After explaining why Rubber futures can be a great market for traders, we will focus on iron ore today. This is another important product traded on the SGX in Singapore.

Iron ore is the primary raw material used in the production of steel. The SGX futures contract is among the world’s most important benchmarks for iron ore given the contract’s specifications and Singapore’s unique strategic location in the seaborne trade. Remember that China accounts for about two-thirds of seaborne iron ore demand, and much of it goes through the Strait of Malacca.

Unlike rubber, which is a smaller market, iron ore is huge and much more liquid. That does not mean it’s automatically better. In fact, I think you’ll find better opportunities in rubber as a trader. Nevertheless, it would be wise to at least watch the price action in iron ore if you trade commodities in general, especially metals.

Why larger markets are more important

Did you know that following iron ore prices can benefit you immensely, even if you do not trade the iron ore futures themselves? I’m speaking from my own experience. While I don’t trade iron ore, I do trade metals like silver, copper, and platinum through ETFs and (rarely) miners.

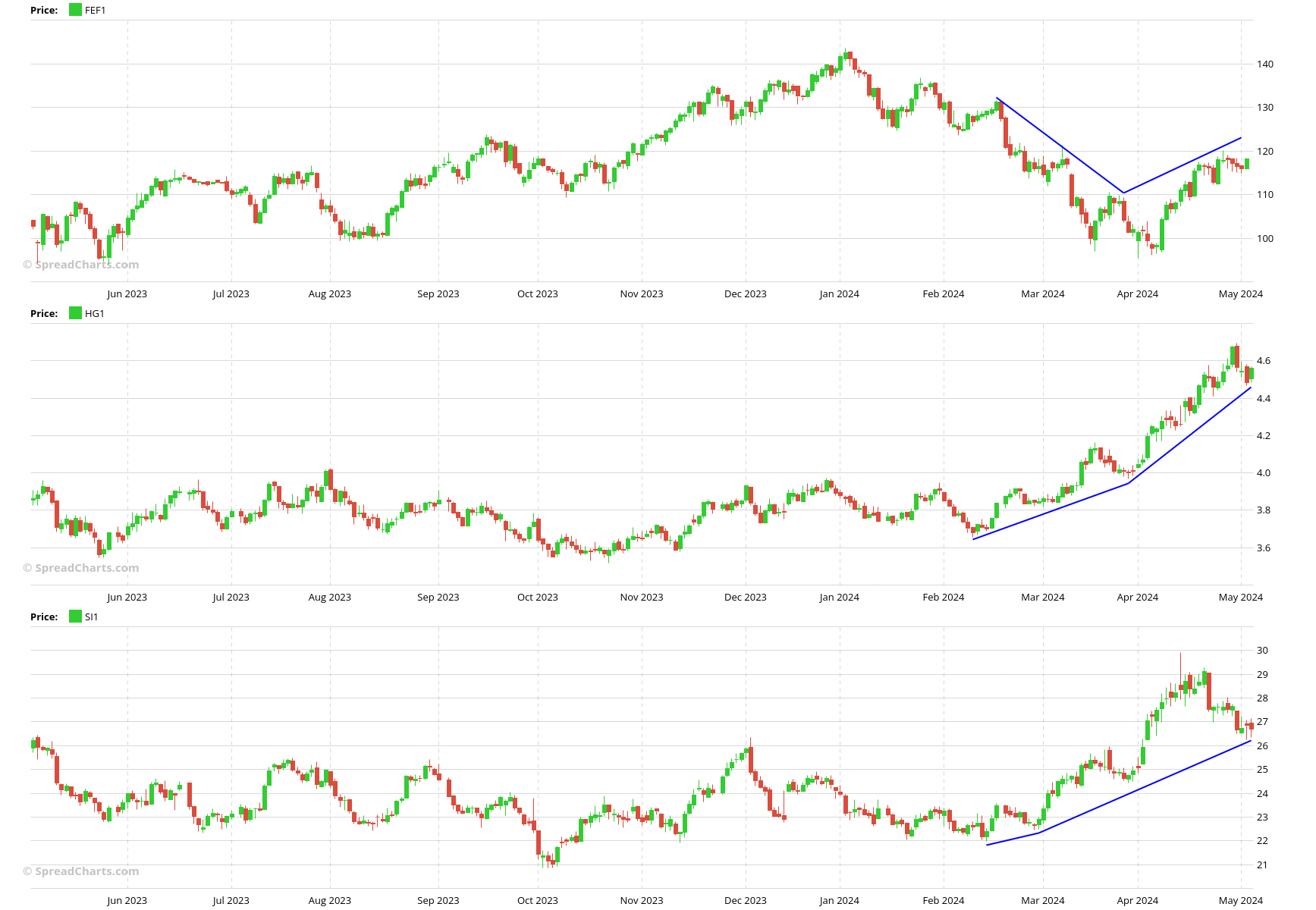

What does iron ore have to do with these different markets? First of all, they are all metals and are correlated to each other most of the time. And second, there is a certain hierarchy within the individual commodity groups. For example, silver is a tiny market compared to copper. That means the price swings in silver can be relatively large as it doesn’t take much money to move this small market in either direction.

On the other hand, this sometimes leads to the silver price getting out of touch with the reality in the physical market. That is exactly the reason why you often see us closely watching the copper market in our premium research when making forecasts for silver. The copper market is much bigger and therefore harder to manipulate. Yes, silver can lead sometimes. But more often than not, it’s copper that’s correct if the two markets disagree. Because in the end, metal prices depend on economic conditions. And if the economy is weak, it’s very unlikely that a particular metal can defy gravity despite short-term speculative flows.

Now that you understand the logic, we can move a step higher. While the copper market is big, the iron ore market is even bigger. It’s the largest commodity market among metals. An example is better than a thousand words.

Do you remember when we were unfazed by silver’s rally in spring 2023, when all the gold bugs were calling for $30+ prices to be just around the corner? Well, we saw that copper and iron ore prices did not support that view.

However, markets can behave unpredictably. The recent rally in metals is a prime example, with both silver and copper leading iron ore. Understanding the catalysts that actually move the market is beneficial. Observing cross-market relationships beyond just metals can be helpful in this regard, which is something we focus on heavily in our premium research.

Keeping the above caveat in mind, I’d still say that larger markets like iron ore usually prevail, given that smaller markets like silver are more susceptible to being squeezed by speculators. Therefore, the recent underperformance of iron ore should make you vigilant.

Insight into the physical market

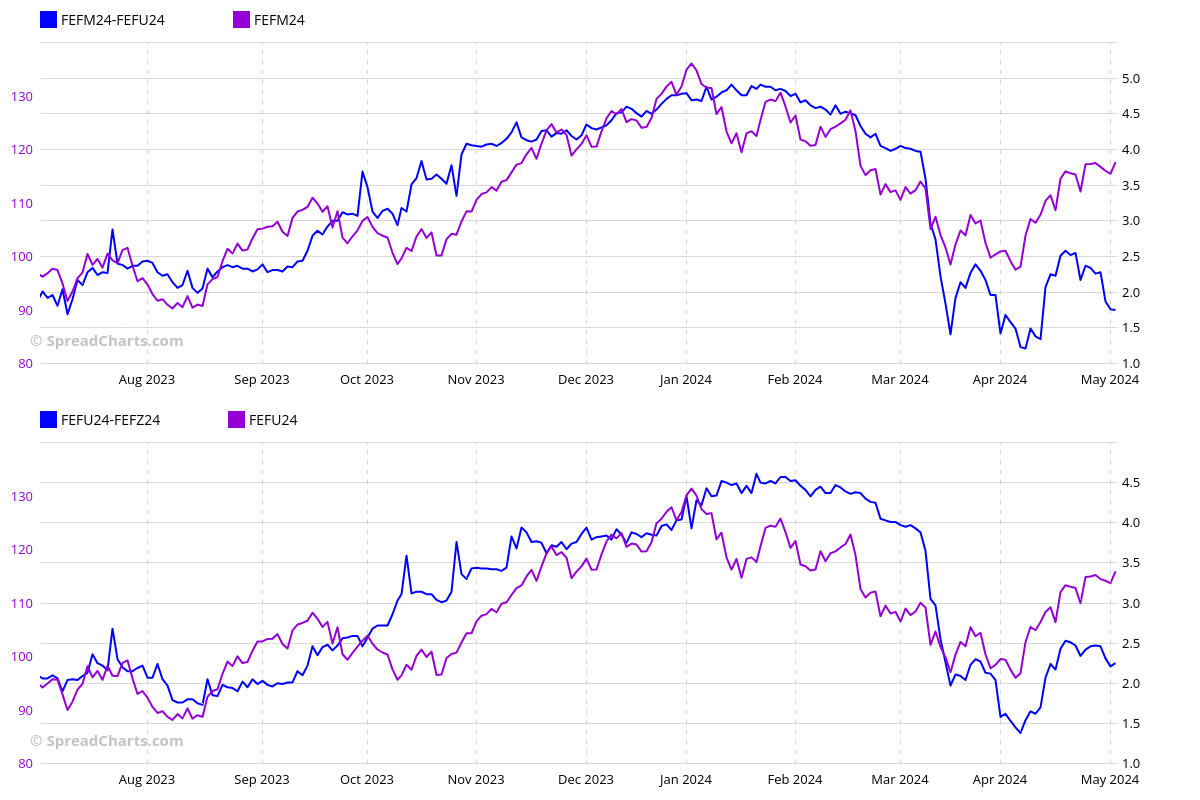

While cross-market analysis is helpful, the interdelivery spreads provide even deeper insight into the market. We watch them on a daily basis as they are probably the most valuable piece of short-term data out there. These spreads are less prone to broad market manipulation and better reflect the actual conditions in the physical market. We use them as confirmation of the trend we see in the underlying commodity.

Of course, the best opportunities emerge when there is a divergence between the spreads (blue) and the underlying (purple). If the divergence is sustained over a period of time, the spreads are usually correct, and the underlying commodity catches up. While these are short-term phenomena only and do not work 100% of the time (like nothing in markets), it provides an incredible edge in commodity trading.

If you’re familiar with our premium research, you know that we closely watch the copper and platinum spreads. Now you can follow the iron ore spreads too as an additional piece of immensely valuable data. The full contract specifications for iron ore are listed below.

We were able to sign the license with the SGX and add this new data into the app only thanks to our premium subscribers. If you want to see additional data in the app, consider purchasing the premium subscription.

|

|

|

| Contract name | SGX TSI Iron Ore CFR China (62% Fe Fines) |

|

|

|

| Exchange | SGX |

|

|

|

| Ticker | FEF |

|

|

|

| Expiration months | F, G, H, J, K, M, N, Q, U, V, X, Z |

|

|

|

| Currency | USD |

|

|

|

| Contract size | 100 metric tonnes |

|

|

|

| Point value | $100 |

|

|

|

| Tick size / value | 0.05 / $5 |

|

|

|

| Settlement | Financial |

|

|

|

The post Insights from the iron ore market appeared first on SpreadCharts.com.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·