Liquid staking is a decentralized finance (DeFi) protocol that allows traders to stake their digital assets on proof-of-stake (PoS) blockchains while maintaining liquidity. Instead of locking up crypto and losing access to it until the end of a lock-up period, as is done in traditional staking, users receive tokenized representations of their staked assets (called liquid staking tokens or LSTs).

LSTs are pegged 1:1 to the value of the staked tokens, and investors can deploy them on other DeFi protocols to generate additional staking rewards from yield farming. Aside from earning yields, liquid staking reduces opportunity costs for investors as they can use their staked assets to fulfil other purposes.

Before now, when investors staked their assets, they became illiquid until the lockup period was exhausted. Liquid staking was introduced to address the liquidity issue in blockchains utilizing the PoS consensus mechanism, allowing investors to earn rewards while engaging in DeFi activities such as lending or trading.

In this article, we will explain in more detail what liquid staking is, the difference between traditional staking and liquidity staking, what liquid staking tokens and protocols in crypto are, and how to get started with liquid staking. Let’s begin!

What is Liquid Staking?

Liquid staking is a relatively new crypto concept that enables investors to stake their crypto assets on Proof-of-Stake blockchains, such as Ethereum, and still participate in other decentralised finance (DeFi) activities, like yield farming. Unlike traditional staking services, where assets are locked and remain inaccessible for a fixed duration, liquid staking gives investors receipt tokens representing the staked asset, LST.

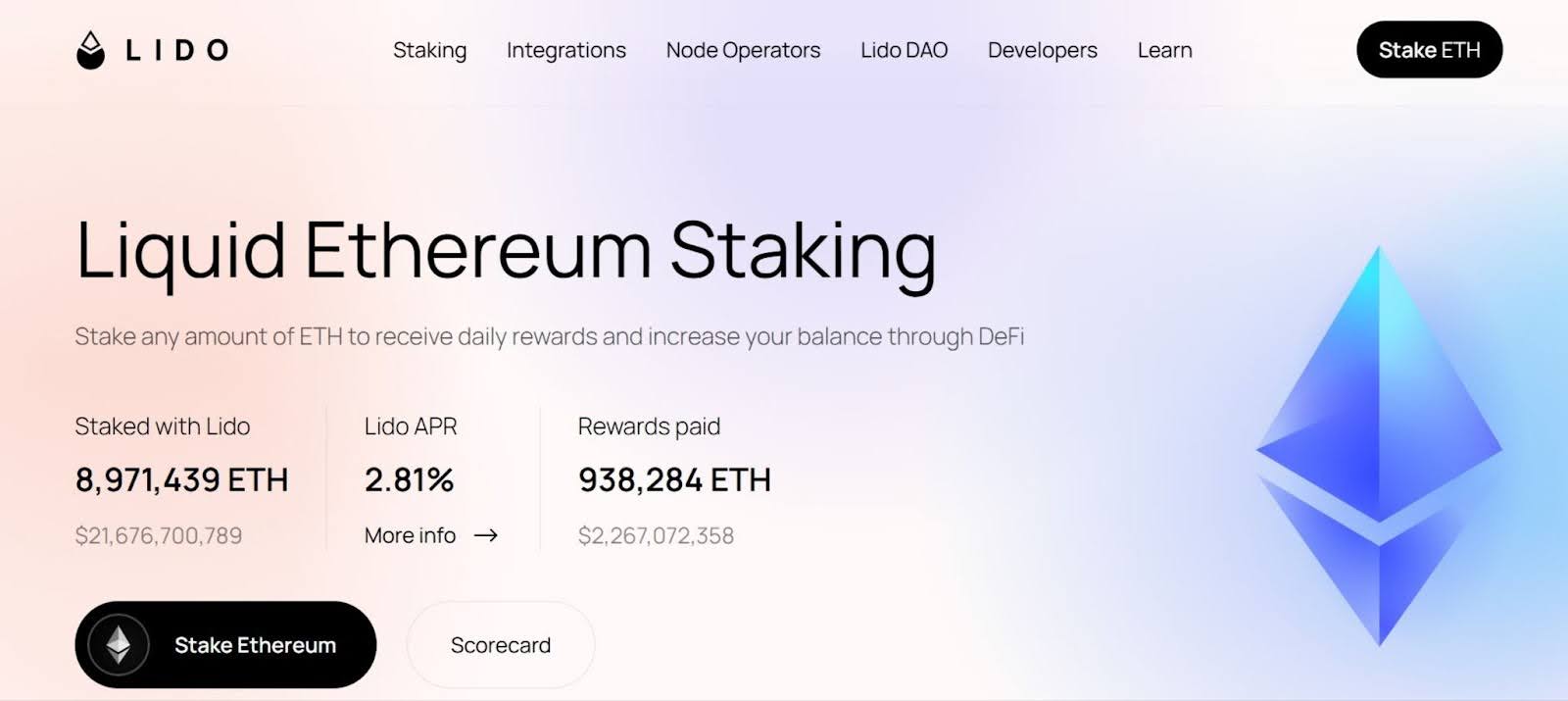

These LSTs can be traded, used as collateral, or integrated into multiple decentralized finance (DeFi) protocols. For example, when staking Ethereum through Lido Finance, users receive Lido Staked ETH (stETH), which represents their staked ETH. With Lido’s native receipt token, you can generate yields, use as collateral, trade, and fulfil other purposes on other DeFi protocols.

How Does Staking Work?

Staking works by allowing users to lock a certain amount of tokens in a wallet or smart contract as collateral. The blockchain network then selects validators from those who have staked assets based on the amount staked and other criteria. The validators confirm transactions and add new blocks to the blockchain, and in return, validators receive rewards paid in the network’s tokens.

But what is staking exactly? Simply put, staking is a way to earn rewards by putting your idle crypto assets to work on proof-of-stake blockchains. In traditional staking, investors lock up assets they are not actively trading in exchange for rewards after a specific period, typically ranging from three to 18 months.

During this period, the staked assets cannot be traded, transferred, or used in other activities. While this helps maintain network integrity, it also limits asset liquidity and restricts users from maximizing the utility and potential returns of their holdings. Hence, liquid staking was introduced to improve capital efficiency.

How Does Liquid Staking Work?

Liquid staking enables users to stake their cryptocurrency in a Proof-of-Stake (PoS) network while still retaining liquidity through the issuance of receipt tokens. It takes the traditional staking model a step further by allowing users to use their staked assets for other activities on DeFi protocols. Here’s how it achieves this capital efficiency:

A user deposits their cryptocurrency into a liquid staking protocol or pool. The protocol stakes these assets on the user’s behalf to participate in the PoS network. In return, the user receives a liquid staking token (LST) or derivative token that represents their staked assets. This derivative token can be freely traded, lent, or used as collateral in the DeFi ecosystem, providing liquidity while the original assets remain staked. The staked assets continue to earn staking rewards, which are reflected in the value of the liquid staking tokens.When the user wants to withdraw their original assets, they return the receipt tokens to the protocol, which then unstakes and releases the original cryptocurrency. This mechanism allows users to earn rewards without losing access to their assets, enabling them to use their staked tokens in other financial activities.

What are the Advantages of Liquid Staking?

The advantages of liquid staking are enhanced liquidity and flexibility, reduced opportunity cost, and continuous rewards.

Enhanced Liquidity and Flexibility: Liquid staking lets traders keep their tokens available while earning rewards. By providing investors with additional tokens (LSTs), they can extract liquidity without unstaking their crypto assets. Reduced Opportunity Cost: In traditional staking, investors cannot access their locked-up assets until the lock-up period is exhausted. This means that they can’t use the assets to participate in any other activity. Liquid staking removes the barrier of waiting through long lockup periods, so you don’t miss chances to react to market changes. Continuous Rewards: Earning rewards on your base tokens does not stop when you receive the tokenized assets; you will continue to earn staking rewards on the original tokens. When you want to unstake your assets, you can redeem your LSTs through the protocol to retrieve the underlying tokens.What are the Challenges and Risks of Liquid Staking?

The challenges and risks of liquid staking include validator slashing, price instability, and protocol reliability issues.

Validator Slashing: When tokens are staked, they are often managed by validators who help secure the blockchain. If a validator behaves dishonestly or fails to follow the rules, such as being offline for too long, the network can punish them by slashing a portion of the staked assets. This affects everyone whose assets are tied to that validator, including users who hold liquid staking tokens, thereby reducing the total value backing those tokens. Price Instability: The token you receive through the liquid staking process doesn’t always match the exact price of the original cryptocurrency it represents. For example, a liquid staking token might trade at a discount during uncertain market conditions. If demand falls or users rush to exit simultaneously, the price can drop below the value of the underlying asset, resulting in losses when attempting to sell or trade. Protocol Reliability: Users rely on the liquid staking protocols to operate transparently, maintain system security, and manage the technical aspects without errors. If the team behind the protocol fails to maintain the platform, or if the project is abandoned or compromised, it could become difficult or impossible to access the staked tokens.What are Restaking and Liquid Restaking Tokens (LRTs)?

Restaking is the process of using assets that have already been staked on one blockchain to secure additional networks and protocols without needing to unstake the original token. Restaking helps extend the security of one network across others, instead of locking up more assets.

Meanwhile, Liquid Restaking Tokens (LRTs) are a way to keep access to your restaked assets, similar to how liquid staking tokens work. LRTs give you a token that represents your position in the restaking process. Instead of waiting through long lockup periods, these LRTs allow you to stay active in the market with a liquid version of your restaked investment.

What are the Differences Between Traditional Staking and Liquid Staking?

The differences between traditional staking vs. liquid staking are access to funds and flexibility.

Access to Funds: In traditional staking, tokens are locked and cannot be moved, traded, or used elsewhere until the end of the staking period. Some networks also have an unbonding time, which adds a delay before you can withdraw your funds after unstaking.On the other hand, when tokens are staked through a liquid staking platform, users receive a separate token that represents the amount staked. This token remains active and can be used while the original assets stay locked in the network.

Flexibility: The major benefit traditional staking offers is the staking reward. The tokens sit idle and are committed to the network’s security during the staking period. However, liquid staking enables users to trade tokenized assets and use them as collateral. You can earn additional yield or reposition your investment without waiting for the original staking lock to end.What are the Differences Between Liquid Staking vs Native Staking?

The differences between liquid staking vs. native staking are asset accessibility, complex staking infrastructure, and yield potential.

Asset Accessibility: Liquid staking enables users to stake their assets through a platform that locks them up and then issues a corresponding token in return. This new token represents your staked assets and can still move around freely. However, native staking locks assets within the network for a fixed time until the unstaking period. Complex Staking Infrastructure: In liquid staking, a separate platform handles the staking and token issuance. Therefore, investors need to understand how the liquid token functions and how to manage it across DeFi environments. While in native staking, the process is often straightforward, using official wallets or validators with minimal interaction. Yield Potential: The liquid staking token can generate additional yield when used in lending protocols, liquidity pools, or other DeFi products. Meanwhile, in native staking, rewards are limited to the base staking yield offered by the blockchain. No further earning opportunities exist unless the assets are unstaked and reallocated elsewhere.What are the Differences Between Liquid Staking vs. Pool Staking?

The differences between liquid staking vs. pool staking are liquidity, flexibility, control, and DeFi participation.

Liquidity: Liquid staking allows you to receive an active receipt token that represents your staked assets. Meanwhile, pool staking locks your cryptocurrency holdings for a fixed period. You lose access to them until you decide to unstake. DeFi Participation: Liquid staking integrates with the DeFi ecosystem. You can use the tokenized version of your stake in liquidity pools, lending protocols, or other yield-generating strategies. On the flip side, pool staking isolates your assets, so while you earn staking rewards, those funds remain unavailable for anything else.What is the Difference Between Liquid Staking vs. Restaking?

The difference between liquid staking vs. restaking are functionality, risk profile, and reward strategy.

Functionality: Liquid staking involves staking once and receiving a tradable token in return. This token represents your original stake and can be used across various DeFi protocols. Restaking, however, builds upon an existing stake. You take assets that are already staked and delegate them to additional networks or services to earn more rewards. Risk Profile: Liquid staking ties your risk to one staking protocol and the token it issues. On the flip side, restaking increases your exposure, leaving you vulnerable. If any of the additional platforms fail, or if the process isn’t secure, your rewards and even your original assets could be affected. Reward Strategy: Liquid staking focuses on utility and mobility. You earn rewards while keeping your capital active. Meanwhile, restaking aims for higher returns by maximizing every opportunity to put the same stake to work. While this can boost earnings, it also increases the chance of a loss if one link in the chain breaks.What is a Liquid Staking Token and Protocol in crypto?

A Liquid Staking Token is the tokenized version of your staked crypto that the protocol gives you. It represents the amount you staked and the rewards you are earning over time. Meanwhile, the Liquid Staking Protocol is a DeFi platform that enables users to stake their tokens while maintaining liquidity.

Which Liquid Staking Tokens are Most Popular?

The most popular liquid staking tokens are stETH, rETH, cbETH, and mSOL. These tokens represent staked assets on major blockchain networks, such as Ethereum and Solana. For Ethereum liquid staking, stETH is issued by Lido Finance, rETH is provided by Rocket Pool, and cbETH is issued by Coinbase. On the Solana side, mSOL is one of the top options, issued by Marinade.

How Does Liquid Staking Work With Different Cryptocurrencies?

Liquid staking works differently across various blockchains, depending on how each network handles staking and validator participation. In the case of Ethereum liquid staking, investors can stake ETH through platforms like Lido Finance, Rocket Pool, or Coinbase and receive tokens such as stETH, rETH, or cbETH in return. These tokens represent the staked ETH and accumulate rewards over time, while still being usable across DeFi protocols.

Meanwhile, Solana liquid staking follows a similar model but is tailored to the Solana network’s architecture. Protocols like Marinade and Jito offer users tokens, such as mSOL or jitoSOL, which reflect their staked SOL and enable them to remain active within the Solana ecosystem. While the mechanics are different for various cryptocurrencies, the goal across all networks is to provide staking rewards without locking up the underlying asset.

How to Get Started with Liquid Staking?

Here are steps on how to get started with liquidity staking.

Step 1. Select a Trusted Liquid Staking Platform

The first step is to decide which liquid staking platform to use. This choice depends on the blockchain you’re interested in. For example, if you’re working with Ethereum, platforms like Lido, Rocket Pool, or Ether.fi are common. On Solana, you might explore Marinade or Jito. For the Cosmos ecosystem, Stride and Persistence are two popular options.

Step 2: Set up a crypto wallet

Once you’ve picked a platform, head over to their official website and connect your crypto wallet. The wallet you use should be compatible with the blockchain you are staking on. For the Ethereum network, MetaMask is a popular choice.

If you’re staking on Solana, Phantom is a good option, and for Cosmos, Keplr is commonly used. Make sure you have the native token of that blockchain in your wallet—like ETH, SOL, or ATOM—as well as a small amount to cover transaction fees. If you’re still unsure which one to choose, consider starting with one from our list of the best crypto wallets to ensure compatibility and security.

Step 3: Stake Your Tokens and Receive Liquid Assets

After connecting your wallet, enter the amount of tokens you want to stake and approve the transaction. Once confirmed, the platform will stake your tokens and issue a corresponding liquid token in return. For example, if you stake Ethereum using Lido, you’ll receive stETH in return.

Token holders can either keep liquid assets in their wallet to passively earn rewards or explore opportunities in DeFi to increase their yield. If you want to exit your position, you can either swap the liquid token back to the original token or use the unstaking process provided by the platform.

What are the Best Practices for Liquid Staking to Reduce Risks?

The best practices for liquid staking to reduce potential risks are research, diversifying across platforms and crypto assets, and managing liquidity and risk exposure.

Research About The Platform Before Using it: Do your own research to understand how the platform works, who built it, and whether it has been audited. Choose one that has been around for a while, is trusted by the community, and has strong security measures. Some security features to look out for are multi-factor authentication, cold storage, regular security audits, insurance coverage, and bug bounty programs. Diversify Across Platforms and Crypto Assets: Use liquid staking protocols with a proven track record, strong security protocols, and transparent governance structures. Platforms like Lido and Rocket Pool have undergone rigorous security audits and maintain open-source smart contracts, which helps reduce counterparty and smart contract risks.Additionally, it is advisable to spread your staked tokens across multiple platforms that offer liquid staking services. This diversification reduces exposure to slashing events, platform insolvency, or smart contract vulnerabilities that could affect one service provider but not others.

Manage Liquidity and Risk ExposureKeep some unstaked or liquid assets aside to maintain flexibility in case of market downturns or protocol issues. Use risk management strategies, such as position sizing and stop-loss orders, where applicable, to limit potential losses during periods of volatility.

Is Liquid Staking a Taxable Event?

Yes, liquid staking is a taxable event. When you stake and receive liquid staking tokens, it’s often treated as selling your original crypto and buying a new token, which may trigger capital gains tax. Also, the staking rewards you earn are taxable as income.

Is Liquidity Staking Worth It?

Yes, liquid staking is worth it, especially if you want to earn staking rewards and explore DeFi protocols without sacrificing liquidity.

If you want to take your crypto journey further, explore the best crypto futures trading platforms that support liquid staking and allow traders and token holders to explore basic and advanced tools for crypto trading. Plus, don’t miss out on exclusive crypto sign-up bonus codes offering fee discounts and additional rewards for new users on top crypto exchanges.

The post Liquid Staking: What It Is and How It Works appeared first on CryptoNinjas.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·