Optimum

Shoppers Drug Mart September 2025 Optimum

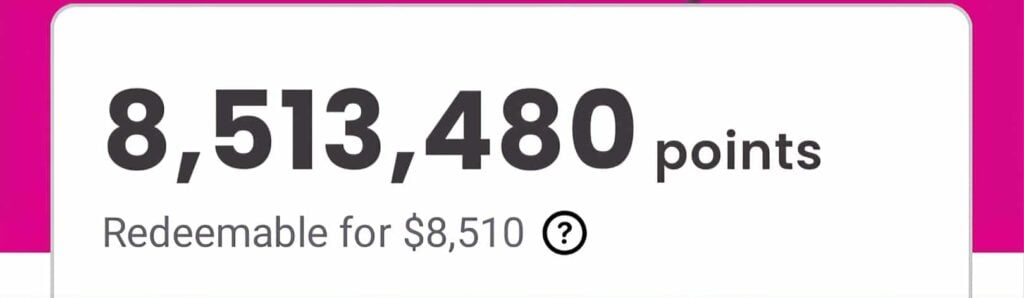

Since 2018, we have earned over 9 million PC Optimum Points, equivalent to $ 9,000.

We started 2025 with under 7 million PC Optimum Points, and as of September, we have 8,513,480, and are working towards $9,000 by the end of 2025.

There are only a few months left to reach our 2025 goal25, and I’m unsure if we will achieve it.

Last month, I asked if you thought it would be a good idea to use our points on groceries in 2026.

However, a new opportunity has arisen, which I will blog about to let you know how we will utilize our Shoppers Optimum Points.

How We Saved So Many PC Optimum Points

Below are blog posts for anyone interested in learning how we earn PC Optimum Points.

How To Earn PC Optimum Points Fast How We Earned 4 Million PC Optimum Points President’s Choice Financial World Elite Mastercard PC Insiders World Elite MastercardCanadian Tire Rewards Points

Canadian Tire Rewards Sept 2025

Canadian Tire Rewards Sept 2025

I didn’t spend much on my Canadian Tire credit card, so my CT Money Balance is $378.22, an increase of about $9 since July.

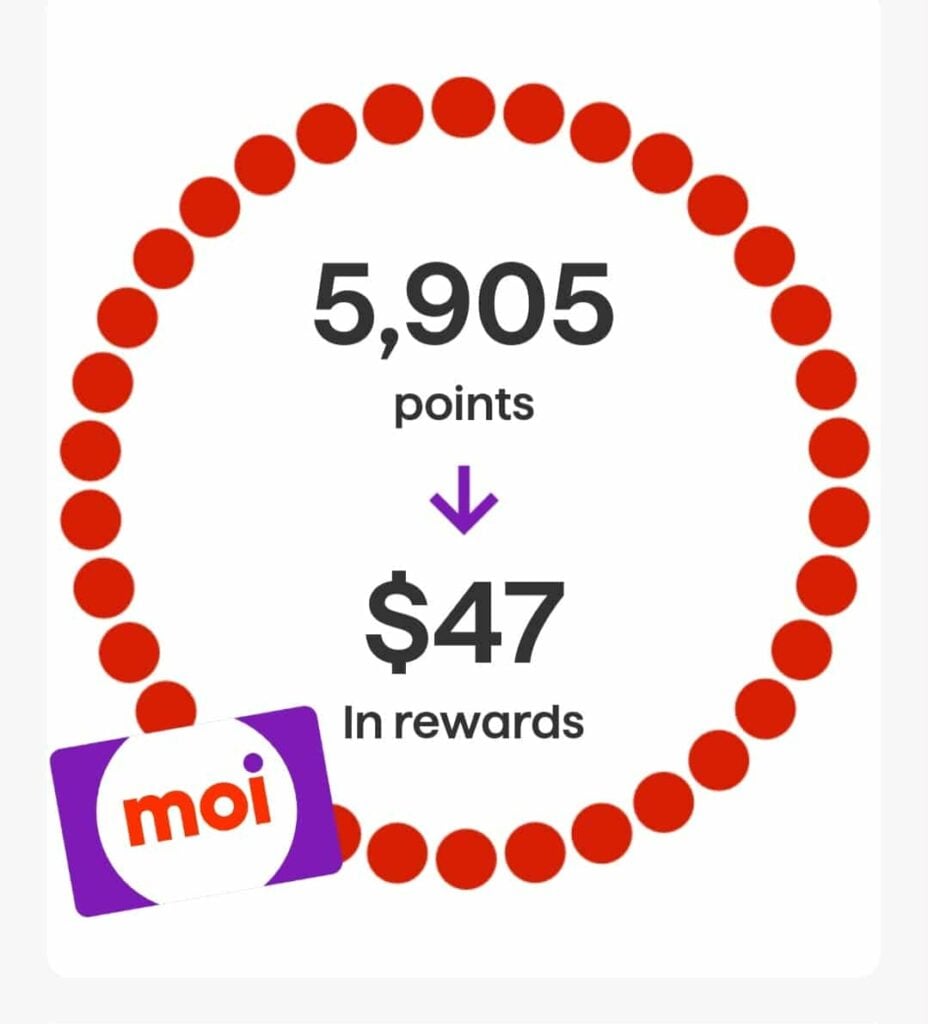

Moi App Rewards

Moi App Rewards Points September 2025

Moi App Rewards Points September 2025

For every 500 points earned, buying products with Moi points equals $4.

My Moi app review is in the works, and I think we’ve had enough experience to offer our feedback on the program.

Currently, we have $47 in Moi Points that we can redeem towards our groceries.

Compared to PC Optimum Points, we are slow to earn rewards, as we don’t often use the offers for which we get points.

TD Rewards Credit Card September 2025

TD Rewards September 2025

TD Rewards September 2025

Our TD Visa has a cash-back balance as of September 2025 of $143.07

This TD Visa credit card is not the best for reward points, as it took us years to earn $500.

We use this account exclusively for online purchases from Amazon, PayPal, Shopify, and other similar platforms.

The credit card has a $5000 limit, although we initially started with $500.

What credit card do you use besides PC Mastercard that offers you amazing cashback?

Dream Air Miles Update

Air Miles September 2025 CBB

Air Miles September 2025 CBB

Most of the 4332 points are from our house and vehicle insurance, which offers Air Miles.

Since July 2025, we’ve increased by 2 points, which is not ideal, but we don’t use the program as much.

Eventually, I’ll get around to writing a review about Air Miles.

Do you find enough benefits in the program to use it?

I’d love your feedback, either by leaving a comment on this post or by emailing me at [email protected].

There was a point where we had to choose Cash Miles or Dream Miles.

Since my family lives in the UK, we felt the Dream Miles would have worked best for us.

September 2025 CBB Net Worth Update

Net Worth Update September 2025

Net Worth Update September 2025

Overall CBB September 2025 Budget + Net Worth Update

I’ve had a few people email me about our mortgage and why it’s not included in the chart.

After purchasing our home in 2009, we paid it off by 2014, which was not easy, but we managed to do it.

Our 2025 market home value is approximately $988,000 to $1 million, and we purchased the home for $265,000 in 2009.

In September 2025, our net worth increased by $31,475.56, primarily due to increases in our investments.

Mrs. CBB, since she doesn’t work, last contributed money to her RRSP in 2009, and it was valued at around $47,000 after she lost money in the financial crash.

Today, it’s worth over 200k. That’s the power of time and why it’s so important to invest when you can, even if it’s something small.

I still have room to contribute to my RRSP, which I may top up come tax time, but I’ll wait and see what happens with the state of the Canadian economy.

2025 Food Challenger Updates

The 2025 Food Budget Challenge aims to determine whether participants can stick to their grocery budget and how much they can save in 2025.

Below is the last remaining Canadian Budget Binder fan who is participating in sharing their grocery budget and expenses with everyone for the year.

We started with four participants in January, and in less than four months, we have been reduced to one.

Budgeting requires a serious commitment, and what I’ve learned over the years from any challenge I’ve hosted is that almost all participants drop out.

On that note, if participant one finishes the year, she wins the challenge!

Let’s see if she can stick with the challenge and keep up with us.

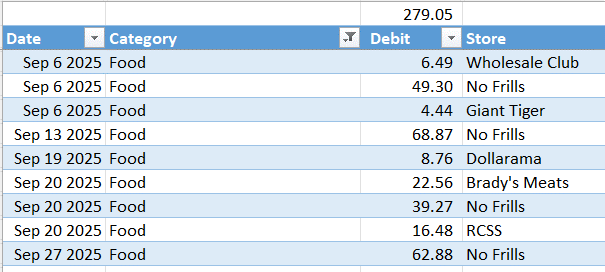

Food Budget Challenger #1

September 2025 Grocery Challenge

September 2025 Grocery Challenge

Hi Mr. CBB,

I am feeding a family of 2 adults and live in Ontario.

In 2025, we aim to achieve these goals

Pay down debt Cut down on unnecessary shopping.Our monthly grocery budget is $400.00, which we try to keep to a maximum of $100 per week.

Typically, shop for groceries at the following stores: – Wholesale Club, No Frills, and Brady’s Meat. We started shopping at Giant Tiger and Food Basics when sales are good.

In September, we saved $120.95 by utilizing flyer sales and avoiding unnecessary purchases. We don’t roll over extra, nor do we roll over overages. Each month is on its own accord.

Signed,

Grumpy Grocery Shopper X 2

The post September 2025 Home Budget Update appeared first on Canadian Budget Binder Your Way To Debt-Freedom.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·