The findings paint a clear picture, particularly highlighting the remarkable growth potential of Bitcoin (BTC) when approached with consistent, incremental investments. The results not only underscore the power of compounding but also demonstrate the significant returns that even small, regular contributions into the leading cryptocurrency could have generated compared to more traditional assets like gold and US stocks. Let’s delve into the specifics of this eye-opening comparison.

Key Findings

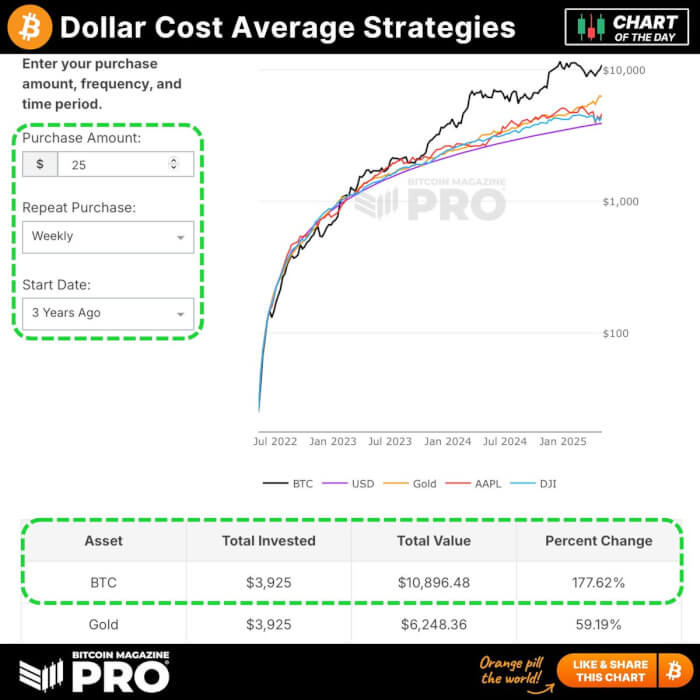

Investment Strategy: The analysis focused on a consistent, weekly investment of $25. Time Period: The performance was evaluated over a three-year span, from approximately May 2022 to May 2025.Asset Performance

Bitcoin (BTC): Demonstrated a remarkable 177.62% increase. An initial investment totaling $3,925 would have yielded a substantial return of $10,896.48. Gold: Showed a positive performance with a 59.19% change. The same $3,925 investment would have grown to $6,248.36.US Stocks: Represented by AAPL and DJI, exhibited a more modest performance of 11.16%.

The chart accompanied the analysis, clearly illustrating the growth trajectory of a $25 weekly investment in BTC, USD (as a baseline), Gold, AAPL, and DJI over the specified three-year period. Bitcoin’s growth curve significantly surpassed that of the other assets.

Conclusion

The data strongly suggests that a dollar-cost averaging strategy focused on Bitcoin would have generated significantly higher returns compared to similar investments in Gold or US Stocks during the analyzed period. The consistent weekly investment of $25 in Bitcoin would have resulted in a portfolio value of nearly $11,000, underscoring Bitcoin’s potential for substantial growth within a DCA framework.

The post Here’s How Much More You’d Have Investing $25 Weekly in Bitcoin vs. Gold & Stocks appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·