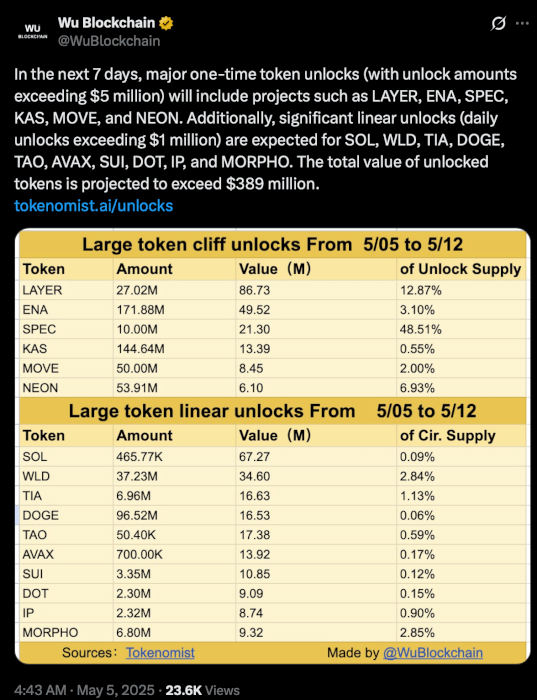

According to a post from Wu Blockchain, between May 5 and May 12, a wave of token unlocks is expected to impact various tokens. This includes both cliff unlocks—one-time, large-scale releases—and linear unlocks, which involve daily disbursements of tokens.

Key Cliff Unlocks (>$5M)

Among the largest cliff unlocks (often considered high-impact due to immediate liquidity injection) are:

LAYER: $86.73M (27.02M tokens, 12.87% of supply) ENA: $49.52M (171.88M tokens, 3.10%) SPEC: $21.30M (10.00M tokens, 48.51%) KAS: $13.39M (144.64M tokens, 0.55%) MOVE: $8.45M (50.00M tokens, 2.00%) NEON: $6.10M (53.91M tokens, 6.93%)These unlocks represent significant portions of token supplies, particularly SPEC and LAYER, raising potential implications for price volatility in the short term.

Key Linear Unlocks (>$1M)

Also expected this week are daily linear unlocks across multiple ecosystems:

SOL: $67.27M (465.77K tokens, 0.09% of circulating supply) WLD: $34.60M (37.23M tokens, 2.84%) TIA: $16.63M (6.96M tokens, 1.13%) DOGE: $16.53M (96.52M tokens, 0.06%) TAO: $17.38M (50.40K tokens, 0.59%) AVAX: $13.92M (700K tokens, 0.17%) SUI: $10.85M (3.35M tokens, 0.12%) DOT: $9.09M (2.30M tokens, 0.15%) IP: $8.74M (2.32M tokens, 0.90%) MORPHO: $9.32M (6.80M tokens, 2.85%)The data, sourced from Tokenomist, reflects an ongoing pattern of large unlocks that market watchers often monitor for sell-side pressure and short-term price action.

Wu Blockchain, known for its timely crypto analytics and insights, warns that the sheer scale—nearly $400 million—could inject volatility into affected tokens and the broader market this week.

The post Over $389M in Token Unlocks Expected This Week, Led by LAYER, ENA, and SOL appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·