The OKX listing has drawn renewed attention to Hyperliquid ($HYPE), adding a fresh layer of liquidity to its market. While the move has sparked moderate optimism, participants remain cautious on HYPE as broader market sentiment stays mixed.

OKX Listing Boosts Market Liquidity for HYPE

The recent announcement by Whale Insider that OKX has officially listed Hyperliquid ($HYPE) for spot trading marks a significant milestone for the project. This integration with one of the top-tier exchanges is expected to attract fresh retail inflows, increase market depth, and enhance liquidity.

Exchange listings often act as strong catalysts for renewed interest, particularly when paired with existing on-chain growth. The added exposure from OKX could help stabilize short-term volatility while allowing a broader audience to participate in HYPE’s expanding ecosystem.

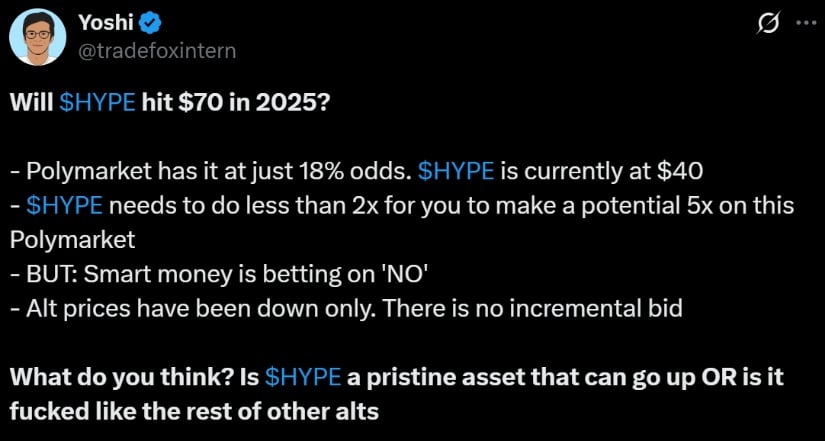

Markets Begin Pricing in a $70 HYPE for 2025

Yoshi’s market insight reveals that Polymarket participants have started to price in HYPE at $70 for 2025, reflecting growing speculative interest despite the asset’s current consolidation near $40. While the odds currently stand at 18%, the implied probability of such an upside move signals market belief in Hyperliquid’s long-term potential.

Polymarket traders are betting on a potential $70 Hyperliquid target for 2025, signaling growing long-term optimism. Source: Yoshi via X

Technically, HYPE would need to achieve less than a 2x price appreciation from current levels to validate this bullish projection. However, the absence of strong alt bids across the broader market suggests that volatility could persist in the near term.

Technical Structure Shows a Possible Recovery Setup

Latest update highlights a developing recovery structure for Hyperliquid as the asset trades within a key demand zone between $40 to $42. The HYPE chart shows repeated liquidity sweeps above $52 followed by consistent absorption near the lower boundary, suggesting a market in accumulation rather than full breakdown.

Hyperliquid consolidates within a crucial $40–$42 demand zone, hinting at accumulation before a potential mid-range recovery. Source: Ahmed via X

As long as the green zone holds, Ahmed believes that the potential for a higher low remains valid. A confirmed push above $45 to $46 could initiate a structural shift back towards $50 to $55, marking the first phase of a mid-range recovery.

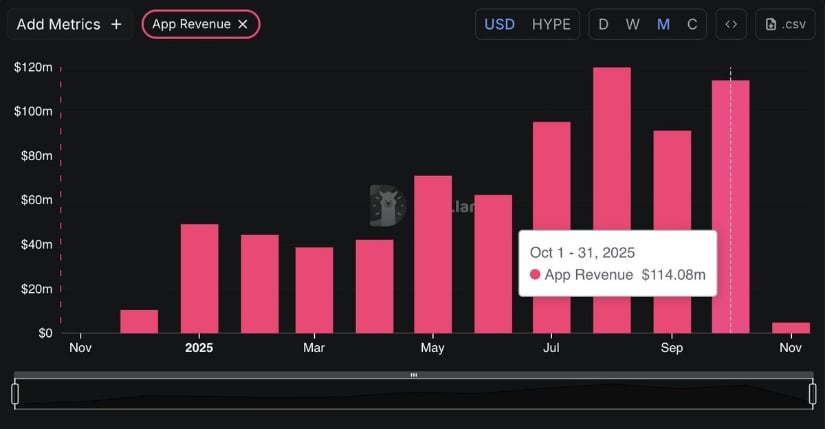

On-Chain Strength Reinforces HYPE’s Bullish Outlook

Famous crypto analyst McKenna points out that Hyperliquid continues to post exceptional on-chain performance, generating $114 million in revenue during October alone, equivalent to $1.37 billion annualized. This sustained growth in protocol earnings highlights strong network utility and active user participation despite broader market weakness.

Hyperliquid records over $114 million in October revenue, underscoring its strong on-chain fundamentals and network efficiency. Source: McKenna via X

Such figures solidify Hyperliquid’s reputation as one of the most profitable and operationally efficient projects in the space. The consistent revenue trajectory supports long-term valuation stability, implying that the underlying fundamentals may soon start aligning with price once broader sentiment improves.

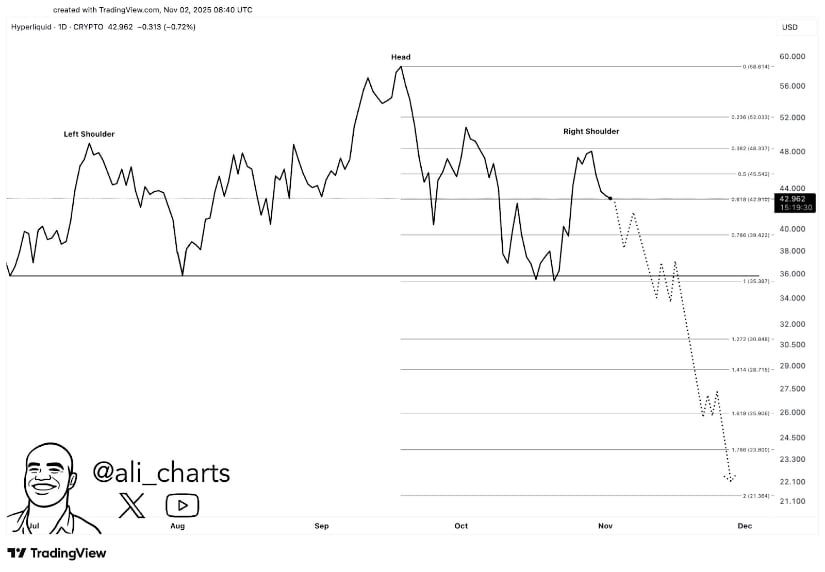

Contrary View: Head and Shoulders Formation Suggests Downside Risk

Ali Martinez’s latest Hyperliquid technical observation introduces a contrary perspective to the otherwise bullish tone. His chart depicts a potential head-and-shoulders pattern forming around the $44 to $46 neckline, typically a bearish reversal signal. If confirmed, the projected downside could extend towards $20, aligning with deeper Fibonacci targets between 1.272 and 1.618 extensions.

A possible head-and-shoulders setup is appearing on HYPE’s chart, signaling caution as key support at $42–$43 faces pressure. Source: Ali Martinez via X

While not yet validated, traders are closely monitoring whether price breaches the neckline on rising volume, a move that could confirm breakdown momentum. For now, the $42 to $43 region remains critical support for HYPE, and holding it could invalidate this bearish structure and restore short-term stability.

Final Thoughts

Hyperliquid finds itself at a pivotal intersection between strong fundamentals and conflicting technical signals. The OKX listing and robust on-chain data point towards sustained ecosystem health, while the near-term chart patterns call for caution.

If support near $40 to $42 continues to hold, recovery back towards $50+ looks plausible, especially as liquidity from new exchange listings filters in. However, a breakdown below this zone could trigger a deeper correction before the next leg higher. Overall, HYPE Hyperliquid remains one of the few assets combining exceptional real-world growth with speculative potential heading into 2025.

16 hours ago

3

16 hours ago

3

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·