The launch followed a heated bidding war where Native Markets beat established players including Paxos, Ethena, and Frax Finance to win the coveted ticker.

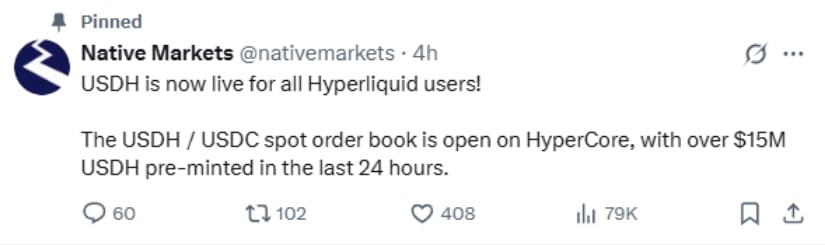

Native Markets reported that over $15 million worth of USDH was pre-minted in the 24 hours before going live, with early trading generating over $2 million in volume. The USDH/USDC pair maintained its dollar peg, trading at 1.001 in initial sessions.

The Battle for USDH Control

The competition began on September 5, 2025, when Hyperliquid announced it would launch its own dollar-backed stablecoin through a community governance vote. The exchange currently holds nearly $6 billion in USDC deposits, representing about 7.5% of all USDC in circulation.

Major crypto firms quickly submitted proposals. Paxos offered deep PayPal integration and 95% revenue sharing. Frax Finance proposed backing USDH with its existing frxUSD. Sky (formerly MakerDAO) promised 4.85% returns and $25 million in ecosystem funding. Even Ethena initially competed with backing from BlackRock before withdrawing from the race.

Native Markets emerged as the unexpected winner despite offering only 50% revenue sharing compared to competitors’ 95-100% offers. The team includes Max Fiege (early Hyperliquid investor), Anish Agnihotri (blockchain researcher), and MC Lader (former Uniswap Labs COO).

Source:@nativemarkets

The selection process sparked controversy. Dragonfly’s Haseeb Qureshi called the process “a bit of a farce,” claiming validators only considered Native Markets despite other serious proposals. Prediction markets showed Native Markets with 96% odds of winning three days before voting ended.

USDH Technical Structure

USDH operates natively on Hyperliquid’s HyperEVM network, backed by cash and short-term U.S. Treasury securities. The stablecoin uses a dual reserve system: BlackRock manages off-chain assets while Superstate handles on-chain reserves through Stripe’s Bridge platform.

Source: @HyperliquidNews

Native Markets committed to splitting reserve earnings equally. Half goes to HYPE token buybacks through Hyperliquid’s Assistance Fund, while the other half supports ecosystem growth programs. This model creates ongoing demand for HYPE tokens while funding platform development.

The stablecoin meets regulatory requirements in the U.S. and Europe, including compliance with the GENIUS Act. Unlike some competitors, USDH receives no special privileges on the platform, though it benefits from native integration.

Market Impact and Revenue Potential

USDH’s launch could reshape Hyperliquid’s economics. Dragonfly partner Omar Kanji estimates a complete migration from USDC to USDH could generate $220 million in annual revenue for HYPE holders, based on 4% yield assumptions. This shift would also reduce USDC’s total supply by 7%.

The timing coincides with intense competition in decentralized perpetual trading. BNB Chain-based Aster DEX recently surpassed Hyperliquid in daily revenue ($10 million versus $3 million), though Hyperliquid maintains leadership in weekly volume and total value locked.

Hyperliquid processes $398 billion in perpetual derivatives monthly and $20 billion in spot trades. The platform controls over 35% of global decentralized perpetual activity, down from a peak of 70% in May 2025.

Launch Strategy and Early Performance

Native Markets implemented a phased rollout starting with capped testing at $800 per transaction. The initial phase targeted a limited user group before opening the USDH/USDC spot pair and removing transaction limits.

Early metrics show strong adoption within testing parameters. USDH reached 2.38 million tokens in total supply with a $2.37 million market cap shortly after launch. The stablecoin maintained its dollar peg throughout initial trading sessions.

The launch supports Hyperliquid’s strategy to reduce dependence on external stablecoins. USDC currently represents over 90% of platform deposits, meaning most interest earnings flow to Circle rather than the Hyperliquid community.

The Road Forward: Platform Independence

USDH represents more than just another stablecoin launch. It marks Hyperliquid’s evolution from a trading venue into a self-sufficient financial ecosystem. By capturing reserve yields internally, the platform can fund continued development while providing direct benefits to token holders.

The successful launch despite initial controversy demonstrates the power of ecosystem alignment over pure financial incentives. Native Markets’ victory shows that deep platform integration and community relationships can outweigh more generous monetary offers.

However, challenges remain. USDH must prove it can compete with established stablecoins while maintaining stability and user trust. The real test comes as Hyperliquid faces growing competition from platforms like Aster that are rapidly gaining market share.

1 month ago

26

1 month ago

26

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·