The Consumer Financial Protection Bureau (CFPB), created after the Financial Crisis, tries to ensure financial institutions don’t rip off ordinary people. Since its inception, it has returned more than $21 billion to Americans—a threefold return on investment compared to its operating budget. By any measure, it’s effective.

That success makes it a Wall Street and Republican target.

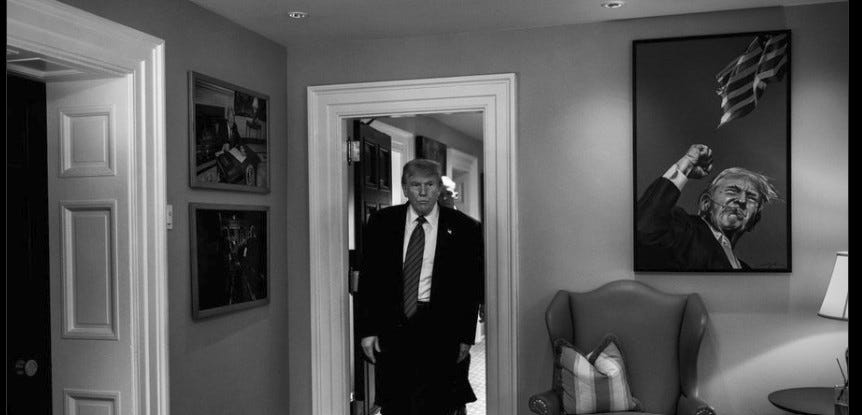

In February, Donald Trump’s administration gutted the agency by executive order. Offices were locked. Enforcement actions were abandoned. More than 1,400 employees, roughly 90 percent of the agency, are slated for termination. A federal court has temporarily blocked the firings, but in the meantime, the bureau remains paralyzed. According to one court filing, the agency’s ethics team was among the first groups to be fired. And even if the courts eventually strike down the firings, the Republican-controlled Congress is poised to swing the executioner’s axe to the agency’s funding once it finalizes a budget agreement.

Tyler Creighton is a CFPB lawyer and union representative still on the payroll—but, like hundreds of his colleagues, he hasn’t been allowed to do his job. Speaking in his personal capacity, he talked to me about the agency’s condition, the lawsuits being dropped, and what is at stake.

The transcript is edited for brevity and clarity.

NW: What’s your job at CFPB?

TC: I was hired two and a half years ago following a clerkship on the Massachusetts Appeals Court. Since then, I’ve worked in the Office of Supervision, which most people haven’t heard of because the work is confidential, unlike the lawsuits our enforcement office brings. Our role is to go into financial companies—mortgage lenders, auto loan servicers, student loan companies—and examine their internal processes. We’re like food inspectors but for loans, credit cards, and other financial products.

We’d look through their books, talk to employees, and identify whether they complied with federal consumer protection laws. We’d push the company to fix violations if we found any—such as improper fees or faulty disclosures. No headlines, no lawsuits. But it means people get restitution, and companies improve their processes to prevent similar issues. Many times, people would have no idea that the check they got from their mortgage company came because someone at CFPB flagged the problem.

I mostly worked on mortgage origination and servicing. I did some student loan and auto finance work. Supervision can be tedious work, but it deters predatory behavior and can lead to relief for taxpayers.

NW: And that work is now stopped?

TC: Yes. Supervision effectively shut down on February 8th. We expected Trump’s new administration to replace our former director on day one. Instead, there was a brief window where the Secretary of the Treasury served as acting director, and only some areas—like enforcement—were told to stop working. But once Office of Management and Budget Director Russell Vought was installed as acting director, everything changed.

He sent an email to all staff expanding the list of “prohibited” work. Over that weekend, they locked us out of our buildings. People inside at the time were kicked out. Most of us still haven’t been allowed to retrieve our things.

NW: They locked the buildings?

TC: Yes. And even for employees who weren’t fired, who are still employed, they haven’t returned our belongings. For the people who were successfully fired, the agency packed up their stuff and gave them a 15-minute slot to pick it up. If you’re still on staff, your things are just sitting there.

NW: And you were told not to work? Literally?

TC: That Monday morning, we got an email that said, “Do not perform any work task.” That’s it. No clarification. People weren’t sure if that meant we couldn’t log onto our computers. Could we check email? Could we file the required annual financial disclosures? Could we complete mandatory training? No answers. And for much of the Bureau, that’s essentially been the policy ever since.

NW: You mentioned enforcement stopping. Are lawsuits still going forward?

TC: I don’t have a clear view of enforcement because our departments are siloed, and Bureau-wide meetings have stopped. But we know from public filings that lawsuits continue to be dropped, including some we’d already won. In one case, we had secured a penalty in a discriminatory lending suit, and the Bureau ended up returning the money to the lender.

There was another involving student loan trusts—companies that were collecting on legally unenforceable debt. That case had been upheld by a federal appeals court. The Supreme Court declined to hear an appeal. We were in the middle of settlement negotiations to get restitution for borrowers. And the bureau just dropped the case.

NW: What do you make of the reports that Gavin Kliger, the DOGE aide overseeing layoffs, holds stock in Apple and Tesla?

TC: What’s been reported is extremely troubling. Employees are prohibited from holding investments in companies supervised by the CFPB and must recuse themselves from matters in which they have a financial interest. That’s federal ethics 101.

We touch any company that offers consumer financial products. A lot of tech companies these days are trying to get more into that space, so it’s not just your conventional mortgage, credit card, or that kind of thing; it’s a little bit broader.

NW: Right. Musk wants X to be the everything app, including banking. So, when the ethics team was among the first to be fired…

TC: That decision speaks for itself.

NW: Your union describes this as a challenge not just to your agency but to democratic governance. What does it mean by that?

TC: The CFPB was created by Congress as an independent agency. What we’re seeing is an attempt to reverse that by fiat. The administration isn’t waiting for Congress to pass a bill. It asserts that the president alone has the power to render an entire agency inoperable and fire hundreds of career civil servants. That’s not how the separation of powers is supposed to work.

NW: If this is allowed, the other independent agencies that help prevent crises like 2008 from happening again—the Federal Reserve, to name one—are more vulnerable. So, what happens now?

TC: We’re in court. A federal judge temporarily blocked the bureau’s layoffs, then an appeals court permitted them on a limited basis, but then blocked them again pending further review after the administration sent layoff notices to 90 percent of staff. But the damage is already being done. When you fire your own ethics watchdogs, it sends a message. And it’s not just a message to us. It’s a message to Wall Street.

NW: And what do you think Wall Street hears?

TC: That no one is watching anymore. That the rules don’t matter. If you wait long enough or elect the right president, the financial cops will be told to go home. In the end, fraud pays.

NW: Are you still hopeful?

TC: I am. Because my colleagues are still dedicated to the CFPB’s mission and aren’t giving up our fight to get back to work for the American people. Because the courts see through the administration’s lies and lawless actions. Because people want someone looking out for them. This fight has made the mission of the CFPB clearer than ever: we exist because when no one’s watching, working families get crushed.

NW: What do you want people to understand about the CFPB?

TC: That it works. That it’s not bloated, or political, or corrupt. It’s just doing the job Congress gave it—making sure Americans aren’t getting screwed by Wall Street. And that’s exactly why billionaires and wealthy special interests want to destroy it.

The post Inside the Trump Assault on the Consumer Financial Protection Bureau appeared first on Washington Monthly.

1 month ago

12

1 month ago

12

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·