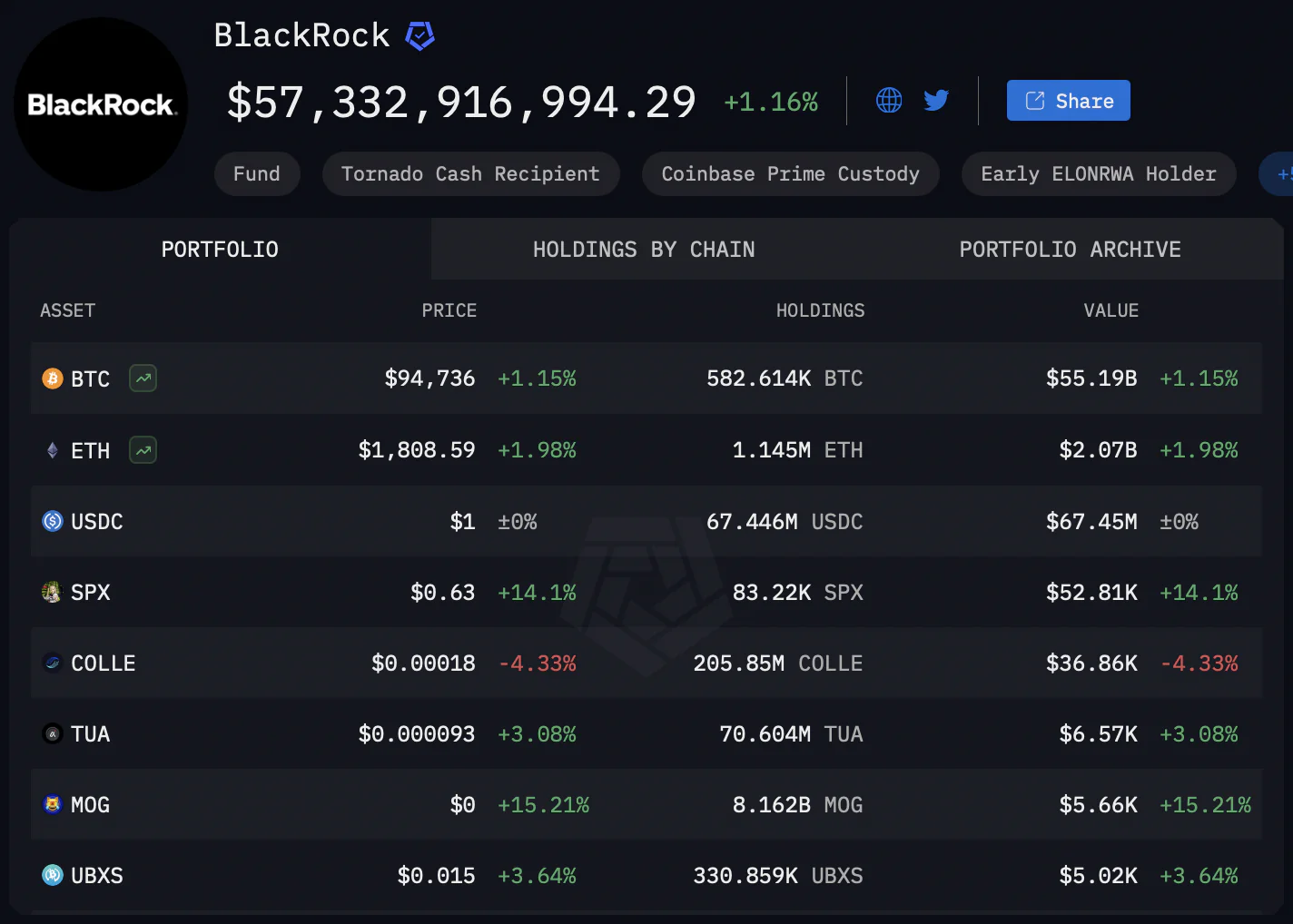

As of the latest snapshot, BlackRock’s crypto portfolio is nothing short of massive, valued at over $57.3 billion, reflecting a +1.16% change in the green.

Major Holdings

The investment giant’s crypto assets span a range of popular and niche tokens, with the lion’s share dominated by two major cryptocurrencies:

Bitcoin (BTC)BlackRock holds a staggering 582,614 BTC, currently valued at $55.19 billion.

With Bitcoin trading around $94,736, this represents the cornerstone of their digital portfolio.

The firm has amassed 1.145 million ETH, totaling around $2.07 billion at a market price of $1,808.59.

These two assets alone account for over 99% of BlackRock’s crypto valuation.

Stablecoins and Others

USDCWith 67.446 million USDC held, the dollar-pegged stablecoin adds $67.45 million in relatively risk-free exposure.

SPX TokenA newer entry, SPX stands at 83.22K units, worth roughly $52.81K, enjoying a strong daily gain of 14.1%.

READ MORE:

HYPE Recovers, Pi Aims for $3, But BlockDAG Could Deliver the Real 100X—Top Cryptos to Watch Now

Smaller-Cap and Experimental Tokens

BlackRock appears to be dabbling in a variety of altcoins and microcaps as well:

COLLE – 205.85M tokens ($36.86K), though currently down 4.33% TUA – 70.604M tokens ($6.57K), up 3.08% MOG – 8.162B tokens ($5.66K), up 15.21% UBXS – 330.859K tokens ($5.02K), up 3.64%While these holdings are tiny compared to BTC and ETH, they hint at exploratory strategies or high-risk/high-reward plays.

Conclusion

BlackRock’s crypto portfolio shows just how seriously institutional investors are now taking digital assets. With over $57 billion allocated—primarily into Bitcoin and Ethereum—it’s clear that crypto is no longer fringe in the world of traditional finance. The blend of heavyweight assets and micro-cap tokens suggests BlackRock is both securing value and experimenting with innovation in the space.

The post Here Is How Much Crypto BlackRock Holds appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·