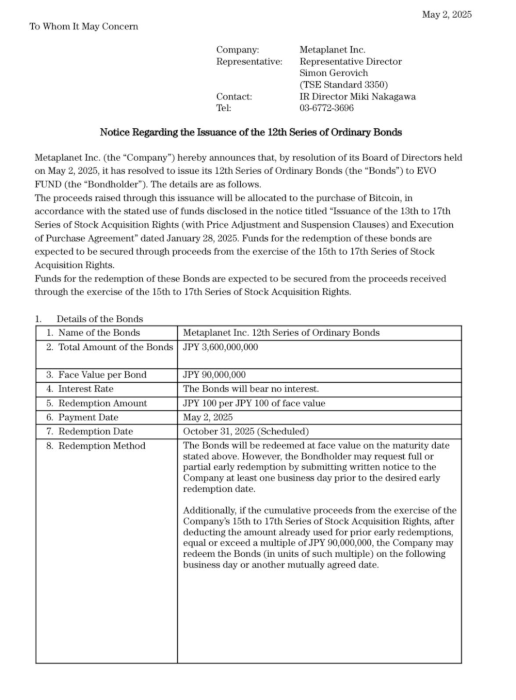

The decision was made following a resolution by the company’s Board of Directors on May 2, 2025, and the entire bond issuance has been allocated to EVO FUND.

According to the official statement, the total value of the issuance amounts to approximately $23.23 million (JPY 3.6 billion). Each bond carries a face value of around $580,645 (JPY 90 million) and will bear no interest. The bonds will be paid for on May 2, 2025, and are scheduled for redemption on October 31, 2025. Investors will receive full redemption at face value, with the company allowing the option for full or partial early redemption upon written request at least one business day in advance.

In addition, the company notes that if proceeds from the exercise of its 15th to 17th Series of Stock Acquisition Rights equal or exceed the value of any single bond—approximately $580,645—early redemption may be triggered without prior investor request.

The issuance has no collateral or guarantee, and no bond administrator has been appointed, as it complies with relevant legal exemptions under Japanese financial regulations. The entire issuance has been subscribed to by EVO FUND, which will act as the sole investor.

Payment and interest will be handled by Metaplanet Inc. at its Tokyo headquarters. The company confirmed that the issuance is not expected to have a significant impact on its consolidated financial results for the fiscal year ending December 2025. However, should any material financial developments arise, Metaplanet pledged to issue a timely update.

By leveraging this bond issuance to increase its Bitcoin holdings, Metaplanet continues to double down on its strategic alignment with digital assets, highlighting the growing trend of institutional Bitcoin adoption in Japan.

The post Metaplanet Issues $23 Million in Bonds to Fund Further Bitcoin Purchases appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·