Investors seeking to understand Hedera’s potential price trajectory will find detailed insights into the token’s momentum signals, volume profiles, and key breakout scenarios that could materialize in the coming weeks. As HBAR consolidates within a defined range, several technical factors suggest a significant move may be imminent.

HBAR Current Price Structure and Key Support/Resistance Levels

Current Trend: Bullish

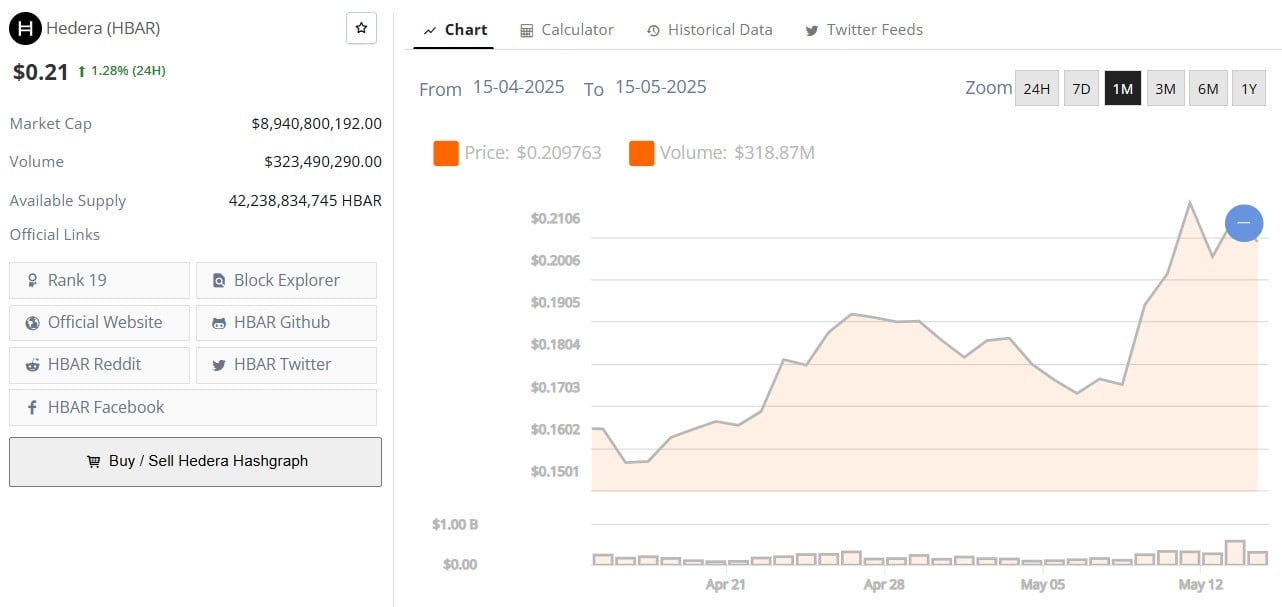

Hedera has been on a tear for the last month, up just over 25% according to data from Brave New Coin’s HBAR market cap table.

Hedera Hashgraph (HBAR) is exhibiting a bullish trend. The 14-day Relative Strength Index (RSI) stands at 80%, indicating strong upward momentum. The price is trading above key moving averages, reinforcing the bullish outlook.

HBAR Key Indicators:

RSI (14-day): At 80%, the RSI suggests that HBAR is in overbought territory, which could precede a short-term pullback. Nonetheless, it’s important to note that in strong uptrends, the RSI can remain in overbought territory for extended periods. Traders often look for divergence or other confirming signals rather than solely acting on an overbought RSI.

MACD: The Moving Average Convergence Divergence (MACD) indicator shows a positive crossover, supporting the bullish momentum.

Momentum: Strong buying interest is evident, with price action consistently making higher highs and higher lows.

Volatility: Price movements have been significant, indicating high volatility, which can lead to rapid price changes in either direction.

Support and Resistance Levels:

Immediate Resistance: $0.285096 (13-week high). A break above this level could signal further upside potential.

Immediate Support: $0.278196. Holding above this level is crucial to maintain the current bullish trend.

Short-Term Outlook (Next 7 Days):

Given the strong bullish indicators, HBAR may attempt to break above the immediate resistance at $0.285096. However, the overbought RSI suggests caution, as a short-term consolidation or minor pullback could occur before any further upward movement.

Medium-Term Projection (Next 30 Days):

If HBAR sustains its position above the $0.278196 support level, it could target the 52-week high of $0.400574. Continued positive momentum and market sentiment will be key factors in achieving this target.

Risk Factors:

Overbought Conditions: The high RSI indicates that the asset may be overbought, increasing the risk of a short-term price correction.

Market Volatility: High volatility can lead to rapid and unpredictable price movements, which may not always align with technical indicators.

External Factors: Market news, regulatory developments, or macroeconomic events could impact HBAR’s price, regardless of technical setups.

External Factors Influencing HBAR’s Outlook

Hedera’s Strategic Rebrand: Unifying an Ecosystem

In early May, Hedera restructured its operations and updated its branding. Source – Hedera.com

Beyond it’s technicals, brand activity with Hedera could also positively influence price in the week’s ahead. Hedera has undergone a significant transformation to its brand structure on May 8, 2025, aimed at bringing greater clarity and coherence to its ecosystem. The rebrand features two key organizational changes: the HBAR Foundation is now “Hedera Foundation,” and the Hedera Governing Council has become “Hedera Council,” both aligned under a refreshed visual identity while maintaining their independent roles.

This strategic restructuring is accompanied by leadership changes, with Charles Adkins appointed as CEO of Hedera Foundation and Tom Sylvester taking the role of President of Hedera Council, while co-founder Mance Harmon will assume the Chairman position in July 2025.

Conclusion:

HBAR is currently in a bullish phase, supported by strong technical indicators. While the momentum suggests potential for further gains, investors should remain cautious due to overbought conditions and high volatility. Monitoring support and resistance levels, along with staying informed about market developments, will be essential for making informed trading decisions.

1 month ago

11

1 month ago

11

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·