Despite newer Layer-1 competitors, Litecoin remains relevant due to its speed, longevity, and consistent upgrades. As analysts and investors examine whether Litecoin will break the $120 mark by the end of the year, another contender—Qubetics—is rising fast. With over 515 million tokens sold in its presale, Qubetics is drawing attention for its practical applications and investor-focused tokenomics.

Litecoin has spent the last few years recovering from multiple market cycles. Known for its faster block times and low transaction fees, it was designed to complement Bitcoin, often referred to as the silver to Bitcoin’s gold. In 2025, the broader market environment, recent network upgrades, and growing attention on established altcoins have revived discussions on Litecoin’s price trajectory.

Can Litecoin Reignite Momentum in 2025?

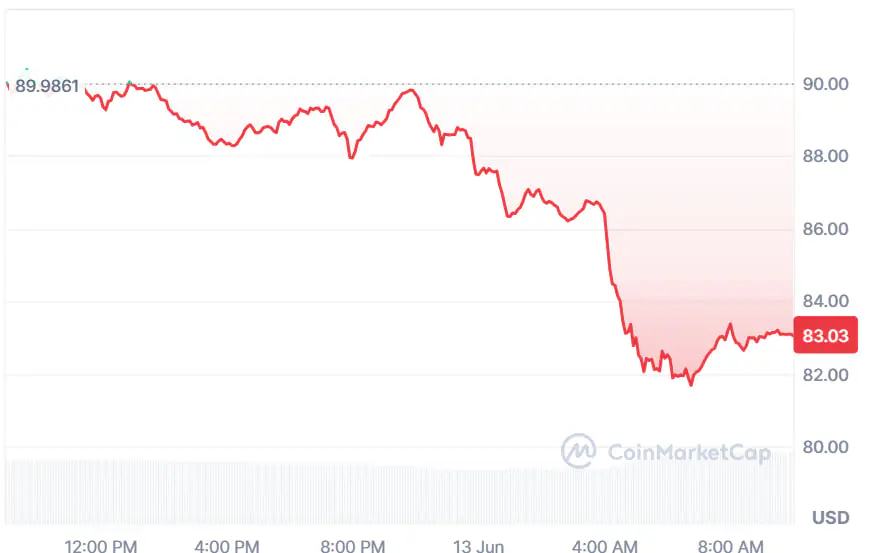

Litecoin’s 2025 outlook depends on several technical and macroeconomic indicators. Analysts have projected a price range of $84 to $119 for the year, as per CoinCodex data. While the lower end reflects Litecoin’s stable base, the higher range depends on market-wide bullish sentiment and continued adoption.

Recent improvements, including integration with privacy protocols like MimbleWimble Extension Blocks (MWEB), have enhanced transaction confidentiality. This makes Litecoin attractive not just for institutional transactions but also for high-frequency use cases. Moreover, Litecoin’s compatibility with PayPal and mainstream merchant platforms keeps it functionally relevant.

Market Position and Technical Behavior

Litecoin maintains a unique market position as a consistently reliable asset. Its total supply is capped at 84 million LTC, with over 76 million already in circulation. A defining feature is its 2.5-minute block time, which ensures faster transaction settlement compared to Bitcoin’s 10-minute average. This feature continues to benefit payment-centric applications, especially in cross-border transfers.

Technically, Litecoin is showing consolidation near its $83–$85 support zone. Analysts highlight $119–$120 as the key resistance to watch. If LTC clears this level with volume confirmation, a sustained breakout could target $132, with halving-related momentum expected by 2027. Network activity remains healthy, and hash rate growth continues to reinforce security and long-term investor confidence.

Risk Factors: Regulation, Volatility, and Competition

As with any crypto asset, Litecoin’s trajectory is subject to significant risks. The asset is vulnerable to global regulatory changes, particularly concerning privacy enhancements. Projects incorporating MWEB are being closely watched by financial watchdogs. Furthermore, volatility remains high, and the lack of smart contract functionality limits innovation compared to ecosystems like Ethereum or Solana.

Competition from newer Layer-1 chains with superior throughput and developer tools also impacts Litecoin’s long-term appeal. However, LTC’s simplicity, stability, and historical relevance continue to make it a hedge against higher-risk altcoins.

Expert Outlook and Forecast Range

Most professional forecasts suggest Litecoin may remain range-bound unless there’s a surge in network activity or macro-level crypto catalysts. The base-case prediction hovers between $90 and $110, while bullish projections stretch toward $120 or slightly beyond. CoinCodex places the 2025 high near $119, aligning with analyst consensus.

Litecoin’s fundamentals remain strong, and the coin’s resilience through multiple cycles positions it as a candidate for breakout potential. However, reaching $120 would require clear market signals, increased on-chain activity, and stronger adoption among merchant networks.

Qubetics: Bridging Utility and Performance in a Crowded Market

While Litecoin retains its place as a foundational asset, Qubetics is emerging as a utility-driven platform with real-world applications. Designed for scalability, interoperability, and developer empowerment, Qubetics is building a multi-faceted ecosystem where apps can thrive across industries.

At the core of Qubetics is QubeQode, a decentralized application environment that enables builders to deploy dApps without permission or custodial control. This self-governing system accelerates innovation by allowing seamless migration across blockchains and data structures. Developers benefit from intuitive coding interfaces, system-level interoperability, and embedded security.

Complementing QubeQode is the Qubetics IDE—a next-generation integrated development environment built specifically for Web3. The IDE supports customizable smart contract scripting, multi-chain testing environments, and real-time debugging. This infrastructure is built for speed, flexibility, and scale—allowing developers to focus on functionality without compromising security.

As Web3 ecosystems demand stronger technical underpinnings, Qubetics offers a developer-first solution designed for mainstream scalability. This positions it as a direct competitor not just to niche dApp platforms but to major Layer-1 ecosystems.

Qubetics Presale Performance: ROI Projections Fuel Excitement

Qubetics is currently in Stage 37 of its crypto presale, priced at $0.3370 per $TICS token. The project has raised over $18 million, sold more than 515 million tokens, and onboarded upwards of 27,900 token holders. What’s capturing the market’s attention, however, is the cadence and scale of its returns.

With supply capped and demand rising, Qubetics is entering its final sale window—and only 10 million tokens are left at $0.3370. The listing price? $0.40. That’s 20% upside for anyone who moves now. Thanks to a revamped tokenomics model, Qubetics reduced total supply by over 66%, pushing it down to just 1.36 billion, tightening scarcity and boosting price potential.

And with 38.55% of tokens allocated to the public, community members now play the leading role. This isn’t just crypto—this is ownership. Even a $1,000 position today could return $15,000 to $30,000 if projections hold. At $10, a $10,000 buy-in hits $300,000. The math checks out. The market is watching. The moment is now.

Final Thoughts

Litecoin and Qubetics illustrate two sides of the crypto landscape. Litecoin represents time-tested dependability, with a moderate upside potential tied to broader market trends and legacy adoption. Qubetics, on the other hand, is the emerging disruptor—offering upside to real-world utility and forward-thinking infrastructure.

Litecoin’s $120 target is achievable but contingent upon strong macro support and rising on-chain metrics. Meanwhile, Qubetics is attracting early investors with a limited supply model, powerful developer tools, and tokenomics geared toward community ownership.

As the crypto market matures in 2025, both assets are positioned to benefit—one from its historical performance, the other from its innovative momentum.

For More Information:

Qubetics: https://qubetics.com

Presale: https://buy.qubetics.com/

Telegram: https://t.me/qubetics

Twitter: https://x.com/qubetics

This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned. Always do your own research!

The post Litecoin Price Prediction 2025: Will LTC Break $120 as Qubetics Presale Sells Over 515M Tokens? appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·