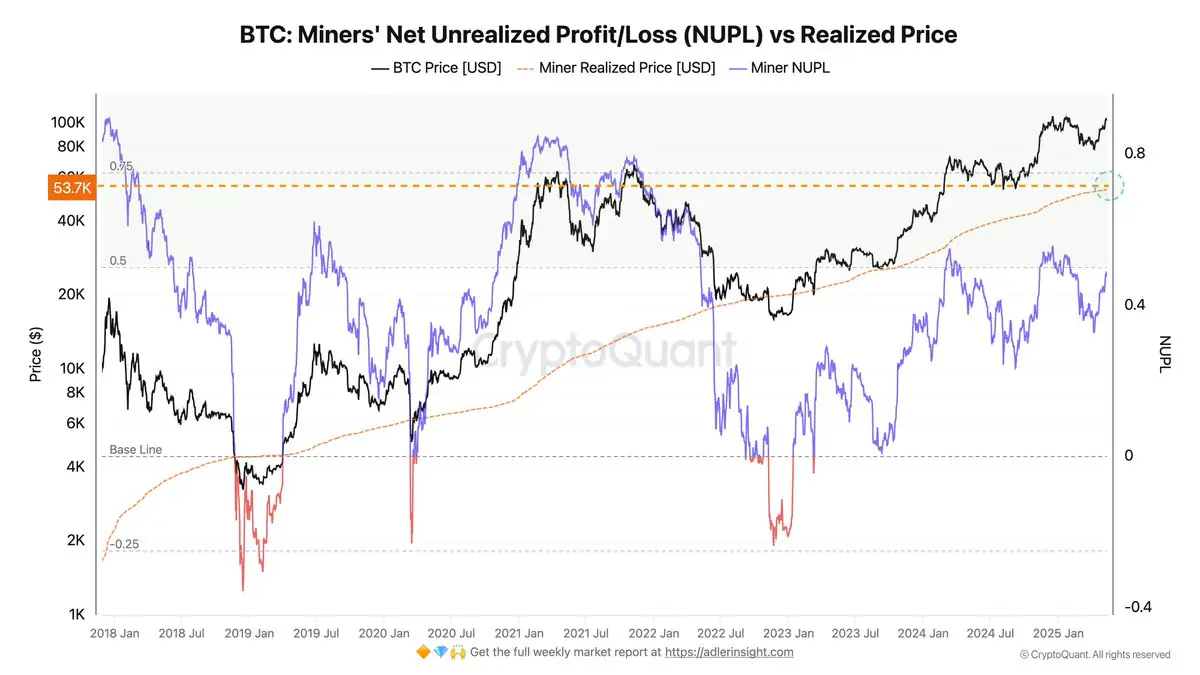

Since early 2023, the spread between Bitcoin’s spot price and the realized price for miners has been steadily widening.

This trend highlights enhanced marginal returns for miners, suggesting a more lucrative mining environment amid rising BTC valuations.

One key metric to watch is the Net Unrealized Profit/Loss (NUPL) for miners, which currently stands at 0.47. This value is approaching the psychologically and historically significant 0.5 threshold.

A break above this level could signal increased confidence among miners — and historically, such breaks have been followed by surges in volatility and shifts in market sentiment.

As the market closely watches these signals, the expanding profit margins could support continued bullish momentum — but also introduce heightened price swings if expectations shift.

The post Miners’ Profitability on the Rise as Realized Price Gap Widens appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·