According to CryptoQuant analyst Darkfost, traders are holding back from opening aggressive long positions as they wait for clearer signals—both from the market and the political environment.

The current hesitation comes amid rising uncertainty tied to ongoing developments involving President Trump, which have added a layer of unpredictability to an already volatile crypto space.

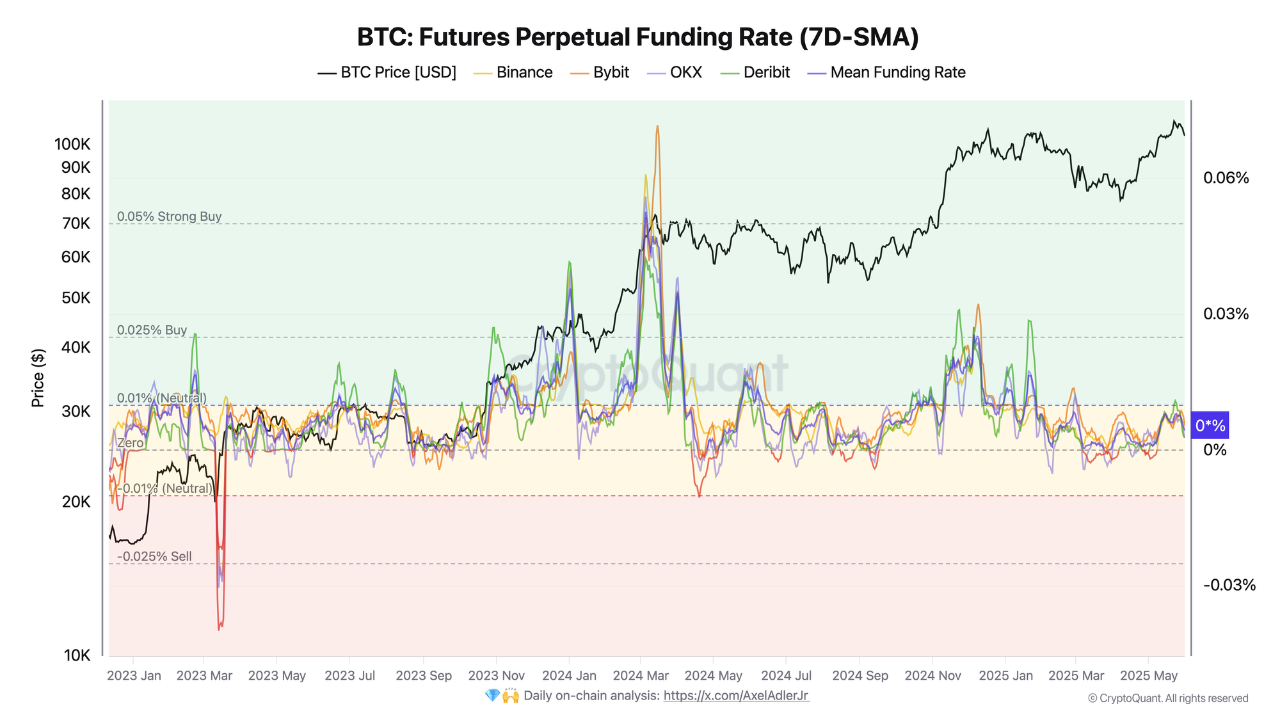

Lack of Euphoria Suggests Derivatives Market Remains Healthy

Historically, BTC breaking past its previous all-time high has triggered a spike in funding rates as bullish sentiment surges. But this time, the usual wave of optimism is absent. Investors appear reluctant to chase momentum without more conviction.

While some might see this as a bearish indicator, Darkfost argues it’s actually a sign of strength. The restrained leverage points to a well-balanced derivatives market—not an overheated one.

Key observations include:

Short positions remain significant, which could fuel future price moves via short liquidations. The market structure appears stable, offering a stronger base for long-term upside. Funding Rates Vary Across ExchangesAnother insight from the report highlights a split in market behavior across platforms. Funding rates on Binance and Bybit are currently twice as high as those on OKX and Deribit.

This discrepancy makes OKX and Deribit more attractive for cost-conscious traders seeking lower funding exposure. As such, traders aiming to build long positions may gravitate toward these exchanges to minimize costs while maintaining upside exposure.

Conclusion

Rather than signaling weakness, today’s low funding environment shows that traders are not rushing into leverage-driven bets. As the market consolidates and political headlines settle, this cautious tone may provide the groundwork for the next major Bitcoin breakout—on stronger footing.

The post Here is Why Low Bitcoin Funding Rates Signal Caution, Not Collapse appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·