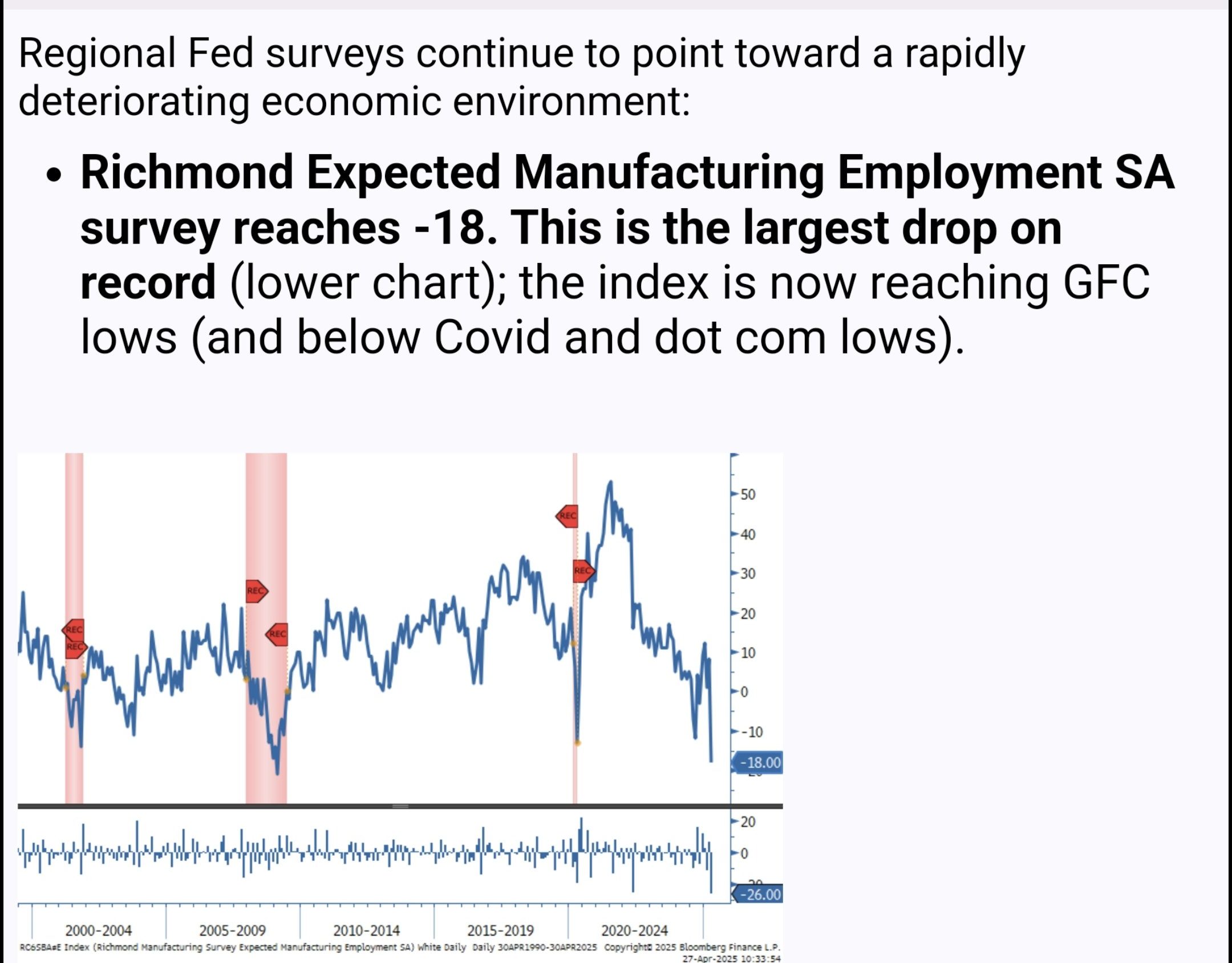

According to Tapiero, second-tier macro indicators — often seen as early warning signals — are now plunging at a rate not seen since the 2008 financial crisis. He describes it as the “largest drop ever,” bringing certain economic measures back to ’08-style lows.

What makes this development even more significant, Tapiero notes, is that the concerning data comes directly from a Federal Reserve survey, making it much harder for policymakers to overlook.

Liquidity Wave Incoming?

Tapiero emphasizes that with short-term interest rates still at 4%, monetary conditions remain way too tight for an economy showing clear signs of stress.

Given the Fed’s historical tendencies, Tapiero expects that a sharp economic slowdown will force a liquidity wave, as central banks are pushed to loosen policy once again.

This anticipated flood of liquidity could have major consequences for hard assets — especially BTC.

Bitcoin Target: $180,000 Within Two Years

Sticking with a theme he has discussed in previous analyses, Tapiero remains highly bullish on Bitcoin. He projects that BTC could surge to $180,000 by summer 2026, fueled by monetary easing, capital rotation, and renewed investor appetite for hard, scarce assets.

The macro backdrop, in Tapiero’s view, is setting up perfectly for Bitcoin to thrive in the coming liquidity-driven environment.

Outlook

If Tapiero’s thesis plays out, the coming months could see a pivotal shift in both markets and monetary policy — with Bitcoin standing as one of the primary beneficiaries.

In short: the slowdown is here, liquidity is coming, and Bitcoin’s path to $180K may already be unfolding.

The post Here’s Why Bitcoin Is Set to Hit $180K Amid the Biggest Drop Since 2008 appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·