TLDR

Monero suffered an 18-block reorg that reversed 117 transactions, caused by Qubic team with 51% hashrate control Despite security breach, XMR token rose 7.4% from $287 to $308 within hours of the attack The reorg exceeded Monero’s 10-block protection mechanism and raised double-spend attack concerns Community may implement DNS checkpoints as temporary solution, though this increases centralization Previous solutions like merge mining with Bitcoin and ChainLocks have been discussed but not implementedMonero experienced an 18-block blockchain reorganization on Sunday that reversed approximately 117 transactions, yet the privacy-focused cryptocurrency gained over 7% in value hours after the security incident. The attack was carried out by the Qubic team, which controls more than 51% of Monero’s mining hashrate.

Nothing to see here. Qubic just pulled a casual 18 blocks reorg on Monero 🤷 pic.twitter.com/fwSFY3olNu

— zuqka ױ (@AvdiuSazan) September 14, 2025

The reorganization began at block 3499659 at 5:12 am UTC and concluded at block 3499676 roughly 43 minutes later. Cryptocurrency protocol researcher Rucknium confirmed the security breach on GitHub, while Monero node operators shared command-line evidence of the incident on social media.

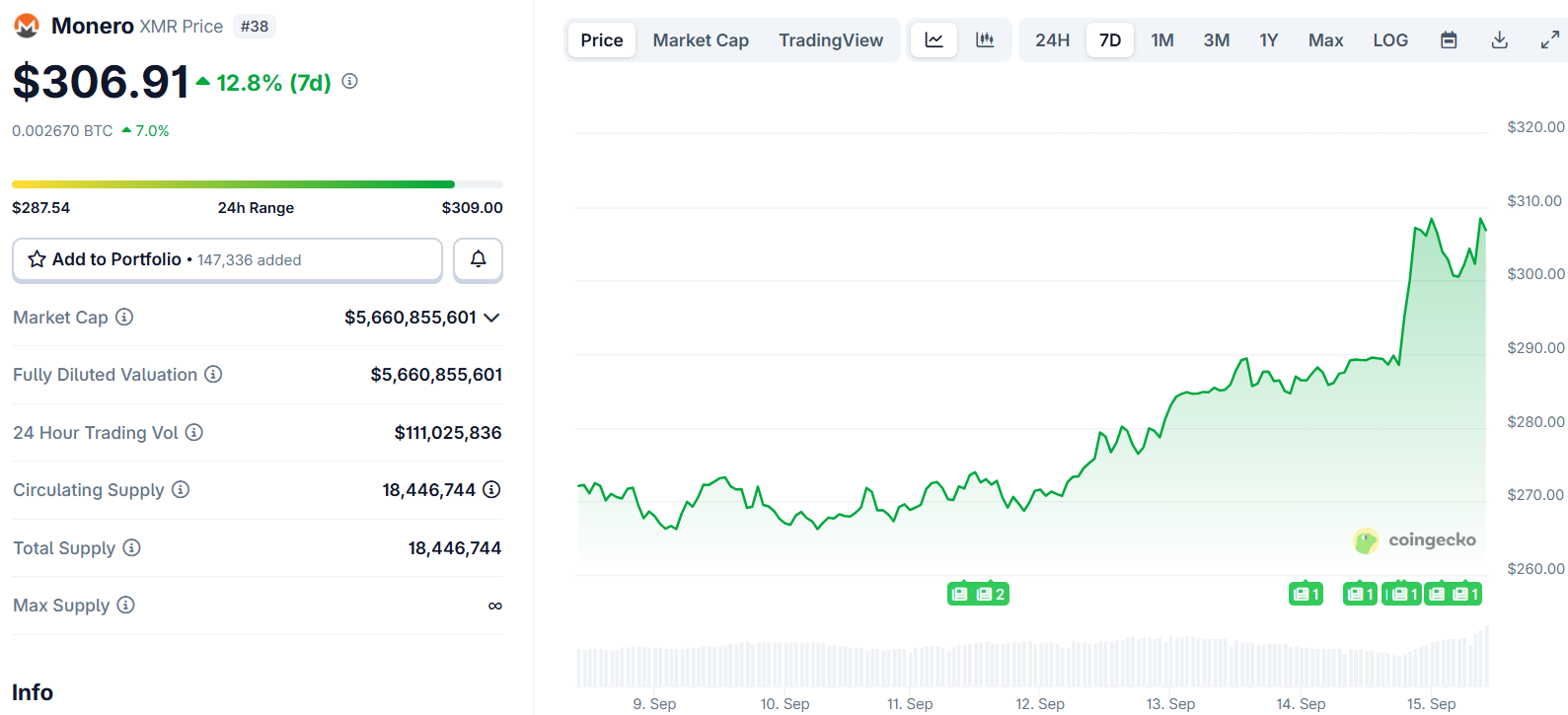

XMR traded flat during the reorganization but rallied 7.4% from $287.54 to $308.55 approximately eight hours later, according to CoinGecko data. This price increase occurred while the broader cryptocurrency market declined around 1%.

Monero (XMR) Price

Monero (XMR) Price

Crypto podcaster xenu, who first reported the reorg, suggested Qubic may have attempted to prevent further XMR price drops. The incident represents the largest reorganization in Monero’s network history.

Security Concerns Mount Over Double-Spend Risks

The 18-block reorg exceeded Monero’s built-in 10-block lock mechanism designed to protect transactions from reorganizations. Blockchain experts noted that reorganizations of this scale are highly irregular for proof-of-work systems and typically indicate deliberate interference or abnormal mining power concentration.

Monero was hit by an 18 block reorg a few hours ago, which invalidated 118 transactions. This is the largest reorg in Monero's history. Unsurprisingly ***ic is looking for any way to stay relevant and to stop the bleeding of their dumping price.

— xenu (@xenumonero) September 14, 2025

Security specialists warned that such events enable potential double-spend attacks. In these scenarios, attackers could invalidate previously confirmed transactions by creating deeper blockchain versions that exclude specific payments.

Traditionally, Monero transactions were considered final after 10 confirmations. However, analysts now suggest this threshold may no longer provide sufficient protection against reorganization attacks.

The incident has reignited concerns about mining concentration in Monero’s ecosystem. In August 2025, Qubic claimed majority control of the network’s hashing power, prompting exchanges like Kraken to temporarily suspend XMR deposits.

Blockchain data showed competing chains being produced by large pools including monero.hashvault.pro and supportxmr.com, while blocks from smaller pools were frequently discarded. This dynamic reflects a network environment where a few large pools dominate mining operations.

Community Considers Centralization Trade-offs

Rucknium stated it is “highly likely” that Monero node operators will temporarily adopt Domain Name System checkpoints as a solution to prevent repeated reorganizations. This approach involves nodes fetching trusted block data from community DNS servers.

However, implementing DNS checkpoints would increase network centralization, which some argue has already been compromised by Qubic’s majority hashrate share. Yu Xian, founder of blockchain security company SlowMist, warned that failure to address reorganization issues would leave Monero perpetually vulnerable.

The Monero community has previously explored various solutions to prevent 51% attacks. Proposed options included localizing mining hardware, switching to merge mining algorithms that would allow XMR to be mined alongside Bitcoin, and adopting Dash’s ChainLocks solution.

Despite these discussions, no effective solution has been implemented to date. Qubic maintains control over the privacy-focused network’s mining operations.

Some community members have expressed loss of confidence in the network’s reliability. Crypto pundit Vini Barbosa announced he would stop accepting XMR payments until the situation is resolved.

The post Qubic 51% Attack Triggers Largest Blockchain Reorg in Monero Network History appeared first on CoinCentral.

2 hours ago

5

2 hours ago

5

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·