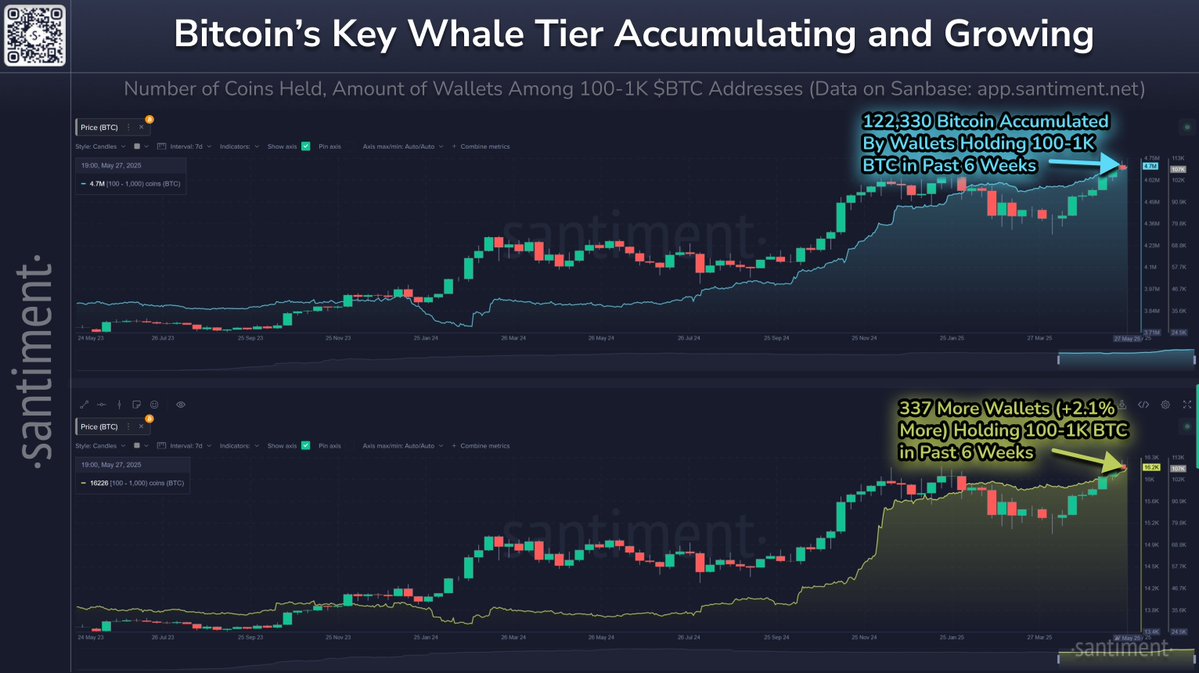

This influential cohort added 122,330 BTC collectively during that period, alongside a net gain of 337 new wallets, representing a +2.13% increase in addresses within this tier.

Most Price-Correlated Group in Bitcoin’s History

Santiment notes that over the past five years, no group of wallets has shown a stronger correlation to Bitcoin price movements than the 100–1,000 BTC cohort. Often viewed as early institutional players, hedge funds, and high-net-worth individuals, their behavior frequently serves as a leading indicator for broader market trends.

Their recent buying spree signals rising confidence in Bitcoin’s long-term trajectory, especially in the context of macroeconomic uncertainty and growing institutional adoption. This group’s actions are being closely monitored, as their accumulation has historically coincided with price uptrends or accumulation phases that precede major breakouts.

Strategic Accumulation or Pre-Halving Positioning?

The surge in wallet growth and BTC accumulation could reflect multiple strategic drivers. Investors in this tier may be front-running future regulatory clarity, institutional demand via ETFs, or positioning ahead of macro events that could impact liquidity and digital asset valuations.

Unlike smaller retail holders or mega-whales with 10,000+ BTC, this tier represents agile yet highly capitalized actors who often balance strategic long-term holds with tactical rebalancing.

If history is any guide, the current behavior of this key whale cohort could foreshadow increased bullish momentum in the months ahead. For now, their aggressive positioning serves as another on-chain signal supporting Bitcoin’s resilience amid a shifting financial landscape.

The post Massive Whale Accumulation: 122K Bitcoin Scooped in 6 Weeks appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·