If you want to learn How to Buy Life Insurance, continue reading for a complete guide on what it is, the different types and which one is best for you.

Losing a loved one is never easy but when an emotional tragedy turns into a financial one the surviving members of your family are left to struggle.

One thing you do not want when you pass on is your loved ones to have any extra hurdles to cross.

Purchasing life insurance provides security for your loved ones and allows them every tool possible to get back to life along with a financial room to take time for grieving.

How much life insurance do you need?

The biggest question you need to consider when planning to purchase life insurance is how much life insurance you need.

This can vary by several factors in your personal situation.

Income

A great rule of thumb is to take your yearly income and add a 0.

So if you make $50,000 a year you would want to consider a plan for $500,000 of life insurance.

This gives your family enough to replace your income for up to ten years.

If you do not have an income and are a homemaker you still need to consider life insurance.

Should something happen to you your family will need to pay to replace the many services you provide from childcare to more expensive meals when you are not there to cook for everyone.

Debt

You do not want to leave your spouse with your debt to worry about after you are gone.

Consider the amount owed on your car, home, and other forms of debt you or your partner have.

Getting life insurance that covers these debts will allow your loved ones to live comfortably after you are gone without worrying about how they can afford the payments.

Dependants

Should something happen to you who would be affected?

Do you have children that need care? An elderly loved one that relies on you?

When it comes to deciding what you need for life insurance you should think about everyone you are leaving behind and whether or not they will suffer financially from losing you.

The more people that rely on you for everything from physical care to financial support the larger the life insurance policy you will want. This will leave more money to help cover your responsibilities after you have passed on.

Should you get life insurance for your children?

While it may be hard to think about, but the fact is that if something should happen to our children the tragedy would be taxing both emotionally and financially.

Between final expenses and missed work the loss of a child can become a major financial stress to add to an emotional one.

One thing we can do as parents is to get a life insurance policy on our children as well so if something horrible happens we have less to worry about while we pick up the pieces of our lives.

A small $5,000 to $10,000 depending on your life situation.

Not only do you want enough to cover final expenses but to allow time off of work for both parents to mentally heal before returning to normal.

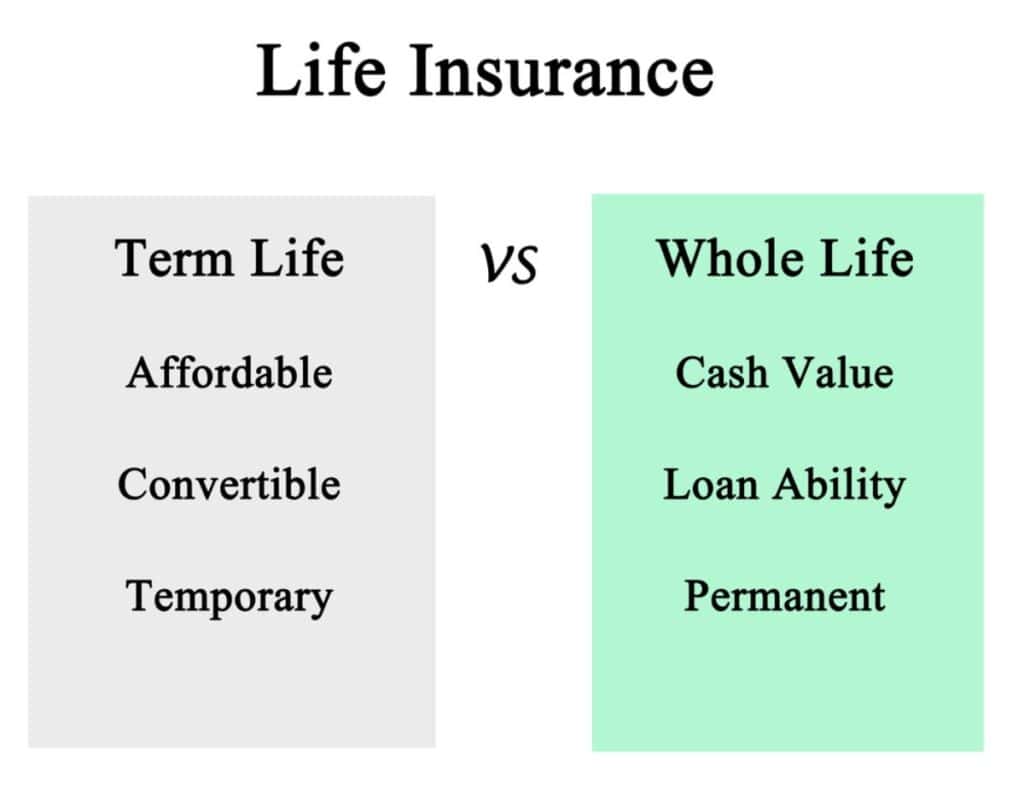

Understanding the Two Main Types of Life Insurance

When it comes to buying life insurance, there are two main types you’ll hear about: term life and whole life. Here’s the simple breakdown:

Term Life Insurance

This type of insurance covers you for a set number of years — usually 10, 20, or sometimes 30 years.

Once the term is over, the coverage ends. If you still need life insurance after that, you’ll have to apply for a new plan (and qualify based on your age and health at that time). Term life doesn’t build any cash value — you can’t borrow from it — but it’s way cheaper than whole life insurance. Because it’s affordable, you can usually get a lot more coverage, which is perfect for seasons when you have big responsibilities (like raising kids or paying off a mortgage).Whole Life Insurance

This one is meant to last your entire life — no matter how long you live.

It’s definitely more expensive, but once you’re approved, you’re covered forever. No worrying about reapplying later. Plus, it builds cash value over time, which you can actually borrow from if you ever need emergency funds. A lot of older adults like this option because it provides a guaranteed payout to their loved ones — and a little financial safety net if needed. For young adults, though, the higher cost usually doesn’t make sense compared to term life.So, What’s Best?

If you’re older or want a policy that’s guaranteed to be there no matter what, whole life insurance might be the way to go.vers you as close to age 60 as possible is often the most affordable and practical option.

If you’re young and healthy, term life insurance that covers you into your late 50s or 60s is probably your best bet.

How to find a good deal on life insurance.

Once you have figured out how much life insurance you need, it’s time to start shopping around.

Review the fine print. Look closely at what’s covered — and what’s not — before you commit. Get multiple quotes. Don’t settle for the first offer you receive. Compare rates from different insurance companies to find the best value. Ask about bundling discounts. Sometimes you can save money by bundling life insurance with your home and auto insurance through the same provider. Consider different policy types. Term life insurance is often much cheaper than whole life insurance, depending on your needs. Check the company’s reputation. Make sure you’re buying from a financially stable insurer with good customer service reviews.Life insurance isn’t always the easiest thing to think about — but it’s one of the most important ways you can care for your loved ones, even after you’re gone.

Taking the time now to plan and purchase the right life insurance policy gives your family the gift of security, peace of mind, and the space they’ll need to grieve without financial stress.

Whether you choose a simple term life policy or a whole life plan that grows with you, the most important thing is that you’ve taken action.

Start today by figuring out how much coverage you need, getting a few quotes, and asking the right questions. Your future self — and your family — will be so thankful you did.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·