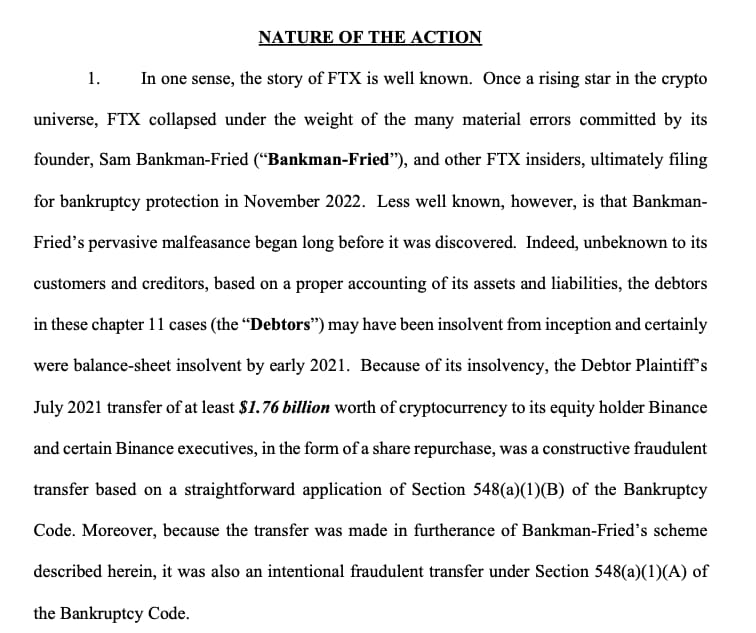

The lawsuit, filed on November 10, 2024, alleges that Binance and its executives received at least $1.76 billion in cryptocurrency through a fraudulent transfer orchestrated by FTX’s co-founder, Sam Bankman-Fried.

FTX-affiliated trading firm, Alameda Research, also recently filed a complaint against Crypto.com to unlock over $11 million held in a Crypto.com account.

On November 7, Alameda Research filed a lawsuit in the United States Bankruptcy Court for the District of Delaware, requesting Crypto.com to release approximately $11.4 million held in an account registered under “Ka Yu Tin,” an alias associated with Alameda’s operations before FTX’s bankruptcy. According to court documents, Alameda alleges that Crypto.com has refused multiple requests to return the assets, which the firm claims are critical to its debt-repayment strategy.

Background of the Allegations

The core of the lawsuit centers on a July 2021 transaction in which Bankman-Fried repurchased approximately 20% of FTX International and 18.4% of FTX US from Binance. The payment for this repurchase was made using a combination of FTX’s native token (FTT), Binance Coin (BNB), and Binance USD (BUSD), collectively valued at $1.76 billion at that time. The FTX estate contends that both FTX and its sister company, Alameda Research, were insolvent as early as 2021, rendering the repurchase transaction fraudulent.

The Lawsuit: Source: Kroll

Accusations Against Binance and CZ

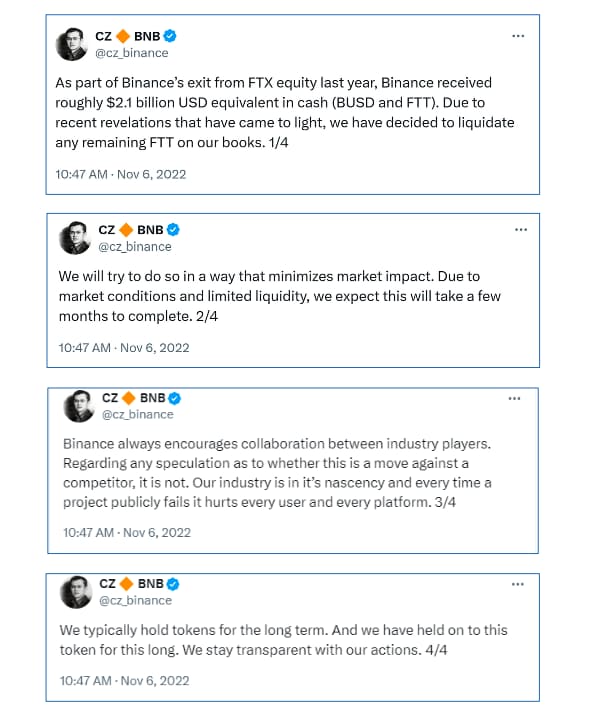

Beyond the financial transactions, the lawsuit accuses Zhao of orchestrating a campaign to undermine and destroy FTX. It cites Binance’s significant liquidation of FTT tokens prior to FTX’s collapse in November 2022 and Zhao’s public statements as part of a deliberate strategy to damage FTX’s market position. The FTX estate argues that Zhao’s actions were intended to maximize market impact, leading to a decline in FTT’s price and harming FTX’s financial stability.

Source: CZ, X

Implications for the Cryptocurrency Industry

As FTX navigates bankruptcy proceedings and criminal fallout, its determination to recover assets locked on platforms like Crypto.com remains essential to repay creditors. The current legal action against Crypto.com highlights the barriers FTX faces, even as it closes in on financial restoration for impacted users.

This lawsuit is part of a broader effort by the FTX bankruptcy estate to recover assets and provide restitution to creditors. It follows other legal actions, including a recent settlement with the Bybit exchange for $228 million.

As of now, Binance and Zhao have not publicly responded to the lawsuit. The case is expected to proceed through the legal system, with potential ramifications for both parties and the broader cryptocurrency market.

6 days ago

1

6 days ago

1

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·