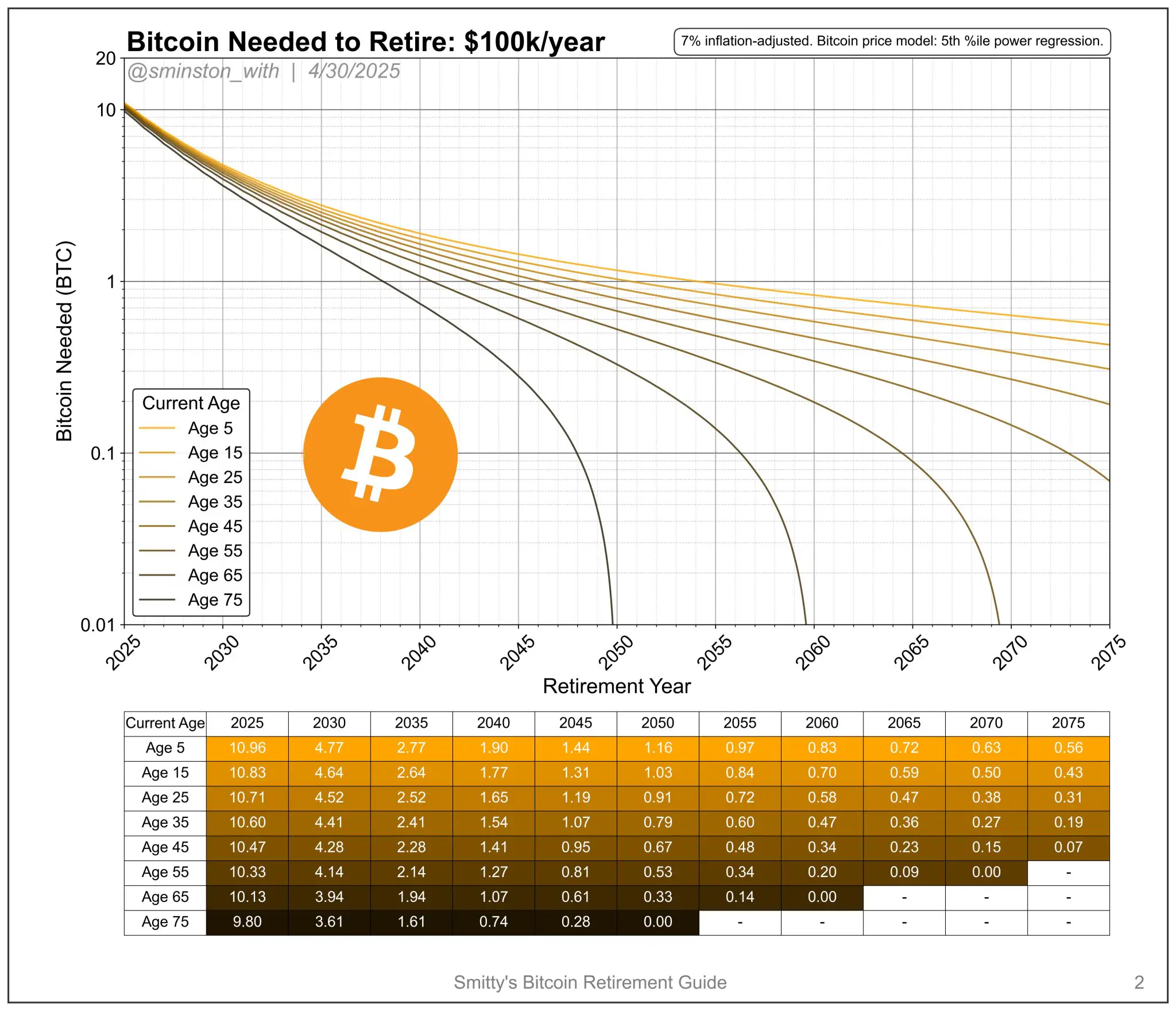

According to chart, shared by Rajat Soni, CFA, if you’re 45 years old today, you’d need approximately 4.28 BTC to retire by 2030 with $100,000 in annual expenses. That equates to roughly $400,000 in today’s market—assuming Bitcoin continues its long-term appreciation trajectory.

“This is meant to be the worst-case scenario,” Soni explains in a tweet, adding that many people who already have that kind of capital still won’t allocate to Bitcoin—often because of reliance on traditional financial advisors who remain skeptical about crypto.

BTC Needed by Age and Year

The visual from @sminston_with helps break this down across age groups and retirement years. It assumes a 7% inflation-adjusted growth rate and calculates BTC required to sustain $100,000/year in expenses.

Here are some key takeaways:

Age 25 today → Needs ~4.52 BTC to retire by 2030 Age 45 today → Needs ~4.28 BTC to retire by 2030 Age 65 today → Needs ~3.94 BTC to retire by 2030 Age 5 today → Needs just ~0.63 BTC to retire by 2075READ MORE:

Coinbase to Delist Five Tokens on May 16

Why This Matters

Bitcoin is often seen purely as a speculative asset, but its scarcity and performance over time suggest it may become a serious part of long-term retirement planning. The chart also emphasizes the power of early adoption—just a fraction of a coin today could support a full retirement decades from now.

Soni warns that ignoring Bitcoin due to outdated advice might mean missing the window of opportunity. “They’ll hold stocks and real estate until it’s too late,” he notes.

The post How Much Bitcoin Do You Need to Retire? appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·