According to Cardone, the firm is currently on its fourth fund, with recent acquisitions adding 350 BTC to the portfolio.

Bridging Two Asset Classes: Real Estate and Bitcoin

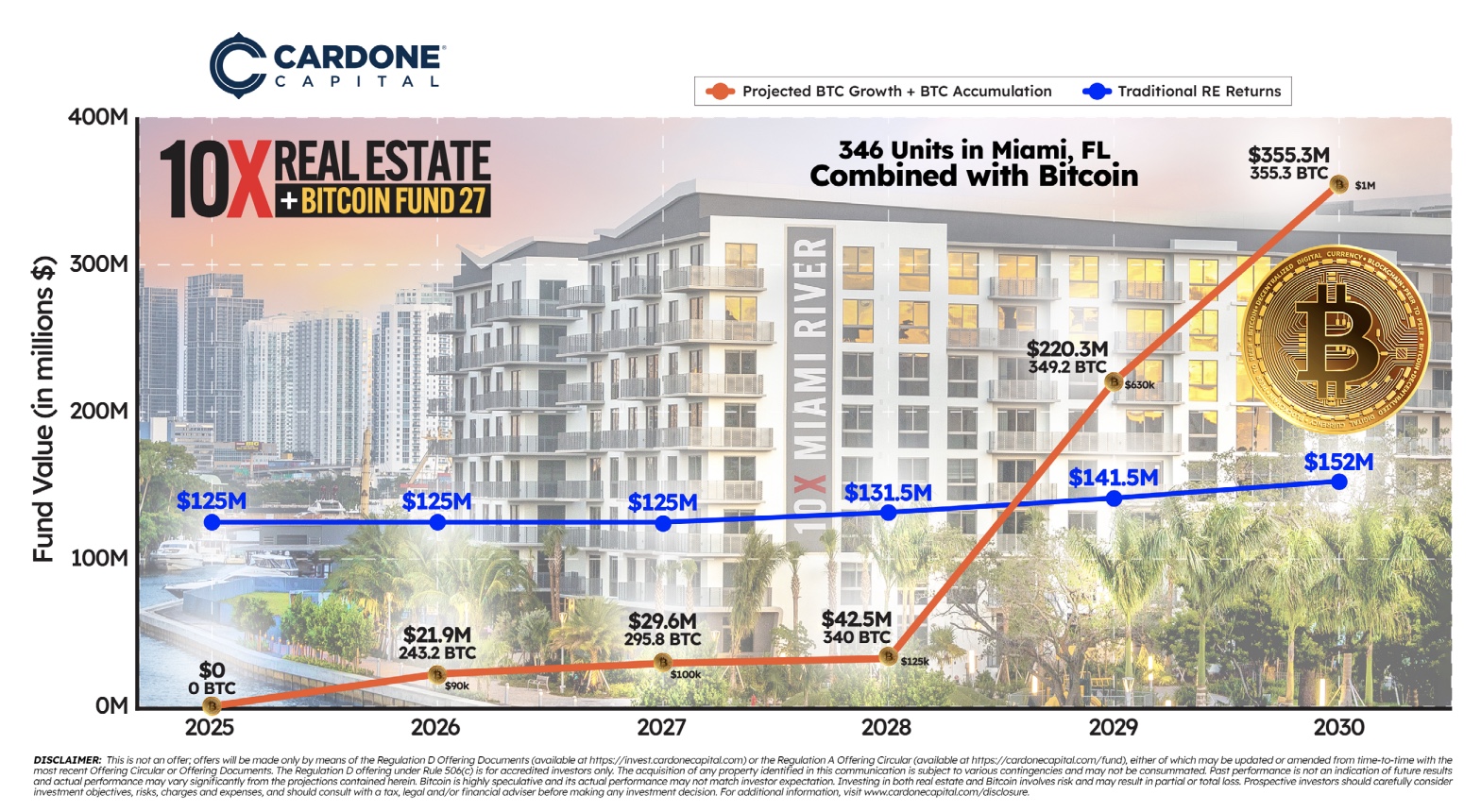

The project, dubbed “10X Real Estate + Bitcoin Fund 27,” aims to combine income-producing real estate with long-term Bitcoin accumulation.

One highlight includes a flagship asset: 346 units in Miami, Florida, where projected fund value growth is modeled to significantly outperform traditional real estate returns when Bitcoin exposure is added.

The fund’s valuation chart shows two clear projections:

Traditional real estate returns (blue line) show steady but moderate growth. Real estate + Bitcoin exposure (orange curve) demonstrates exponential upside, assuming Bitcoin’s projected performance continues. By 2030, projections estimate the fund could reach a value of $355.3 million, underpinned by a Bitcoin reserve of approximately 355 BTC.READ MORE:

4 Best Performing Crypto Coins in 2025: Unstaked, Arweave, Stacks & VeChain— High Growth Ahead!

Why This Matters

Cardone’s strategy reflects a growing trend among asset managers who see Bitcoin not as a speculative gamble, but as a long-term hedge and growth enhancer alongside traditional assets.

By combining the stability of real estate with the asymmetric upside potential of Bitcoin, Cardone Capital is positioning itself at the forefront of a new hybrid investment model — one that could appeal to both traditional investors and the rapidly expanding crypto-savvy crowd.

Moreover, in a world where inflation concerns and monetary debasement loom large, the idea of coupling hard assets like real estate with digital scarcity (Bitcoin) offers an intriguing hedge against economic uncertainty.

The post Grant Cardone’s Real Estate Empire Moves Into Bitcoin appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·