PENGU has been under pressure lately, but fresh signs of accumulation from smart wallets and top traders are starting to shift the mood. Despite the recent dips, this quiet buying hints that things could turn over once bulls break past a key resistance.

Reversal Signs Building for PENGU

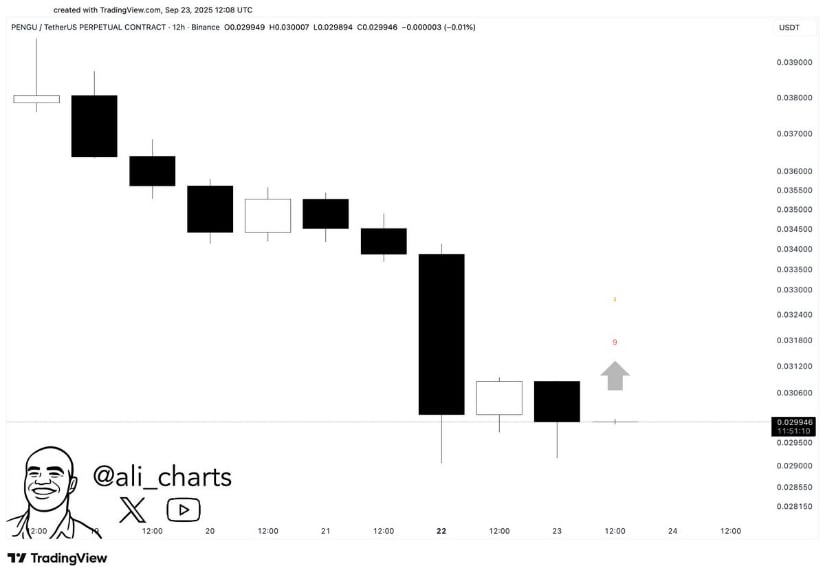

PENGU has triggered a TD Sequential buy signal, hinting that the heavy selling phase may be running out of steam. The chart has been sliding for days with consistent red candles, but this indicator often shows up right before a shift in momentum. With price hovering near recent lows, traders are watching closely to see if this zone can act as a turning point.

PENGU flashes a TD Sequential buy signal as fundamentals align with technicals for a potential turnaround. Source: Ali via X

What makes this setup more interesting is that it’s not just about the charts. Ali highlights key developments like expansion into Asia, rising U.S. toy sales, and an ETF filing all coming together at the same time. If buyers respond here, the mix of technical and fundamental drivers could finally give PENGU the push it’s been lacking.

PENGU’s Consolidation Phase Approaching Breakout Point

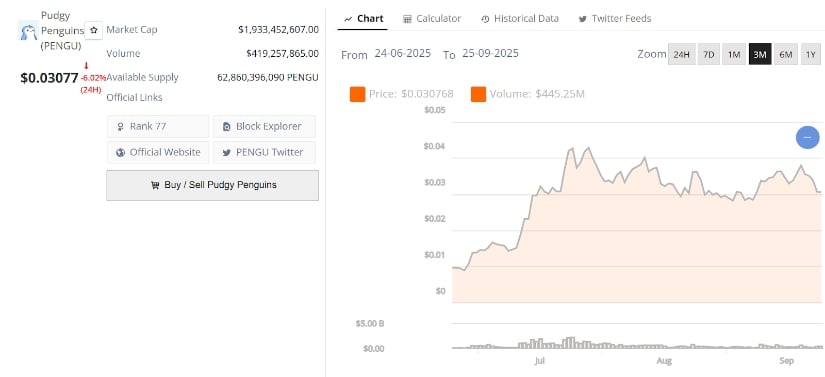

PENGU is trading around $0.0307 after a -6% daily dip, with the chart showing a clear sideways pattern forming over the past few weeks. Price has been bouncing within a tight range after its summer run, signaling indecision between bulls and bears.

Pudgy Penguins’ current price is $0.03077, down -6.02% in the last 24 hours. Source: Brave New Coin

With volume cooling and volatility likely to increase, this setup is hinting at an imminent breakout. The question now is whether buyers can step in to reclaim momentum, or if another leg down tests deeper supports. After recent signals pointing to a possible reversal, the sideways grind looks like the calm before the next wave of volatility.

PENGU Technical Analysis

Analyst CryptoFayZ has outlined a potential plan for PENGU Pudgy Penguins price, showing how price may still sweep lower before a stronger recovery attempt takes shape. The chart points to a retest of support around the $0.028 to $0.029 zone, an area that has already attracted buyers in previous dips. Holding this region would be key, as it could provide the base for a rebound into the higher resistance zones.

Pudgy Penguins’ eyes a retest of $0.028–$0.029 support, with a potential rebound towards $0.034–$0.043 if momentum kicks in. Source: CryptoFayZ via X

A clean bounce from $0.028 to $0.029 support levels would carry PENGU back towards mid-range resistance near $0.034 and $0.036. If momentum strengthens, higher levels around $0.040 and even $0.043 come into play as the next upside targets.

With the recent reversal signals in play and ongoing sideways consolidation, this technical roadmap adds weight to the idea that PENGU is setting up for a decisive move in the coming sessions.

Nansen Research Flags Accumulation Signs

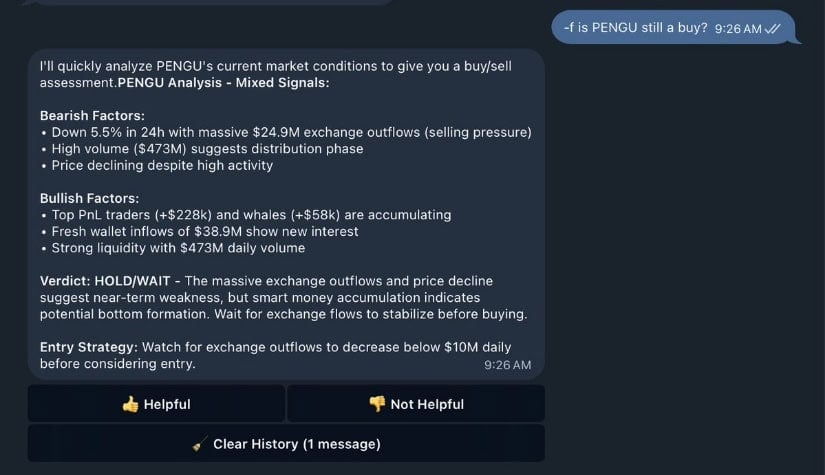

Nansen’s latest research update on PENGU shows a mix of signals, balancing out both bearish and bullish factors. On the downside, exchange outflows of nearly $25 million and a 5.5% daily dip point to heavy selling pressure. At the same time, high trading volume of $473 million suggests the market is still stuck in a distribution phase. This combination explains the ongoing choppy action and why confidence in the short term remains fragile.

PENGU sees $38.9M in smart money inflows even as exchange outflows signal heavy selling pressure. Source: Nansen via X

On the flip side, Nansen highlights that smart money wallets and top PnL traders are actively accumulating. Fresh inflows of $38.9 million into new wallets and liquidity strength are encouraging signs that a bottom may be forming. Their verdict leans towards caution: wait for exchange outflows to cool under $10 million daily before looking at new entries.

Final Thoughts

PENGU is standing at a key point right now. The recent selling and big exchange outflows show that pressure from bears is still strong. At the same time, smart wallets and top traders quietly adding to their positions suggest that not everyone has given up. This mix of selling and hidden buying makes the next few days especially important for deciding the token’s direction.

If the $0.028 to $0.029 support area holds and exchange outflows start to slow, it could signal that buyers are ready to step back in. From there, PENGU price prediction could begin testing higher resistance levels and prove the recent reversal signals right.

1 month ago

35

1 month ago

35

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·