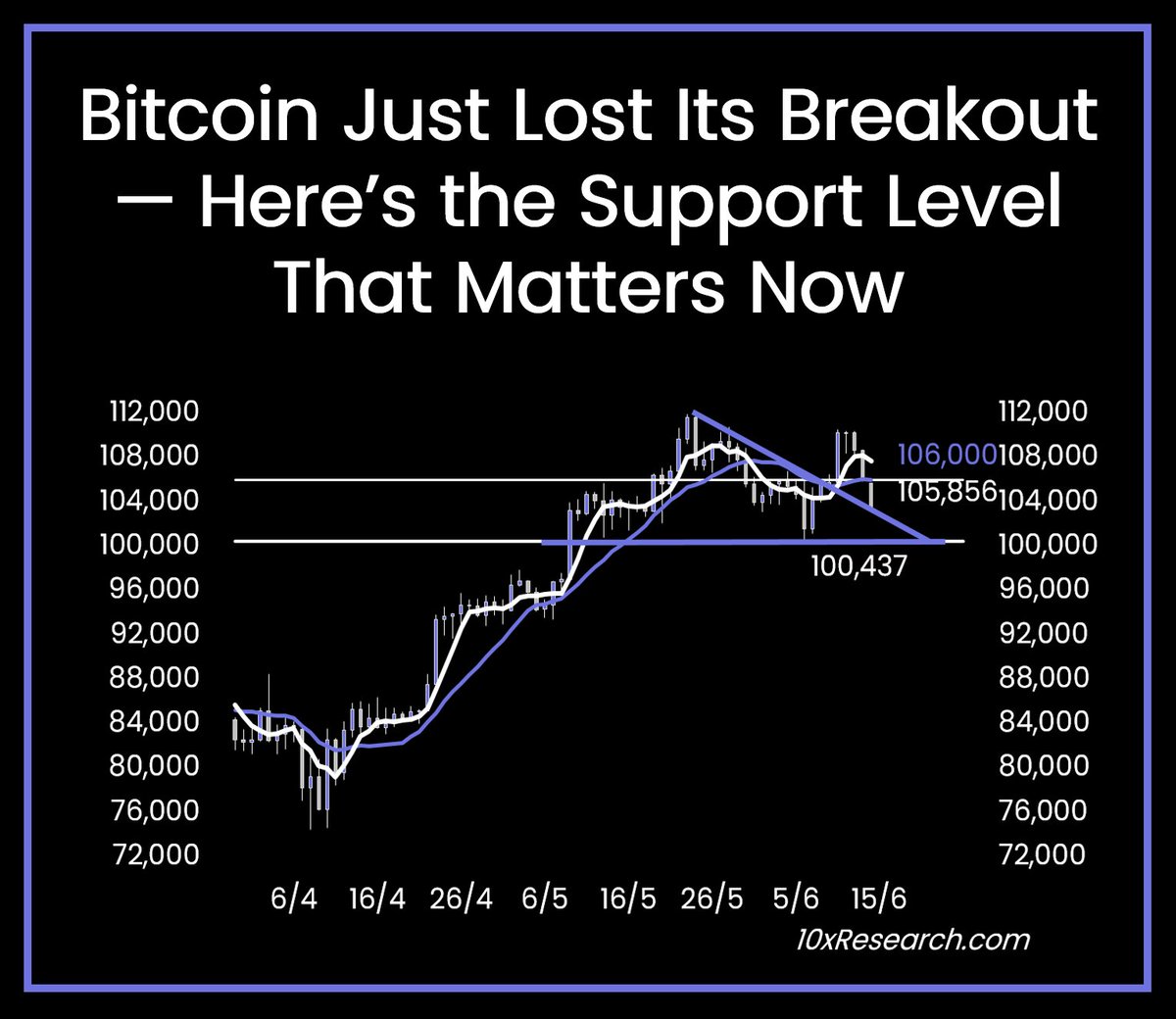

The pullback below this key level has invalidated the bullish signal issued earlier in the week and reinforces concerns about the sustainability of recent upside momentum.

Failed Breakout Raises Red Flags

As noted in the report, Bitcoin’s move above $106,000 was a critical test. Slipping back below that threshold suggests the breakout was driven more by speculation than structural demand. The reversal signals a breakdown in bullish conviction and aligns with 10x Research’s cautious stance on the broader market.

The key level now is $100,437, identified as the next meaningful area of support. A breakdown below that line could open the door to deeper downside moves, especially if macro conditions or crypto sentiment deteriorate further.

Ethereum’s Divergence: High Risk, Low Conviction

The report also highlights unusual behavior in Ethereum markets. While ETH open interest has surged over 60% since May 1, its funding rate has collapsed—a divergence that hints at rising speculative activity without strong market conviction.

One firm reportedly made a $425 million Ethereum treasury allocation, only to see its stock plunge 70% in after-hours trading, further illustrating the fragility of the current market narrative around ETH.

IPO Hype Fades, Reality Returns

Analysts at 10x suggest that last week’s breakout may have been temporarily fueled by hype surrounding Circle’s $24 billion IPO announcement. While that story briefly re-ignited enthusiasm, the underlying market still lacks the fundamental drivers needed for sustained rallies in either BTC or Ethereum.

With BTC now trading back below the breakout level and ETH showing signs of speculative dislocation, traders are being urged to remain cautious and watch for further confirmation around the $100K support zone.

The post Here’s the Support Level That Matters Now for Bitcoin appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·