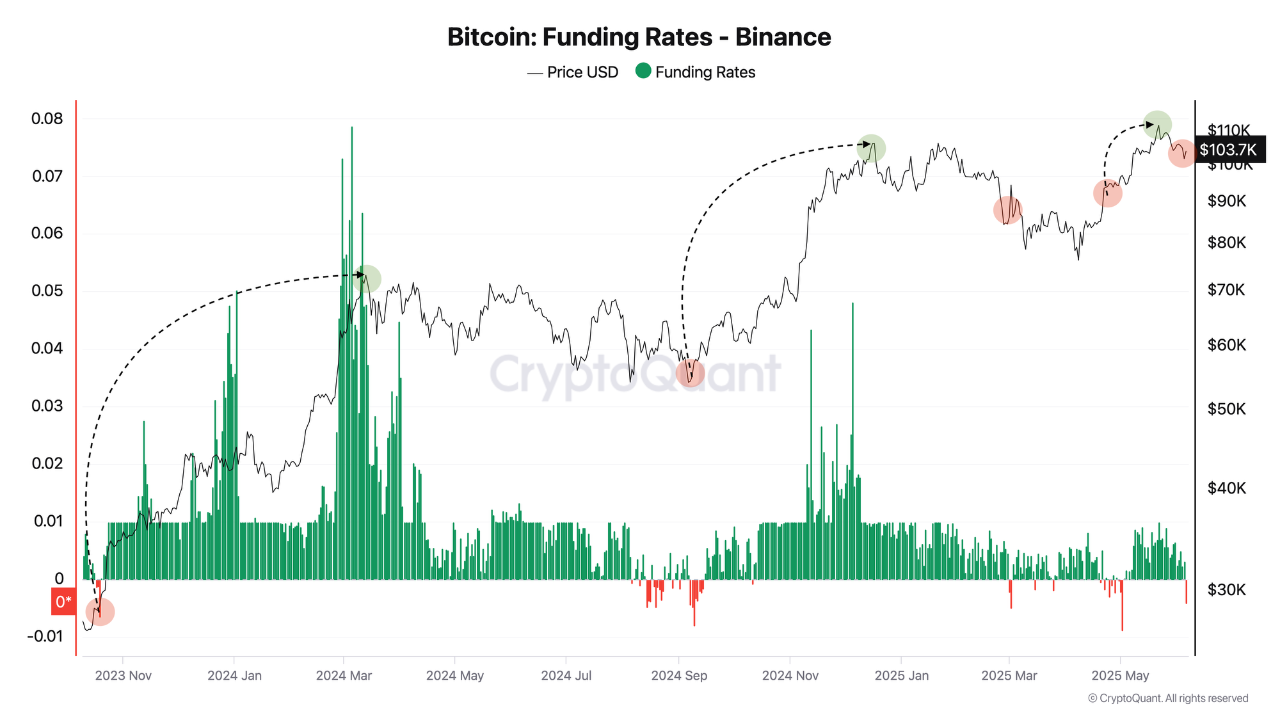

Despite Bitcoin maintaining its footing above $100,000, sentiment in the derivatives market has shifted sharply. On Binance, funding rates for BTC perpetual contracts have once again dipped into negative territory—a rare occurrence that has previously marked key turning points.

According to data from CryptoQuant, the funding rate briefly surged to +0.003 before plummeting below -0.004. This rapid shift follows heightened political tension between Donald Trump and Elon Musk, which triggered sudden volatility and increased fear among traders.

What Negative Funding Means

When funding rates go negative, it reflects traders paying to hold short positions. This indicates that the majority expect further downside—a clear sign of extreme fear. However, in previous cycles, such conditions have often preceded major price rebounds.

Historical Precedents of Bullish Reversal

October 16, 2023: BTC jumped from $28,000 to $73,000 September 9, 2024: BTC surged from $57,000 to $108,000 May 2, 2025: BTC rose from $97,000 to $111,000Each event followed a drop in funding rates below zero.

The only exception was in March 2025, when tariffs imposed on Canadian and Mexican imports sparked broader risk-off sentiment.

Traders Eye Another Squeeze

If Bitcoin holds its ground or pushes higher, it could trigger a short squeeze as overleveraged shorts scramble to cover. This could rapidly flip sentiment and fuel another leg up.

While fear dominates short-term behavior, seasoned traders are watching closely. History suggests these moments of maximum pessimism often offer the greatest upside potential.

The post Extreme Fear Sets In as Bitcoin Funding Rates Turn Negative Again appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·