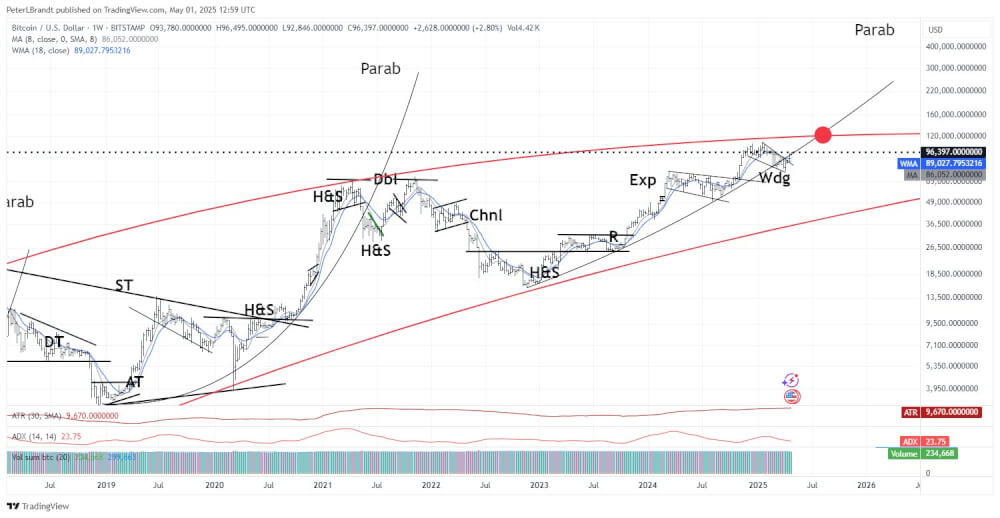

Brandt shared this outlook in a tweet referencing his latest chart analysis, which highlights Bitcoin’s historical price behavior and parabolic growth patterns.

A Return to the Parabolic Slope?

Brandt points to Bitcoin’s past price cycles and a “broken parabolic slope” that the digital asset must regain for this bullish scenario to materialize. The parabolic slope has historically acted as a support for explosive BTC rallies, and reclaiming it could trigger another massive upward movement.

According to Brandt’s annotated chart, if Bitcoin can break back above this slope, it is poised to complete the current bull cycle at the $125K–$150K range. This projection aligns with long-term patterns observed in prior cycles, including formations like Head & Shoulders (H&S), Channels (Chnl), and Wedges (Wdg), all of which suggest cyclic consolidation and breakout phases.

Potential for a Sharp Correction

However, Brandt also warns that such a rally may be followed by a significant market correction—potentially more than 50%. Historically, Bitcoin’s parabolic advances have been followed by sharp drawdowns, as speculative fervor subsides and profit-taking accelerates.

This outlook reinforces the importance of strategic risk management for traders and investors, especially as BTC enters what could be the final stages of this market cycle.

With over 236,000 views on his post and growing engagement, Brandt’s forecast is drawing serious attention as market participants weigh the possibility of a new Bitcoin all-time high in the next 12–16 months.

The post Peter Brandt Sees Bitcoin Hitting $150K Before Major Correction appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·